Business

Mortgage Rates Drop to Lowest Level Since October 2024

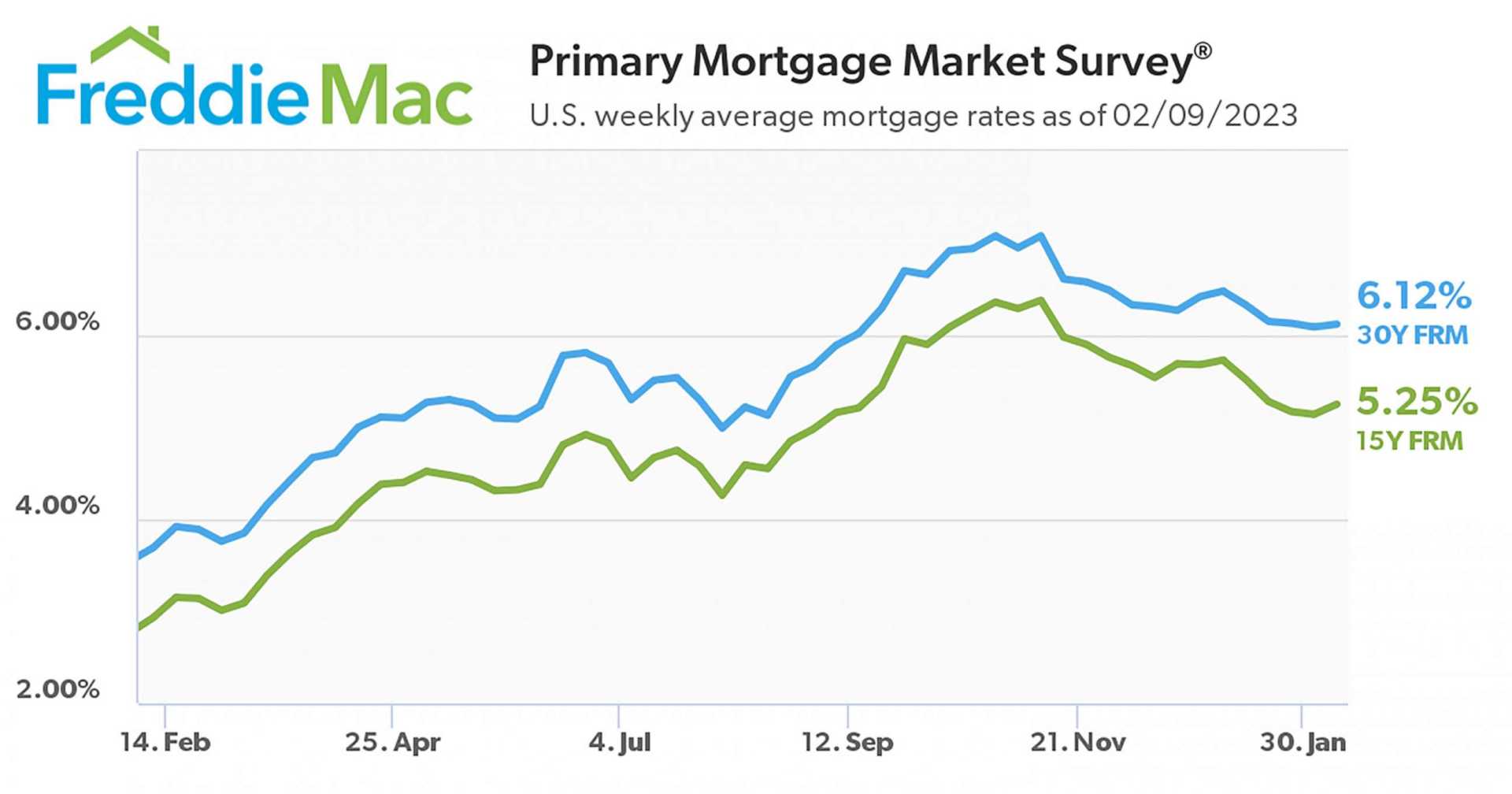

Washington, D.C. — Mortgage rates have fallen to their lowest level in nearly ten months, providing some relief for homebuyers and homeowners looking to refinance. The average rate on a 30-year fixed mortgage dropped to 6.58% for the week ending August 14, according to Freddie Mac.

This decline comes as expectations rise that the Federal Reserve may cut interest rates, following weaker-than-expected employment data. Kara Ng, a senior economist at Zillow Home Loans, noted that recent job market revisions have indicated a cooling economy.

Although the Fed does not directly set mortgage rates, its decisions can greatly influence the key benchmark for home loans. As rates have hovered near 7% throughout the year, the real estate market has slowed significantly, with homes taking longer to sell and bidding wars becoming rare.

“Purchase application activity is improving as borrowers take advantage of the decline in mortgage rates,” said Sam Khater, Freddie Mac’s chief economist. He emphasized that a drop in borrowing costs could revitalize a softening market.

The average rate on a 15-year fixed mortgage also fell, reaching 5.71% from 5.75% the previous week. One year ago, rates were lower at 6.49% for 30-year loans and 5.66% for 15-year loans.

Despite these declines, affordability remains a concern for many potential buyers. The median sales price of previously occupied homes reached an all-time high of $435,300 in June.

Mortgage applications surged 10.9% last week as homeowners sought to refinance amidst lower rates. Refinance applications accounted for nearly 47% of all mortgage applications, with a notable 23% increase from the week prior, marking the strongest activity since April.

As the housing market grapples with rising prices and elevated interest rates, Treasury Secretary Scott Bessent highlighted the federal priority of addressing this affordability crisis in his strategy moving forward.

“We are really going to work on this housing affordability crisis,” Bessent stated during a recent interview.

The market outlook remains uncertain, but with mortgage rates dipping below the 6.6% mark, the hope is that more buyers can re-enter the housing landscape.