Business

Tesla Faces Pressure as Investors Question Breakneck Growth

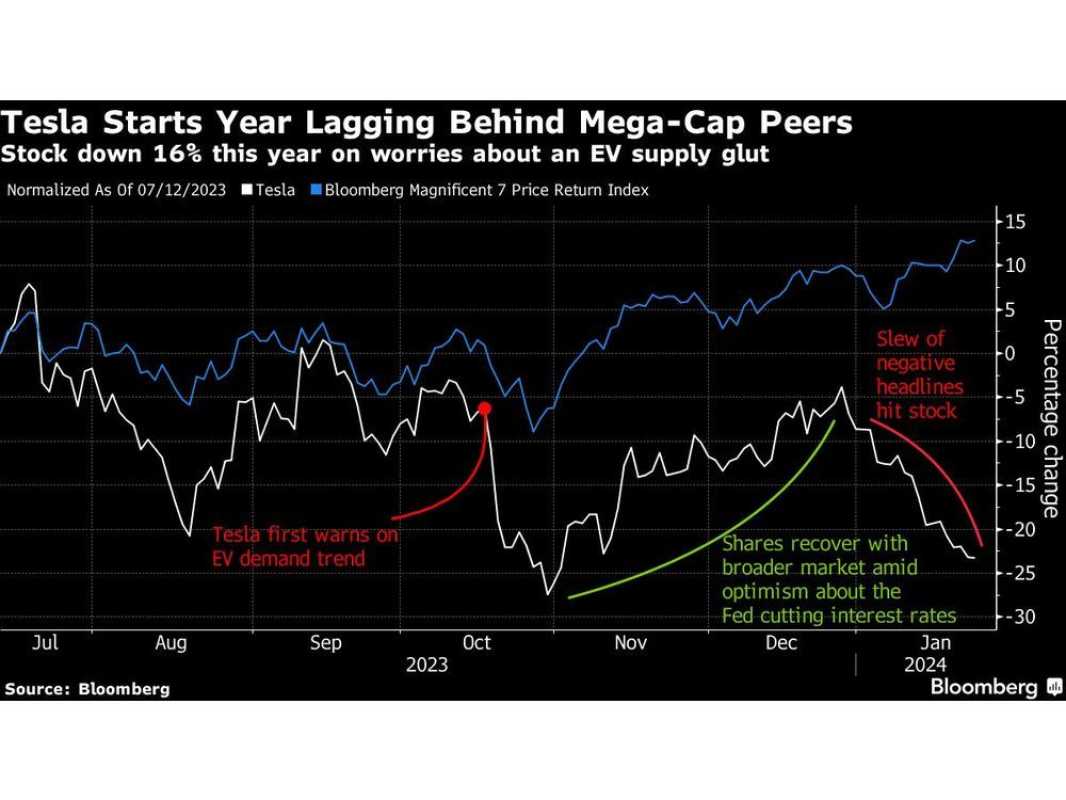

As Tesla Inc. prepares to report its fourth-quarter earnings on Wednesday, the company finds itself under scrutiny as the worst-performing and most expensive stock among the tech megacaps known as the Magnificent Seven. Investors are increasingly concerned about whether Tesla can sustain its breakneck growth.

Since its inception, Tesla has been synonymous with rapid expansion and innovation. However, some investors are beginning to question whether the company can continue to deliver the impressive results that have become expected of it.

With Tesla’s stock price soaring to unprecedented heights, it has also become the most expensive stock among its tech giant counterparts. As a result, any signs of weakness or failure to meet expectations can have a significant impact on its valuation.

Investors are looking to the fourth-quarter earnings report for reassurance that Tesla’s growth trajectory remains on track. The report will provide insights into the company’s financial performance and its ability to meet demand for its electric vehicles.

While Tesla has delivered record-breaking vehicle deliveries in the past, there are concerns about the sustainability of this growth. The company faces increasing competition from other automakers entering the electric vehicle market, as well as regulatory challenges.

Despite these hurdles, Tesla has demonstrated its ability to overcome obstacles in the past. Its dedicated fanbase and loyal customer following are evidence of the company’s strong brand appeal.

However, as Tesla prepares to release its earnings report, investors are eager for more concrete evidence that the company can keep up its breakneck growth. Any indication of slower-than-expected growth or missed targets could lead to a significant selloff in Tesla’s stock.

As Wall Street eagerly awaits Tesla’s earnings announcement, analysts and investors will be closely analyzing the results and management’s commentary. The future trajectory of Tesla’s stock will largely depend on whether the company can address the concerns surrounding its breakneck growth and deliver positive results.