Business

Indian Stock Market Plummets Amid Global Trade Tensions

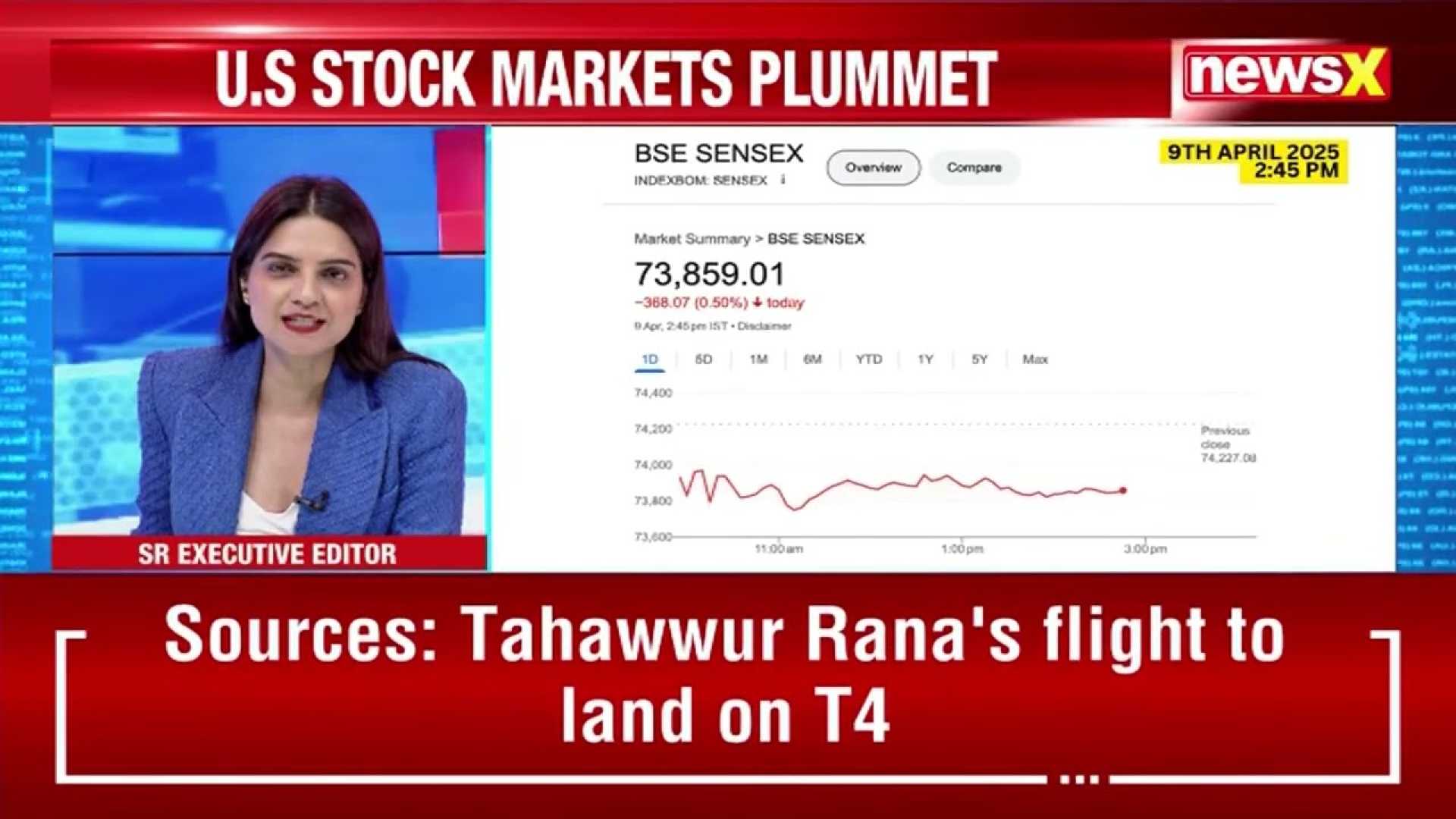

MUMBAI, India — Indian equity markets faced severe losses on April 7, 2025, as ongoing global trade tensions and economic growth anxieties rattled investors for the third consecutive session. The benchmark BSE Sensex plummeted 2,226.79 points, or 2.95%, closing at 73,137.90, after experiencing substantial fluctuations throughout the day.

Markets opened lower, reflecting a broader trend across global exchanges, as the Sensex reached an intraday high of 73,284.24 before sinking to a low of 71,425.01. All 30 components of the Sensex ended in negative territory, with Tata Steel leading the decline, falling by 7.16%. Similarly, the NSE Nifty50 dropped by 742.85 points, or 3.24%, settling at 22,161.60.

The sharp market downturn was attributed to escalating trade tensions, particularly following U.S. President Donald Trump’s announcement of new tariffs, which prompted immediate retaliatory measures from China. Amid this unfolding crisis, investor sentiment soured significantly, with broader indices like Nifty Midcap100 and Smallcap100 experiencing losses of over 3% each.

According to market analyst Vishnu Kant Upadhyay from Master Capital Services, “Indian benchmark indices witnessed significant volatility following retaliatory actions from China and other nations in response to the United States imposing reciprocal tariffs. The Nifty50 opened with a sharp gap-down of over 1,100 points.”

In addition to the declines in equity markets, global shares were similarly affected; Asian stocks saw significant losses, with Japan’s Nikkei 225 down nearly 8%. Oil prices also took a hit, with U.S. benchmark crude falling by $2.50 to $59.49 per barrel.

A further indication of market instability is reflected in the volatility index, India VIX, which surged by 60.5% to reach 22.08, signaling high levels of uncertainty as investors reacted to global economic risks.

As a response to the market plunge and escalating trade disputes, President Trump called upon the Federal Reserve to consider cutting interest rates. “The U.S. has a chance to take decisive action that should have been done decades ago,” Trump encouraged during a press briefing.

With trade uncertainties at an all-time high, analysts caution that volatility may persist in the near term. “Long-term investment opportunities remain viable at current levels, especially in sectors like Finance, Oil & Gas, and FMCG,” Upadhyay added. “Technically, the Nifty may retest the 21,500 mark, and below this level, further downside risks may emerge.”

In an effort to discuss tariff implications, Israeli Prime Minister Benjamin Netanyahu is set to meet with Trump, aiming to persuade him to ease the considerable tariffs imposed on Israeli goods.

As the market reacts, the upcoming meeting of the Reserve Bank of India is anticipated to be closely watched, with expectations for a 25 basis point rate cut, which analysts believe could mitigate some of the market strain.