Business

Experts Predict Mild Decline in Mortgage Rates for 2025 Amid Economic Uncertainty

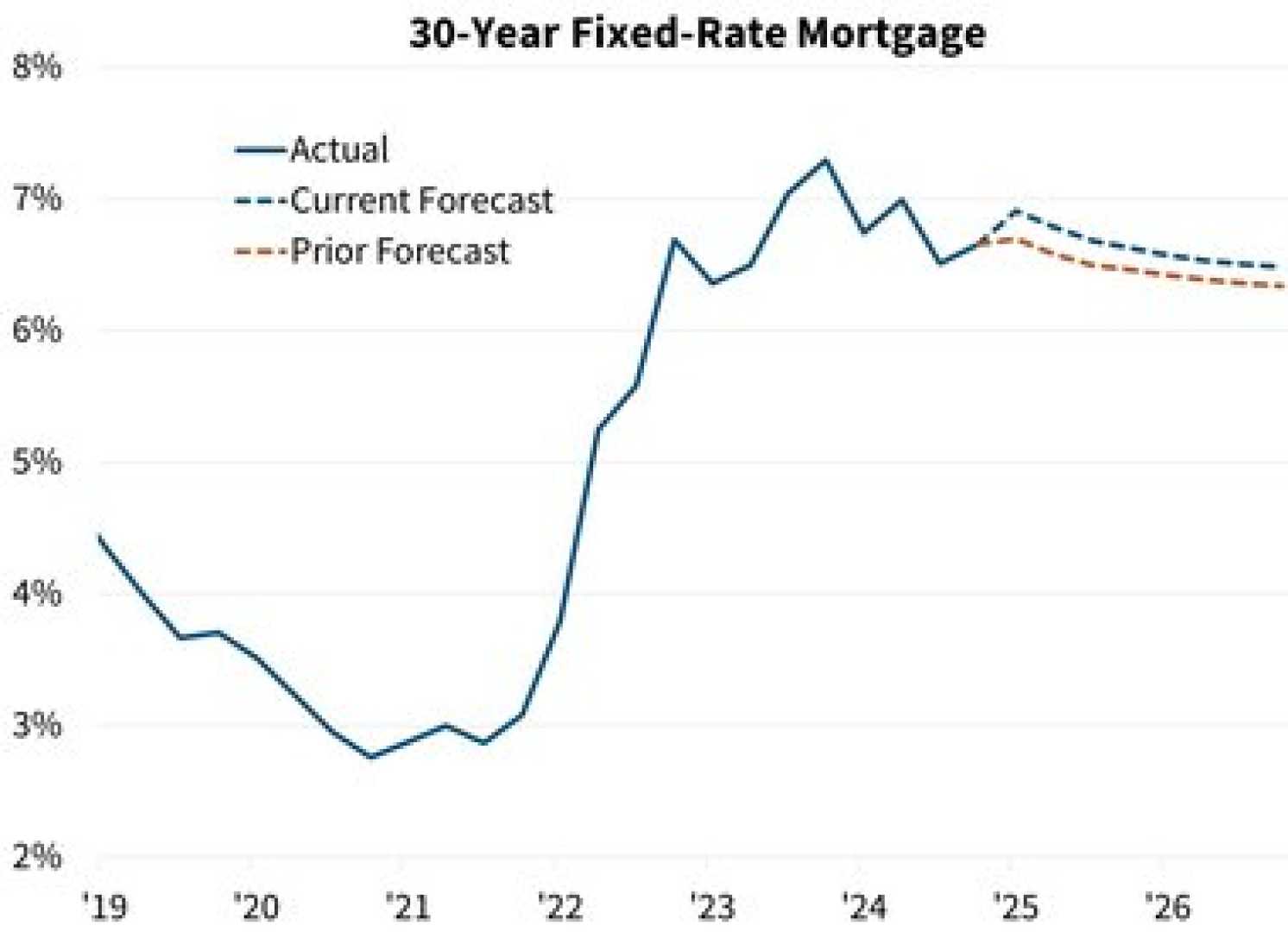

WASHINGTON, D.C. — Mortgage rates in 2025 are expected to dip slightly, according to forecasts from various financial institutions, despite a backdrop of economic uncertainty. As the Federal Reserve continues to navigate inflation and economic policies, the trajectory of these rates remains a pivotal topic among mortgage experts.

Data from Freddie Mac shows that the average rate for a 30-year fixed mortgage stood at 6.64% as of early April 2025. This is a decrease from the previous month, but it still reflects a complex market influenced by multiple external factors.

None of the predictions suggest that rates will fall below the 2024 lows, which hit a minimum of 6.08% last September. As a result, even if rates decline slightly, potential homebuyers may not experience significant improvements in affordability.

“While many project a slight dip in rates this year, significant fluctuations remain likely,” said Afifa Saburi, a capital markets analyst. “Potential buyers should be careful about waiting for rates to drop further, as the economic outlook is unpredictable.”

The housing market typically sees an increase in demand when mortgage rates are low, as lower rates enhance buying power. However, as rates escalate, many prospective buyers drop out, further complicating market dynamics.

This trend, known as the “lock-in effect,” has constrained housing supply. Many current homeowners choose to stay put, reluctant to relinquish their historically low mortgage rates. This behavior has contributed to escalating home prices, exacerbating affordability issues for buyers.

Factors influencing the mortgage market include investor demand for mortgage-backed securities, inflation rates, and overall economic health. Generally, mortgage rates climb during economically prosperous periods, while economic slowdowns can lead to lower rates.

The current mortgage environment remains sensitive to broader economic indicators. For instance, data revealing investor demand and inflation forecasts have kept rates relatively high. When the economy slows, there is typically a corresponding decline in mortgage rates due to increased investor interest in safer securities.

Mortgage rates fell to historic lows during the COVID-19 pandemic, with rates dropping below 3% in 2021, primarily due to the Federal Reserve’s aggressive monetary policies aimed at staving off an economic crisis. However, recent increases in inflation have prompted the Fed to adjust its policies, resulting in rising mortgage rates since 2022.

After peaking in October 2022 at 7.08%, rates remained high through 2023. Predictions for 2025 suggest a potential decline to the range of 5.5% to 6.0%, but much depends on inflation and Fed interest rate policies.

As market conditions evolve, experts suggest that homebuyers should consider purchasing now rather than waiting for rates to drop. “Locking in a purchase could avoid competition when rates fall,” added Saburi. “Buyers can always refinance later if better rates become available.”

In summary, while 2025 may not bring significant improvement in mortgage rate affordability, it presents a landscape where buyer action today could yield benefits with potential future refinancing options. Homebuyers should closely monitor their financial profile, including credit scores and debt-to-income ratios, which significantly impact the rates they can secure.