Business

MicroStrategy (MSTR) Stock Surges to New Heights Amid Bitcoin Rally

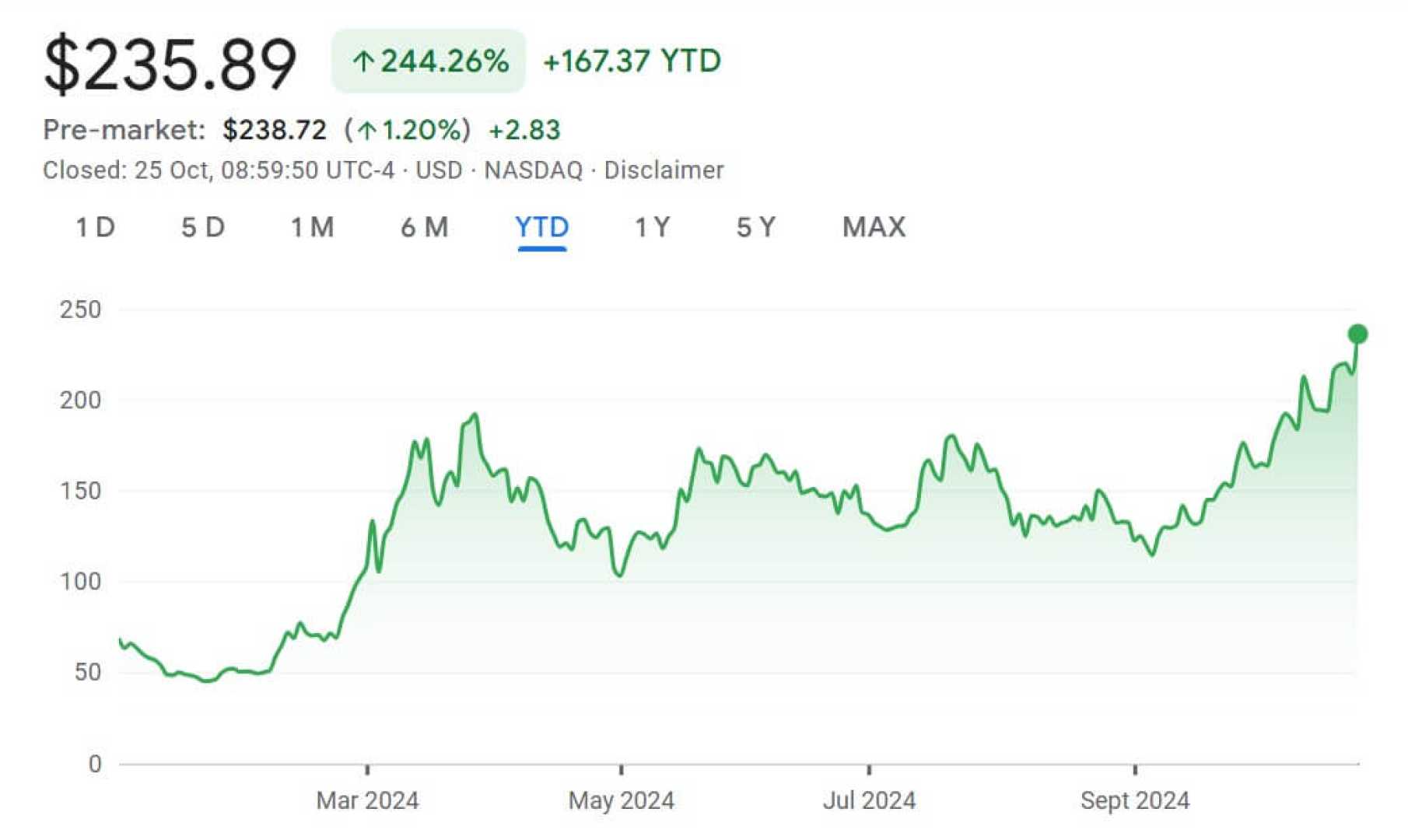

MicroStrategy Incorporated (MSTR) has seen a significant surge in its stock price, reaching new highs in recent trading sessions. As of October 29, 2024, the stock has risen by 8.96% to $255.34 per share, marking a new 52-week high.

The company’s stock performance has been closely tied to the value of Bitcoin, given MicroStrategy’s substantial investments in the cryptocurrency. Under the leadership of CEO Michael Saylor, MicroStrategy has positioned itself as a major player in the digital asset space, with its Bitcoin holdings influencing the stock’s volatility.

Year-to-date, MicroStrategy’s stock has skyrocketed by 263%, outperforming many other tech and cryptocurrency-related investments. This surge is partly attributed to the company’s strategic use of convertible debt to monetize the amplified volatility of Bitcoin, as well as its innovative approach to generating returns from its BTC holdings.

Analysts have maintained a “Strong Buy” rating for MSTR stock, with a 12-month price target of $212.50, although the current price has already exceeded this forecast. The company’s financial performance, including its recent completion of a $1.01 billion offering of convertible senior notes, has also contributed to investor confidence.

In addition to its cryptocurrency strategy, MicroStrategy continues to enhance its core business in enterprise analytics software. The latest release of MicroStrategy ONE, which includes new capabilities to strengthen GenAI reliability and accessibility, further solidifies the company’s position in the AI-powered business intelligence sector.