News

Deadline Looms for 2021 Recovery Rebate Credit Claims

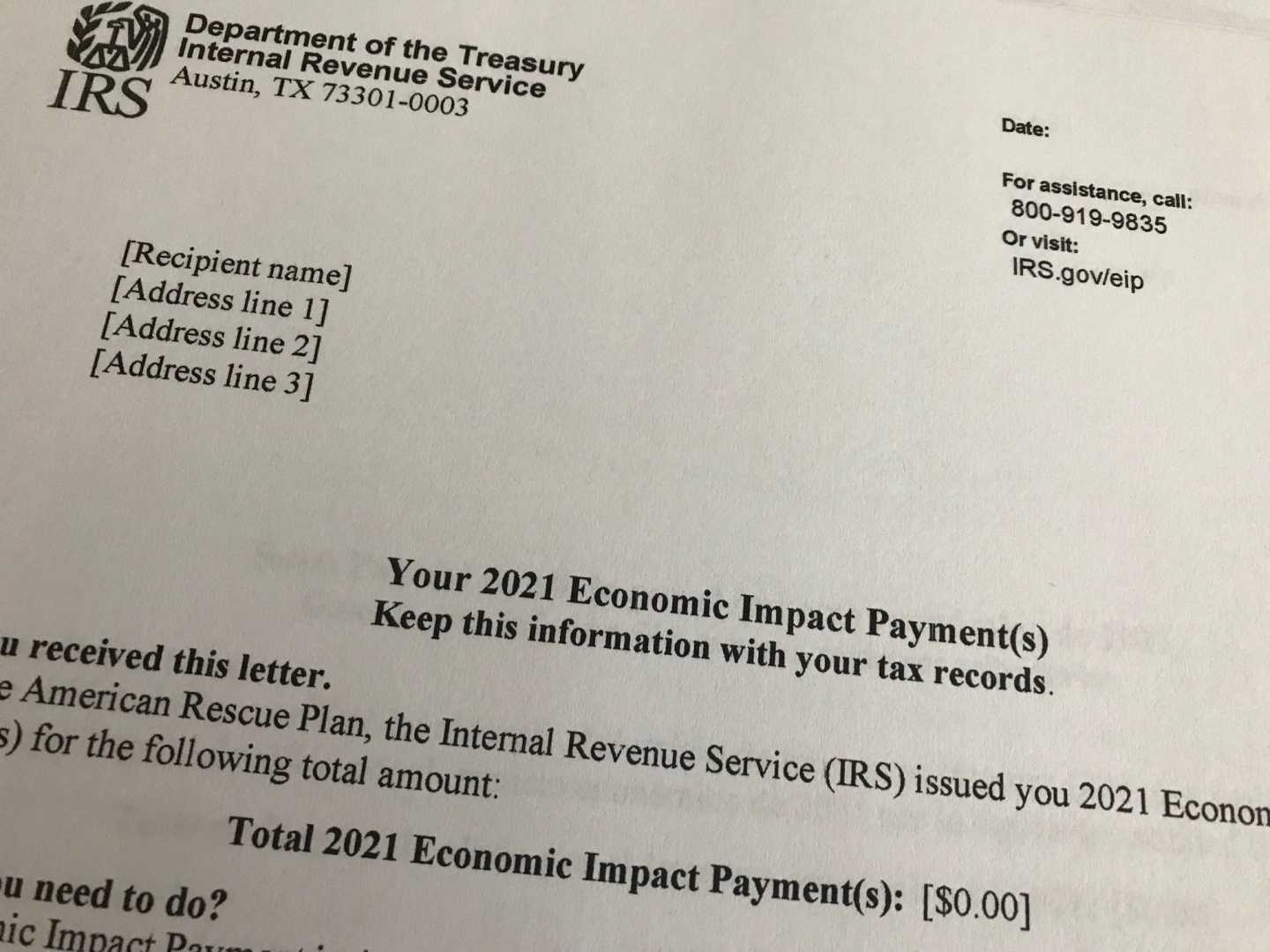

New York, NY — Taxpayers are rapidly approaching the April 15 deadline to claim the $1,400 Recovery Rebate Credit for the tax year 2021. This credit, part of the federal government’s efforts to provide financial relief during the COVID-19 pandemic, has been left unclaimed by many eligible individuals and families.

According to the Internal Revenue Service (IRS), Americans who did not file their taxes in 2021 still have a final opportunity to claim the credit. If taxpayers qualify, they must submit their 2021 tax returns by the April 15 deadline, or they will forfeit the funds, which will then return to the U.S. Treasury.

“The Recovery Rebate Credit is crucial for individuals who may not have been aware they were eligible for stimulus payments,” said Kevin Thompson, finance expert and CEO of 9i Capital Group. “It’s refundable, meaning you can receive the credit even if you don’t owe taxes.”

Many Americans did not claim the payments, especially those not required to file. The IRS estimates that as of late 2021, up to 1 million individuals could qualify for the rebate.

The credit is available to individuals with an adjusted gross income of up to $75,000, and for married couples filing together, the limit is $150,000 for that tax year. Families with children may receive even more, with claims up to $5,600 available for couples with two qualifying dependents.

For those who filed a return but missed the Recovery Rebate Credit, the IRS announced in December that it would automatically send special payments totaling approximately $2.4 billion to these individuals. These payments were intended for taxpayers who either did not claim the credit or erroneously reported it as $0.

“If there’s any uncertainty regarding your status, it’s best to file your 2021 return to ensure you can claim the credit before the deadline,” said Robert Nassau, a law professor at Syracuse University. “Once it hits April 15, any unclaimed funds go back to the Treasury.”

Eligible taxpayers can check their IRS accounts online for information about their stimulus checks. Tom Lucas, a certified financial planner, emphasized, “That’s the best place to look,” referring to the online portal’s “tax records” section.

The IRS urges taxpayers to act quickly to prevent missing the opportunity to receive these funds, particularly amidst the financial uncertainties many still face in the pandemic’s aftermath. With the deadline fast approaching, those who may qualify are urged to prepare and file their returns promptly.