Business

Global Bond Yields Surge, Threatening Borrowers and Shaking Markets

NEW YORK — Government bond yields are skyrocketing worldwide, with U.S. Treasury yields hitting a 14-month high and European and Japanese bonds following suit, raising borrowing costs for governments, businesses, and consumers alike.

The yield on 10-year U.S. Treasury bonds reached 4.8% by Jan. 13, 2025, marking a half-percentage-point increase over the past month. German bunds climbed to 2.6%, up from 2% in December, while Japanese bond yields also rose sharply. In the U.K., gilt yields recently hit nearly 5%, their highest level since 2008.

“The rising rates on bonds will certainly impact everybody,” said Adam Lampe, CEO of Mint Wealth Management, in an interview with ABC News. Higher yields mean increased borrowing costs for mortgages, credit cards, and other loans, with the average 30-year fixed mortgage rate now at 6.93%, up from just over 6% in September.

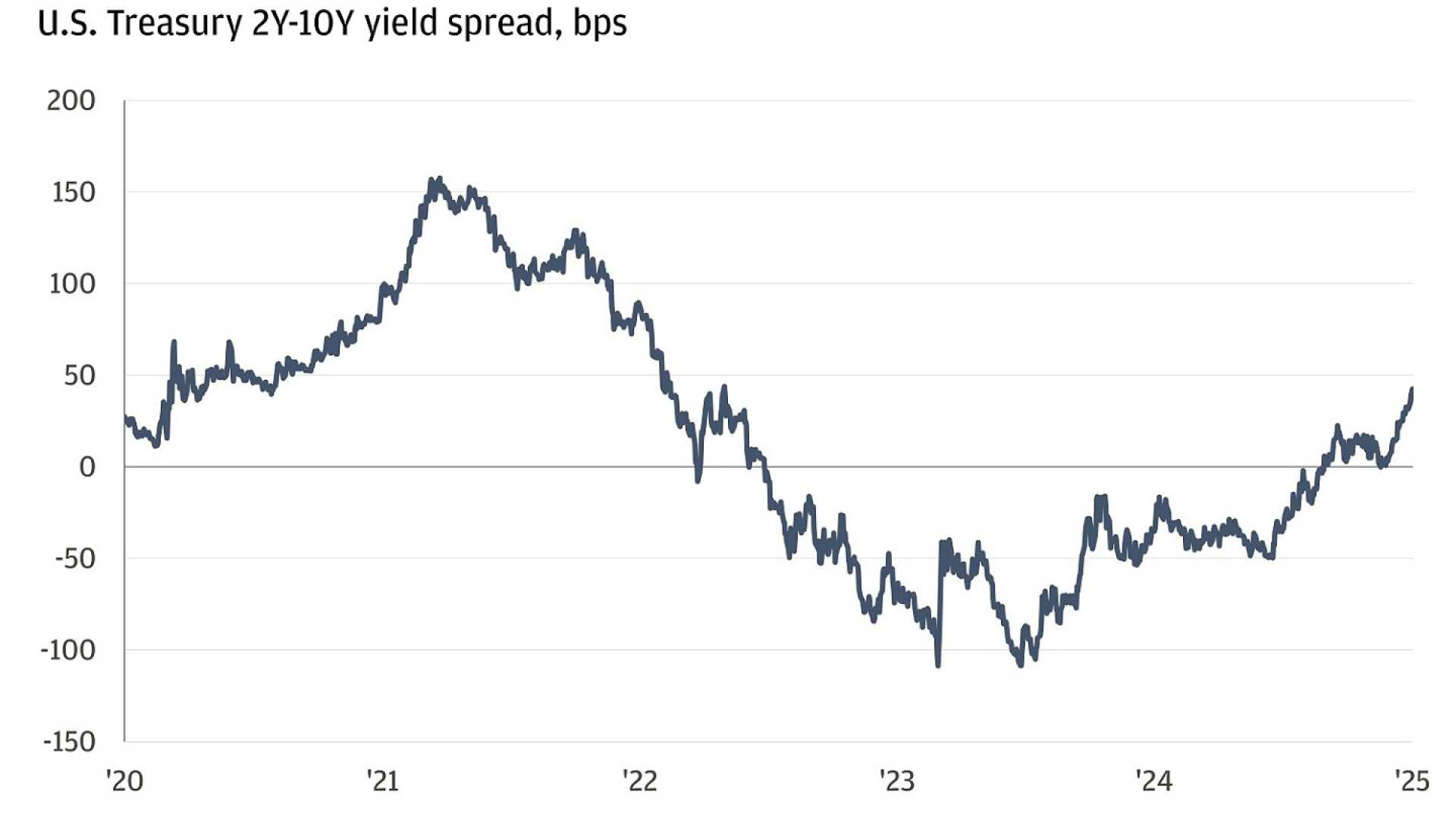

The surge in yields follows stronger-than-expected economic data, which has led the Federal Reserve to delay anticipated interest rate cuts. Dominic Pappalardo, chief multi-asset strategist at Morningstar Investment Management, told ABC News that long-term Treasury yields influence interest payments across nearly all forms of borrowing, creating financial strain for consumers.

However, the trend isn’t entirely negative. Investors in low-risk instruments like money market funds and high-interest savings accounts are seeing better returns. The average yield for a money market fund now stands at 4.27%, outpacing the current inflation rate of 2.7%. “For those who want to see their money go up faster than the inflation rate, you can do it now with almost no risk,” said Jim Bianco, a market analyst at Bianco Research.

The stock market, which reached record highs in 2024, may face challenges in 2025 as higher bond yields make equities less attractive. The S&P 500 soared 25% last year, but experts predict more moderate returns ahead. “Equities don’t look as attractive in a higher-interest-rate environment,” Lampe noted.

Despite the uncertainty, some analysts remain optimistic. Inflation has slowed significantly from its 2022 peak, and potential economic initiatives under President-elect Donald Trump could spur growth. However, a booming economy could also reignite inflation, further complicating the financial landscape.

As bond yields continue to climb, investors may increasingly turn to bonds for safer returns. “Bond funds will return you most of what the stock market will return you, but with less risk,” Bianco said.