Business

Housing Market Set for Shift as Prices and Rates Expected to Drop in 2026

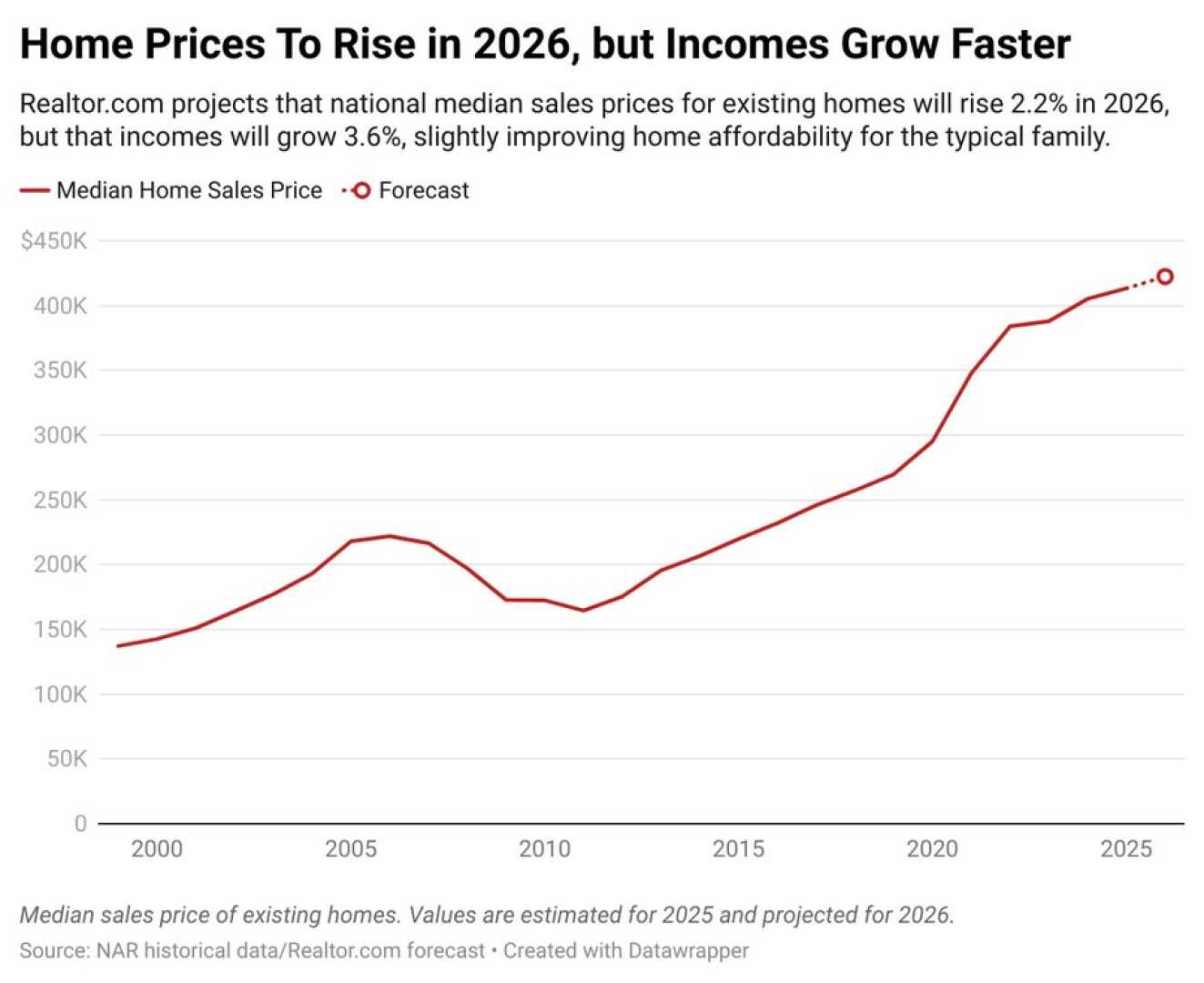

WASHINGTON (TNND) — The housing market may see changes in 2026, as home prices and mortgage rates are projected to decline in several major U.S. cities. A new analysis by Realtor.com indicates that 22 of the largest 100 U.S. cities will experience falling property prices.

Jake Krimmel, a senior economist at Realtor.com, stated that the market is set to become more ‘buyer-friendly’ next year. He described the upcoming year as likely to represent ‘the most balanced housing market’ since the pandemic, meaning neither sellers nor buyers will dominate negotiations.

Mortgage rates are expected to decrease to an average of 6.3% in 2026, a slight reduction from 2025’s average rate of 6.6%. Krimmel emphasized that lower borrowing costs and strong wage growth will encourage more buyers to enter the market. ‘2026 is going to be a year where we think the market is going to steady,’ he said. ‘It’s going to show a lot of signs of getting back on track to what we consider to be normal.’

Existing-home sales are projected to rise slightly by less than 2%, reaching 4.13 million properties in 2026, up from 4.07 million this year. This slight increase comes after transactions have remained flat throughout 2025.

The cities expecting home price drops predominantly lie in the Southeast and the West. Notably, seven of Florida’s eight largest cities, excluding Miami, are anticipated to see declines. Among these, the Cape Coral-Fort Lauderdale metropolitan area is expected to have the most significant drop at 10.2%, followed closely by North Port-Sarasota-Bradenton with an 8.9% reduction.

According to Krimmel, these price declines are likely due to expanded inventory, offering more choices for buyers, alongside lighter demand compared to the pandemic era, which was marked by low mortgage rates and the shift to remote work. ‘These places, among others, saw a huge frenzy during the pandemic, so part of what we are projecting is that demand continuing to come back down to earth,’ he explained during an interview.

Average prices in other 78 large U.S. cities are expected to rise, but modestly, with a projected median increase of about 4%. The predictions come from analyzing various indicators, including inventory levels, new construction, price growth, wage and job growth, and unemployment rates across the country.