News

Thrift Savings Plan (TSP) Updates for 2025: New Contribution Limits and Key Considerations

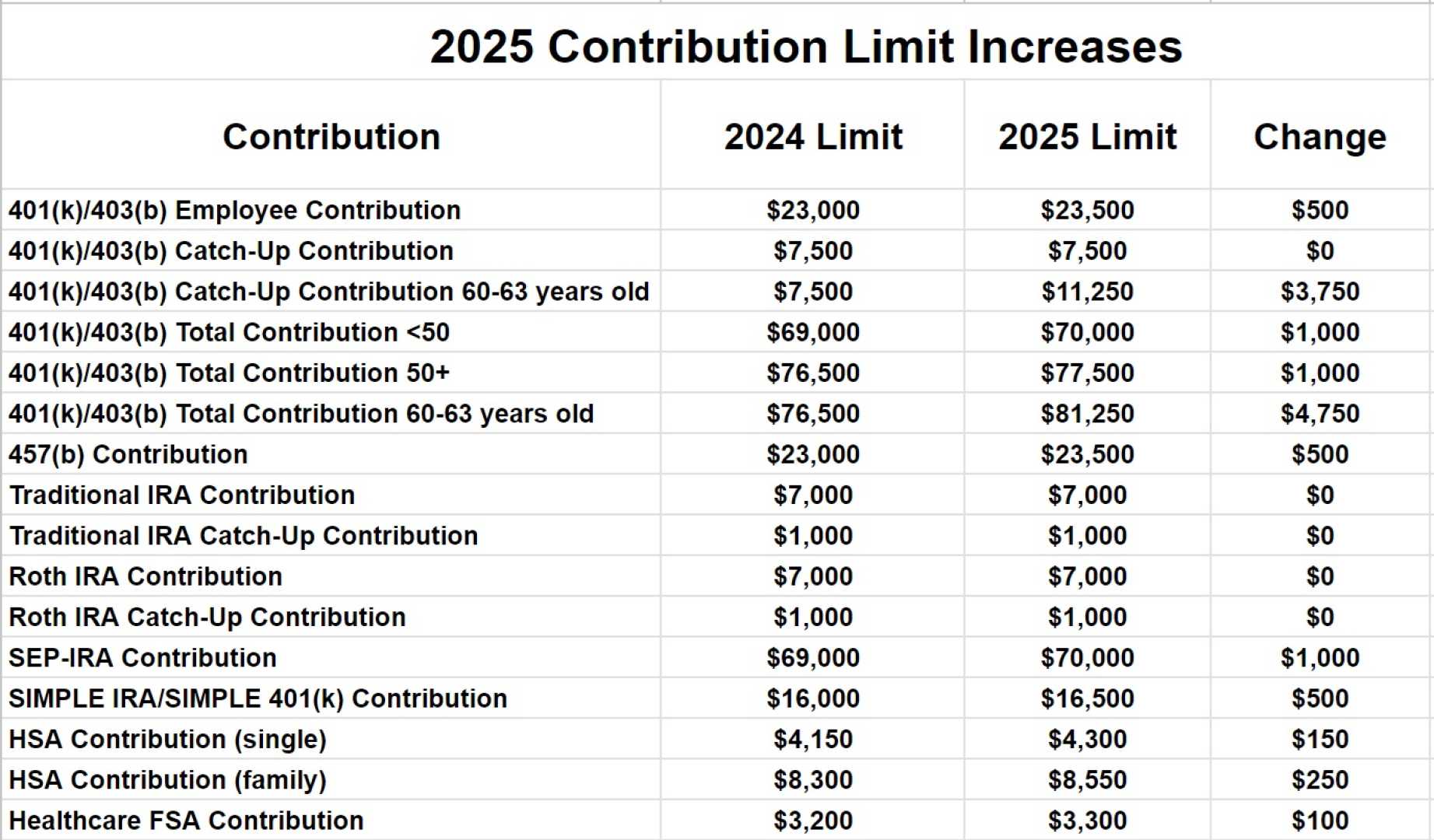

The Thrift Savings Plan (TSP), a retirement savings plan for federal employees, has announced several important updates for 2025. One of the most significant changes is the increase in contribution limits. As of 2025, the new limits for TSP contributions have been officially raised, providing federal employees with the opportunity to save more for their retirement.

For federal employees, it is crucial to understand the implications of these changes. Contributions to the TSP must be made through payroll deductions, and once an employee separates from federal service, they can no longer contribute to the plan. Therefore, maximizing contributions while still employed is essential.

In addition to the increased contribution limits, separated TSP participants should be aware of other key considerations. For instance, withdrawals taken before the age of 59½ may be subject to a 10% early withdrawal penalty. Moreover, the TSP has made it easier for separated participants to withdraw funds, with changes effective as of May 15, 2024.

The Federal Retirement Thrift Investment Board (FRTIB), which administers the TSP, continues to make improvements to the plan. Recent updates include a major overhaul of the TSP website to enhance user experience and the elimination of security questions as part of the multi-factor authentication process.