Business

Workday (WDAY) Q3 Earnings: What to Expect and Market Reactions

Workday Inc. (WDAY) is set to release its Q3 FY25 earnings results on November 26, 2024, after market close. Wall Street analysts anticipate the company to report earnings of $1.76 per share, representing a 15% year-over-year increase. Revenues are also expected to rise by 15% year-over-year, reaching $2.13 billion for the quarter.

The company has seen significant gains over the past year, with its shares increasing by about 14%, largely driven by advancements in artificial intelligence (AI). Workday has been enhancing its platform by integrating AI technologies, improving capabilities in data analysis, automation, and decision-making. The upcoming earnings report will be closely watched to see how these AI advancements impact the company’s financial performance and future growth.

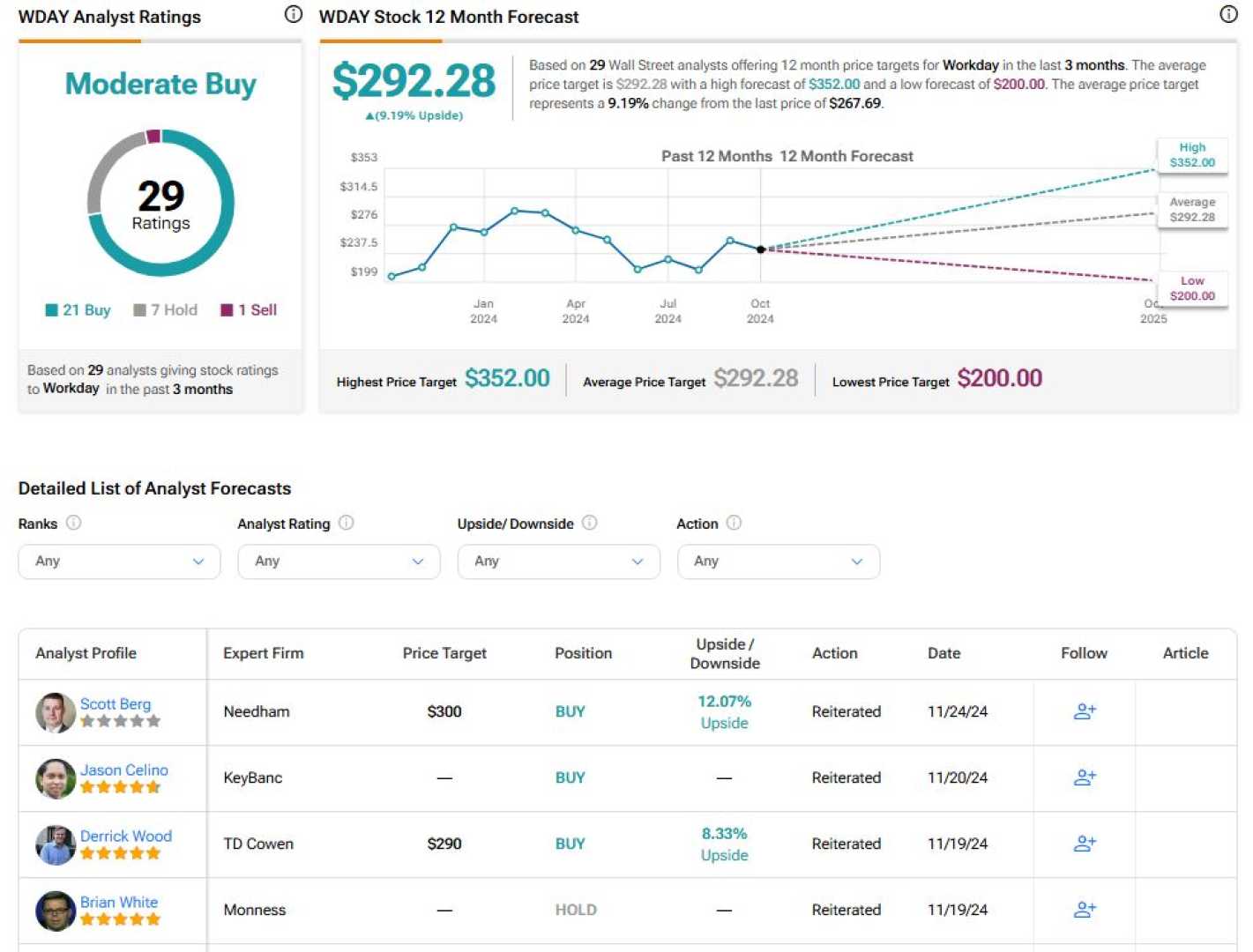

Workday has a strong track record of earnings surprises, having surpassed estimates in each of the last nine quarters. However, analysts have mixed sentiments ahead of the Q3 earnings. Monness analyst Brian White reaffirmed a Neutral rating on WDAY stock, citing challenges in a tough macroeconomic environment and slowing growth. In contrast, TD Cowen analyst Derrick Wood reiterated a Buy rating with a price target of $290, highlighting the company’s growth plans and the potential of its Illuminate platform, which uses AI and machine learning to enhance decision-making.

Options traders are anticipating a significant move in the stock price post-earnings, with implied volatility suggesting a move near 7.4%, or $19.98, after the results are released. The median move over the past eight quarters has been 10.5%.

Following the release of the Q3 results, Workday will host a conference call at 4:30 PM ET on November 26, 2024, to discuss the earnings. The live webcast can be accessed through the company’s investor website.

In late trading, Workday shares fell 4.5% after the company lowered its full-year revenue outlook, despite reporting stronger Q3 results. The lowered guidance overshadowed the positive quarterly performance, including a 15.8% year-over-year increase in subscription revenue to $1.959 billion.