Business

Stock Market Today: Microsoft and Meta Lead Wall Street Lower Despite Strong Earnings

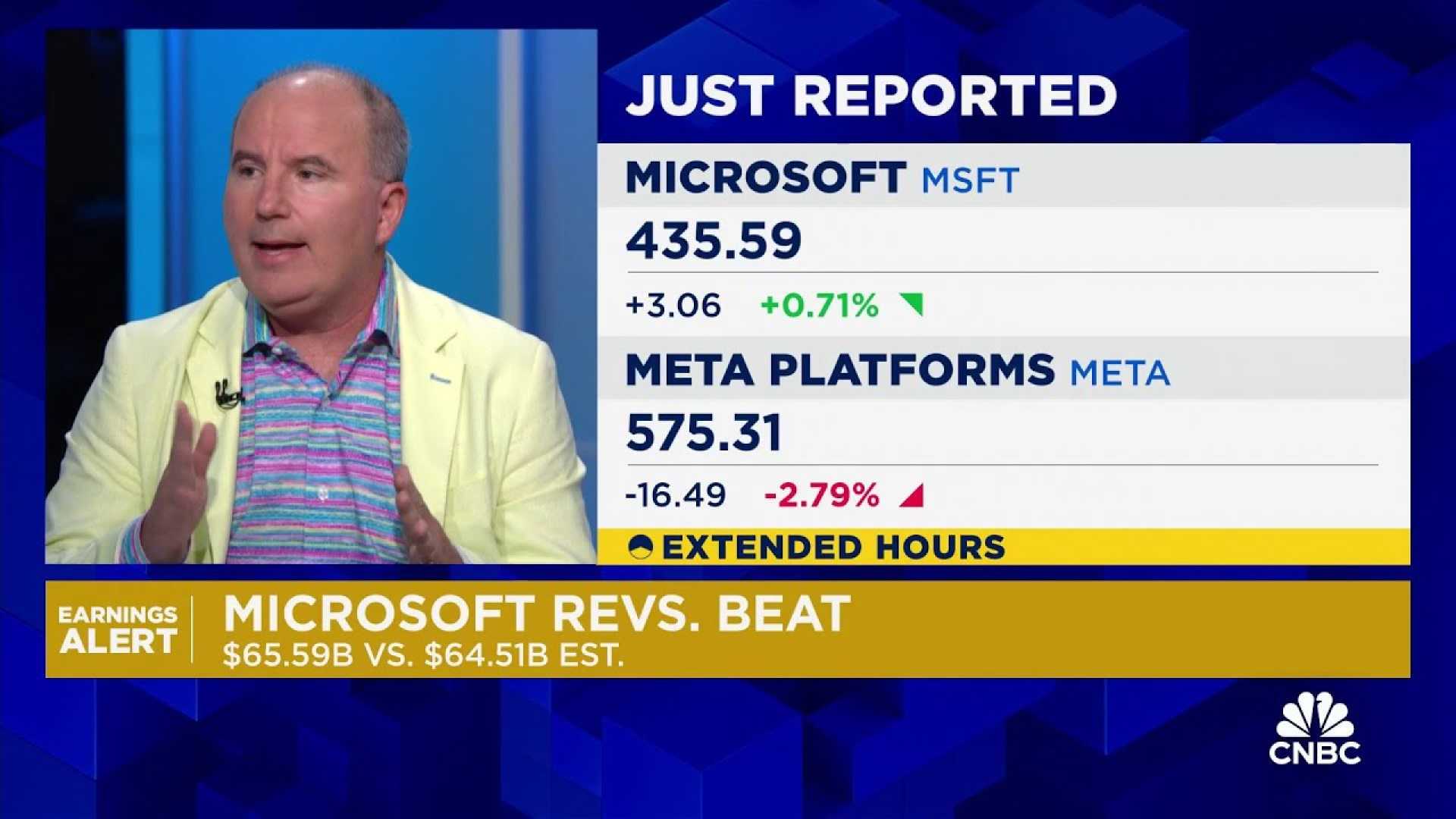

On Thursday, Wall Street experienced a downturn driven by the performance of tech giants Microsoft and Meta Platforms, despite both companies reporting stronger-than-expected profits for the summer quarter. The S&P 500 dropped 0.8% in early trading, while the Dow Jones Industrial Average fell by 177 points, or 0.4%, as of 9:36 a.m. Eastern time. The Nasdaq composite was down 1.3%, heading for its second consecutive loss after recently setting a new all-time high.

Microsoft’s stock sank 4.9% despite the company’s revenue and profit exceeding analyst forecasts. Investors were particularly concerned about Microsoft’s forecast for growth in its Azure cloud-computing business, which did not meet some analysts’ expectations. Similarly, Meta Platforms, the parent company of Facebook, saw its stock slip 0.7% after warning of a “significant acceleration” in spending next year, primarily on artificial intelligence development.

Both Microsoft and Meta Platforms have been among the most influential stocks on Wall Street, driven by excitement around AI. However, their stellar performances have also raised concerns that their stock prices may have climbed too high, making them too expensive. The next big tech companies to report earnings are Apple and Amazon, both of which were also experiencing declines in their stock prices ahead of their reports.

In the bond market, Treasury yields continued to rise following mixed reports on the U.S. economy. A measure of inflation favored by the Federal Reserve slowed to 2.1% in September, nearing the Fed’s 2% target. However, underlying inflation trends, excluding food and energy costs, were slightly hotter than expected. Additionally, growth in workers’ wages and benefits slowed during the summer, which could ease future inflation pressure. The yield on the 10-year Treasury was at 4.30%, up from approximately 3.60% last month.

Global markets also reflected the downturn, with indexes lower across much of Europe and Asia. The resilient U.S. economy, combined with the Federal Reserve’s decision to cut interest rates, has bolstered hopes of avoiding a recession but has also led traders to adjust their expectations for the depth of future rate cuts).