Business

Blue-Chip Stocks Show Resilience Amid Market Decline

NEW YORK, NY — Investors in blue-chip stocks have found some relief amid recent market turmoil, as several leading companies reported positive returns during a challenging period from March 11 to April 11, 2025.

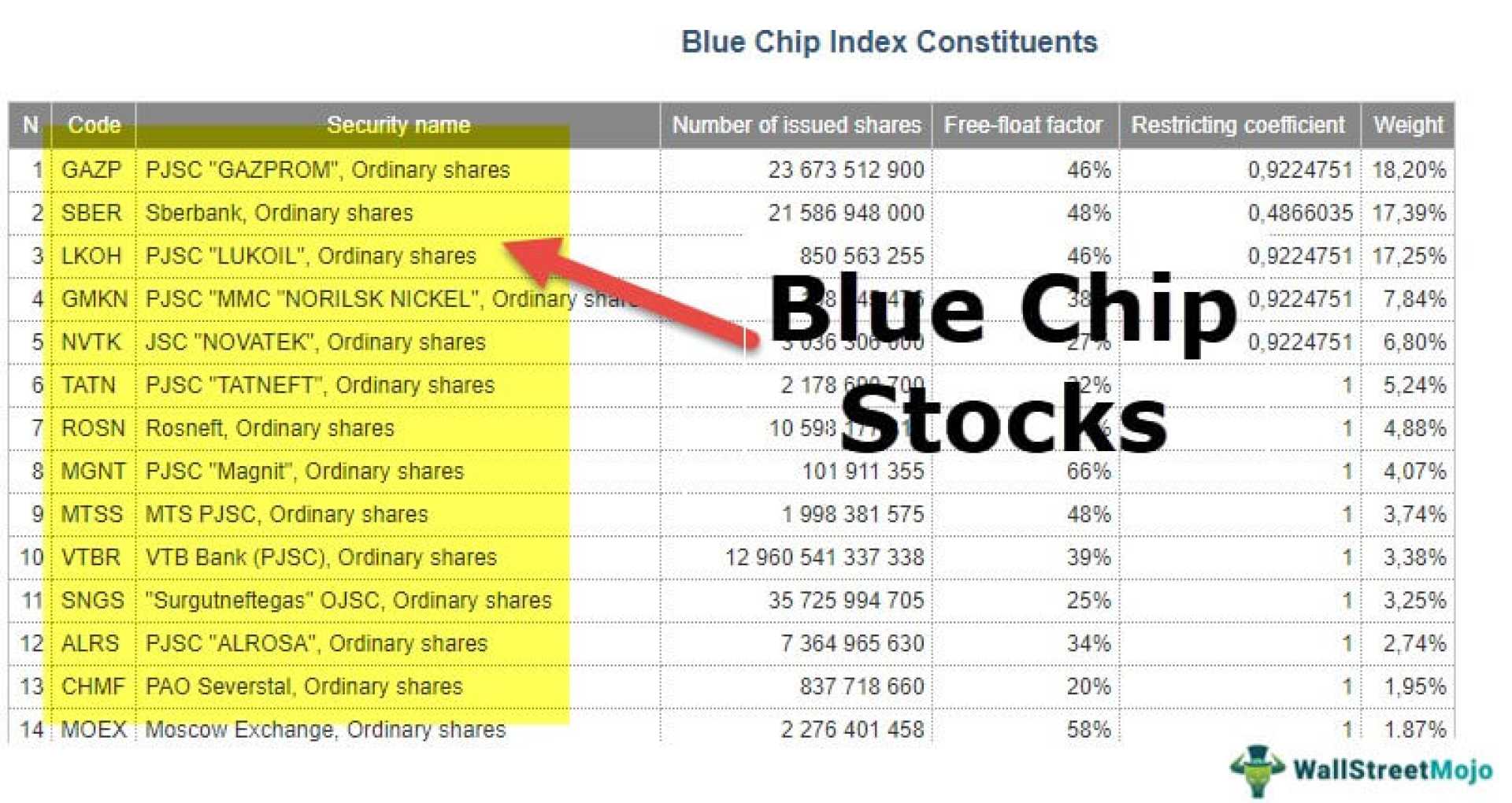

Blue-chip stocks, often referred to as reliable investments, are shares from well-established companies with large market capitalizations. These companies not only have a solid financial background but also typically offer dividends, making them appealing to long-term investors.

During the one-month timeframe, notable blue-chip companies like JPMorgan Chase, McDonald's, Coca-Cola, Microsoft, and Home Depot managed to experience positive returns, despite the S&P 500 falling by more than 4% during the same period. This performance underscores the stability associated with blue-chip stocks, although it is important to note that these stocks are not immune to market volatility.

To qualify as blue-chip stocks, companies must be established public entities for over 20 years, have a market cap exceeding $200 billion, and pay dividends. Among the top performers listed, Walmart Inc. offered a dividend yield of 0.92% with an annual performance of 1.54%, while International Business Machines Corp. (IBM) led with a 6.75% dividend yield and a performance of 44.61%. Other high-performing stocks include Costco Wholesale Corp., JPMorgan Chase & Co., Apple Inc., and NVIDIA Corp., all showcasing significant returns.

The data comes from Finviz and is accurate as of the market close on April 30, 2025. Investors are reminded that crafting a successful stock portfolio requires a diversified approach, balancing small, mid, and large-cap companies across different sectors.

As many investors approach retirement, blue-chip stocks are often favored for their perceived reliability and steady dividends, making them attractive for those investing for income.

Investors should also consider low-cost index funds or exchange-traded funds (ETFs) that focus on blue-chip stocks for a diversified investment strategy. These funds allow investors to gain exposure to a wide range of blue-chip companies efficiently and effectively.

For more information and resources on investing in blue-chip stocks and building a diversified portfolio, investors can explore various online platforms dedicated to financial education.