Business

Retail Investors Surge Amid Market Changes and Predictions

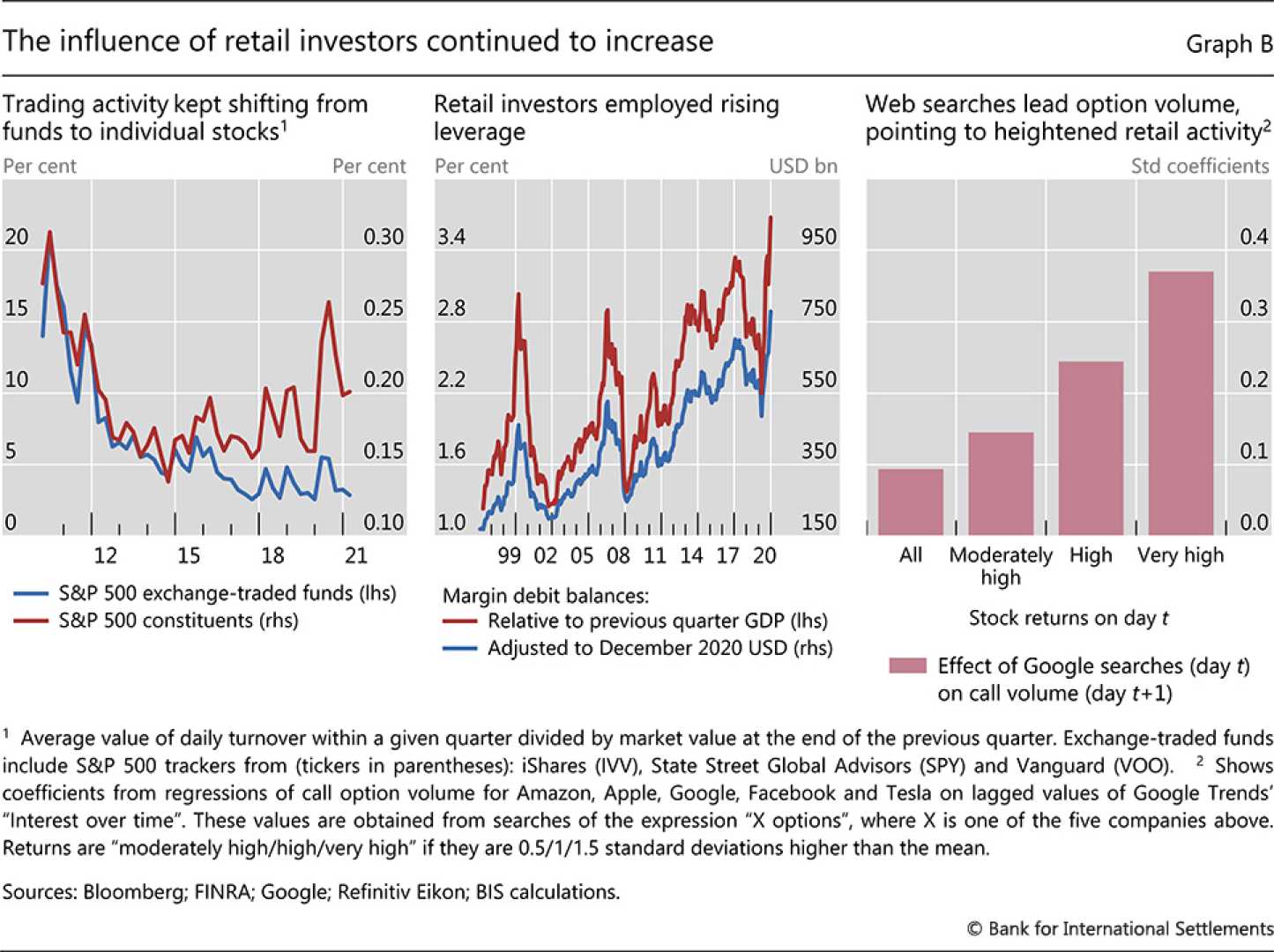

NEW YORK, May 14, 2025 — Retail investors made a significant move in the stock market last Thursday, purchasing $4.7 billion in stocks, the highest level seen in a decade, according to JPMorgan. This surge comes at a time when many were anticipating a potential economic disaster stemming from policy decisions.

Analysts pointed to the recent tariff announcement as a misguided strategy, particularly for members of what some call the Big Chess Party. Unrealistic expectations of a transformative economic impact from these tariffs have left many disappointed.

In contrast, market performance has defied the grim forecasts. On April 9, roughly 99% of the volume on the New York Stock Exchange showed signs of increased trading activity. Previous predictions of recession and bear market rallies did not materialize as expected. A report from Citi highlighted that holding the S&P 500 for just 60 minutes in the past month would yield a full 17% recovery.

Moreover, blue-chip companies listed on the S&P 500 revealed plans to repurchase $192 billion of their own stocks in the coming months, marking the highest weekly figure since 1995. This trend indicates a strong confidence among these companies amid positive price dynamics.

In other real estate news, active home listings in the South have noticeably increased, as reported by Realtor.com. Notably, the Pope’s childhood house in Dolton is currently up for sale for $199,900, capturing public interest.

As conversations around investment strategies continue, some are comparing returns on real estate to stock market performance. An example shared noted that an investment made in an Airbnb property in 2017, which was sold for $377,750, may offer less attractive returns than investments in the S&P 500.

These developments reflect changing dynamics in both real estate and stock markets as retail investors adapt to current financial climates.