Business

Cava Group’s Stock Skyrockets: Is It Worth the Hype?

NEW YORK, Feb. 16, 2025 — Cava Group’s stock has surged by 160% over the past year, outpacing the S&P 500’s 20% rise, raising questions about its sustainability amid the restaurant sector’s competitive landscape.

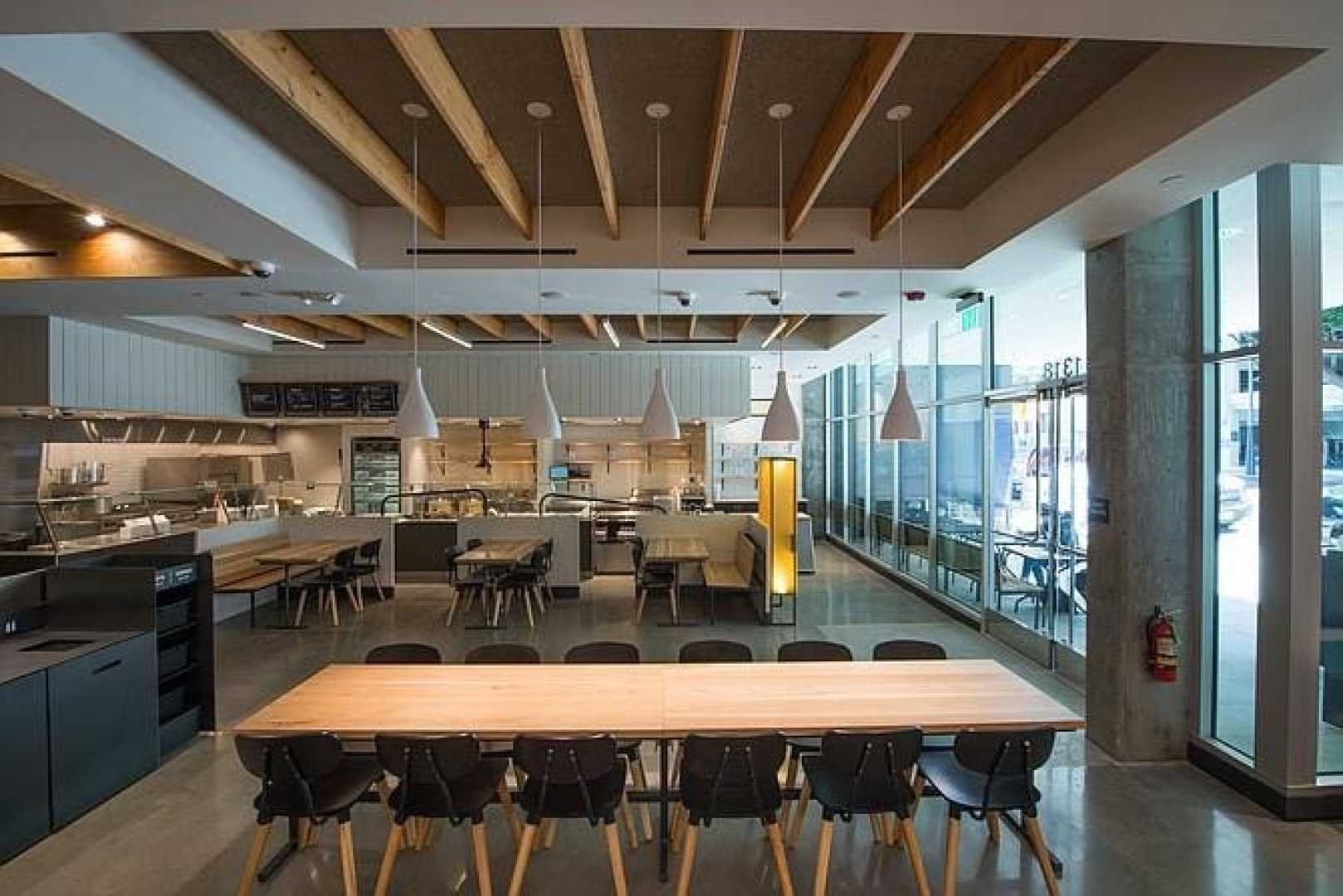

The Mediterranean-themed fast-casual chain, known for its assembly line-style food preparation, has drawn comparisons with Chipotle Mexican Grill. Investors are optimistic that Cava could replicate Chipotle’s success given the latter’s 340% stock growth over the last decade, despite a recent drop in share price. Cava operated approximately 350 locations as of the end of the third quarter of 2024, while Chipotle boasts over 3,700 restaurants.

Cava’s potential for growth lies in its ability to appeal to health-conscious consumers, evidenced by an impressive 18% increase in same-store sales reported for the third quarter of 2024. “Cava’s business model resonates well with customers seeking fresh, customizable meals,” said an analyst familiar with the sector.

However, rising expectations come with risks. Cava’s current price-to-earnings (P/E) ratio exceeds 300, significantly higher than Chipotle’s 50 and the S&P 500 average of 23. This exorbitant valuation may concern investors. “If Cava’s growth trajectory shows even the slightest sign of slowing, we could see a quick sell-off among investors,” warned another market analyst.

Despite robust sales and new restaurant openings, analysts advise caution. The soaring stock price may already factor in much of the anticipated good news. If Cava can maintain solid growth, the valuation may be justified, but any downturn could lead to turbulence. Investors need to closely monitor the situation.

To put Cava’s Return on Equity (ROE) into context, it stands at 8.7%, below the industry average of 14%. While not ideal, a lack of debt provides the company with a better footing for future growth opportunities. “Investors should appreciate that Cava has zero debt, giving it more flexibility to invest in expansion,” a finance expert noted.

As aggressive growth potential exists, Cava appears best suited for investors willing to tolerate volatility. “The stock is attractive for those who believe in the restaurant’s growth potential, but prudent investors might consider other options,” one financial advisor suggested.

In conclusion, while Cava Group’s stock performance has been stunning, prospective buyers should remain vigilant. With lofty valuations, any shift in growth momentum could lead to significant price drops. Investors should weigh their options carefully before jumping in.