Business

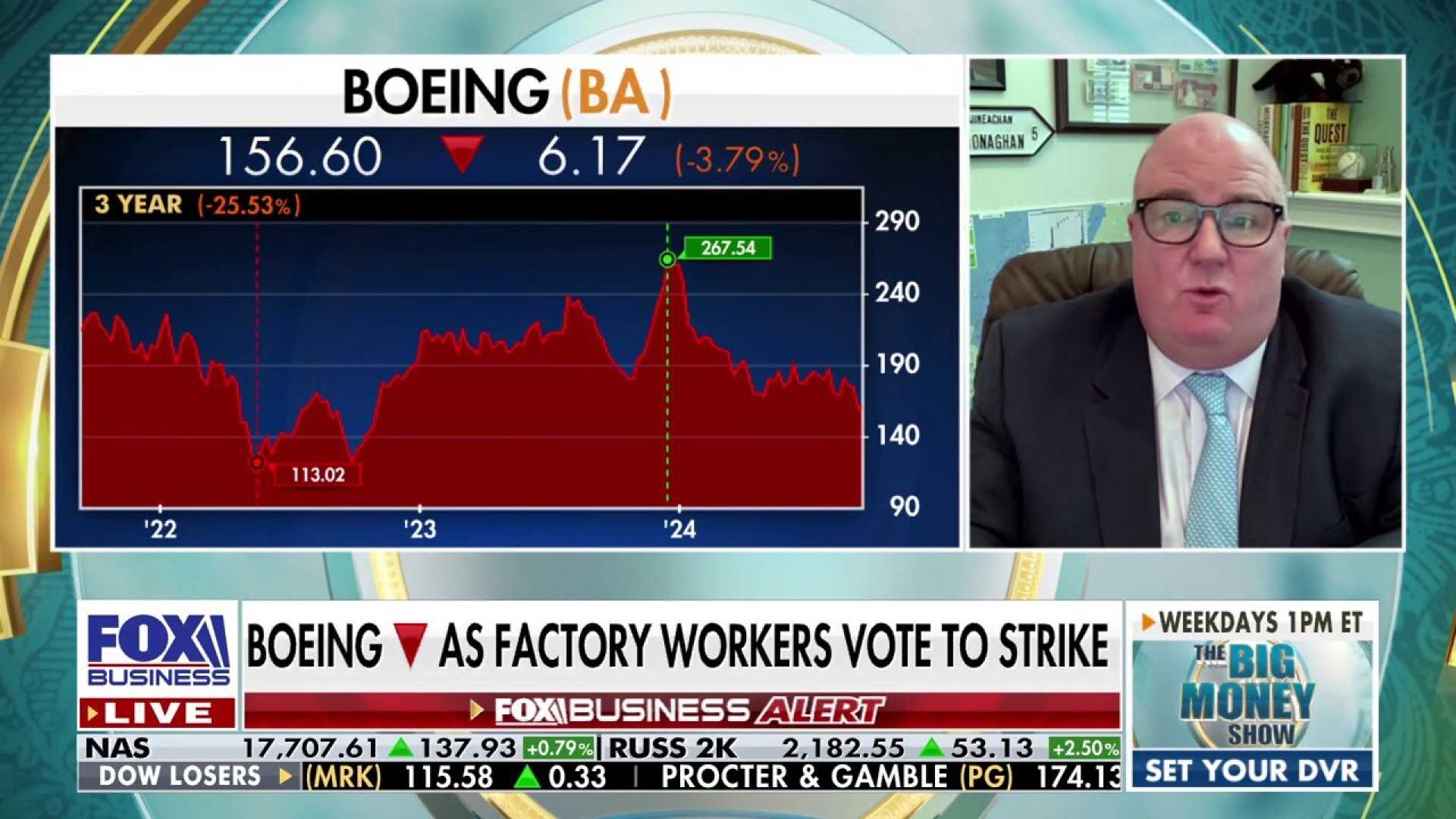

Boeing Stock Plummets Amid Ongoing Labor Strike and Credit Downgrade Fears

Boeing‘s stock has been under significant pressure in recent days due to an ongoing labor strike and the potential for a credit rating downgrade. The strike, which began on September 13, involves over 33,000 members of the International Association of Machinists and Aerospace Workers (IAM) and has halted production at Boeing’s factories, including those producing the 737 Max jets.

The breakdown in negotiations between Boeing and the IAM has led to a more aggressive stance from the company, with Boeing lodging a charge of unfair labor practices against the union. This move follows the retraction of Boeing’s contract proposal, which the union did not consider seriously.

The financial impact of the strike is substantial, with S&P Global estimating the monthly cost to be around $1 billion. This has prompted S&P to place Boeing on CreditWatch, indicating a potential downgrade to junk status if the strike persists. Such a downgrade would increase Boeing’s borrowing costs and complicate its financial situation.

Analysts predict that Boeing may need to secure additional funds through an equity offering, potentially exceeding $10 billion, depending on the strike’s duration. At the end of the second quarter, Boeing reported approximately $58 billion in total debt and $126 billion in cash.

The strike has also disrupted Boeing’s plans to increase 737 Max production to 38 units per month by the end of the year. Year-to-date, Boeing’s stock has declined by about 40%, and it is currently hovering near its 52-week low.

Despite these challenges, analysts maintain a “Buy” rating for Boeing stock, with an average price target of $209.11, indicating a potential upside of 42.62% from the current price.