Business

CME Group Lithium Futures Reach Record Trading Volume in 2025

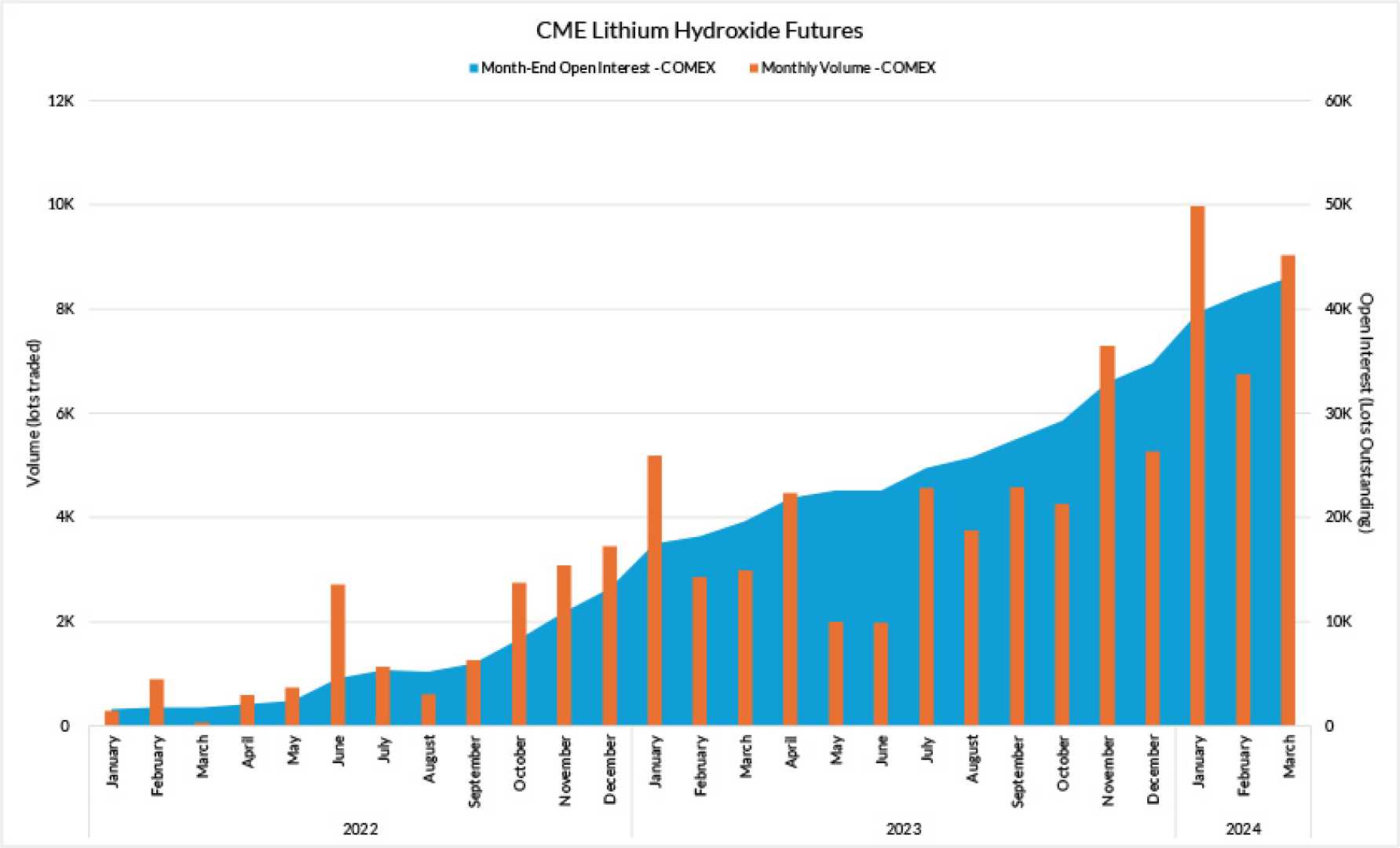

Chicago, IL—The market for lithium futures has skyrocketed in 2025, with the Chicago Mercantile Exchange (CME) lithium hydroxide contract setting new trading records. In July, 17,013 tonnes of lithium hydroxide were traded through CME futures contracts, surpassing the previous record of 15,837 tonnes set earlier in the year.

This surge in activity highlights a growing sophistication in trading battery materials as the global energy transition accelerates. The CME has seen month-over-month increases in trading volumes, reflecting a strong commitment from participants towards longer-term positions.

Przemek Koralewski, Global Head of Market Development at Fastmarkets, noted, “We are seeing increased participation in ex-China lithium futures markets, which indicates that the fundamentals may be shifting and new entrants are coming to the market.”

The CME has witnessed significant developments in daily trading volumes, with August 8 recording 1,910 lots traded. This figure approaches the all-time daily trading high of 2,161 lots set earlier this year.

The rise of CME lithium hydroxide futures also correlates with recent supply disruptions. On August 9, CATL, a major Chinese battery producer, suspended lithium mining operations due to the expiration of its mining permit. This operational halt has created uncertainty in lithium supply chains, impacting futures prices globally.

In the wake of the CATL announcement, CME futures contracts showed a more pronounced contango structure, indicating market expectations of future price increases. For October 2025, the contract price climbed to $10.27 per kg, signaling concerns over prolonged supply disruptions.

As the market matures, exchanges like CME are implementing measures to maintain market integrity and prevent excessive speculation. The sustained growth in trading volume suggests that lithium futures are becoming an essential tool for price discovery and risk management in an increasingly competitive market.