Business

IRS Reveals Updated 2026 Tax Brackets and Deductions

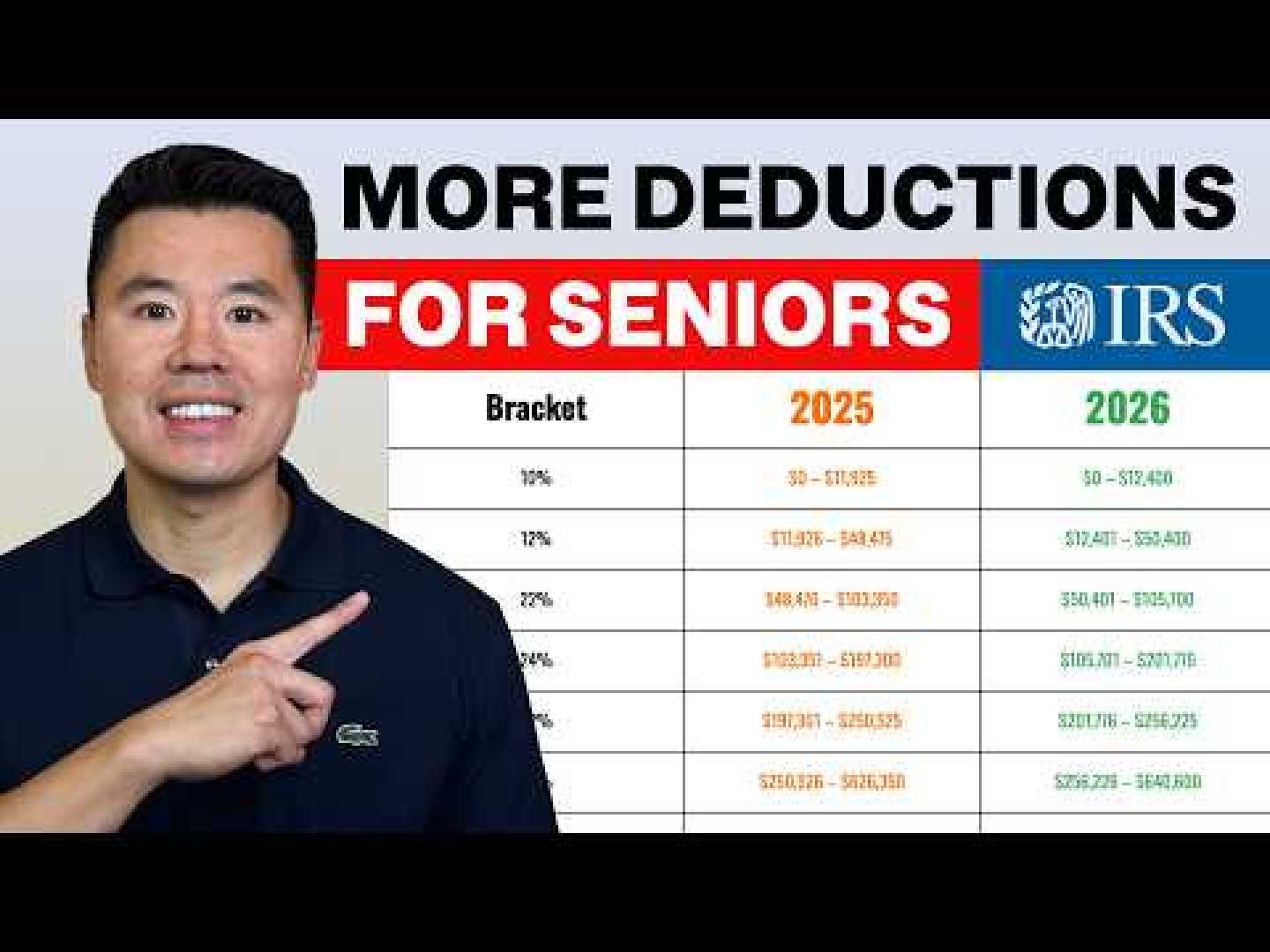

BETHLEHEM, Pa. — The Internal Revenue Service (IRS) has announced changes to federal income tax brackets and standard deduction amounts for the year 2026. These adjustments could directly affect how much Americans owe in taxes when they file in 2027.

The IRS revealed these updates as part of its annual inflation adjustments. The standard deduction, a key tax item for many, will increase, allowing taxpayers to subtract a larger amount from their taxable income. This reduction means that individuals will pay taxes on a smaller income, which many people are eager to know.

The new standard deduction will amount to $32,200 for married couples filing jointly, $16,100 for single filers, and $24,150 for heads of households. These increases reflect a rise of $350 for married couples, $700 for single filers, and $525 for heads of households compared to the previous year.

In addition to the standard deduction increase, the updated tax brackets will mean that the income thresholds are now higher. For single filers, the 10% tax bracket applies to income up to $12,400, while the 12% tax bracket extends up to $50,400. The 22% bracket will only apply to income above that level. Higher tax brackets also see upward corrections.

These changes can lead to tax savings for many households, especially those earning around $68,000 annually, common for professionals in the Lehigh Valley area. Such households could see an increase of about $400 in take-home pay across the year, equating to approximately $15 to $20 extra per paycheck.

While these adjustments can help offset rising costs of living, such as housing and groceries, local municipalities may increase taxes. For instance, Lehigh County Authority plans to raise water and sewer rates, which could offset some of the federal tax savings.

Overall, no action is necessary for taxpayers to benefit from the new federal tax brackets, as employers are expected to update payroll systems automatically in January. Taxpayers are encouraged to review their W-4 withholding forms, especially if they’ve had changes in employment or personal circumstances.