Business

U.S. Stocks Plunge Amid Fears of Escalating Trade War

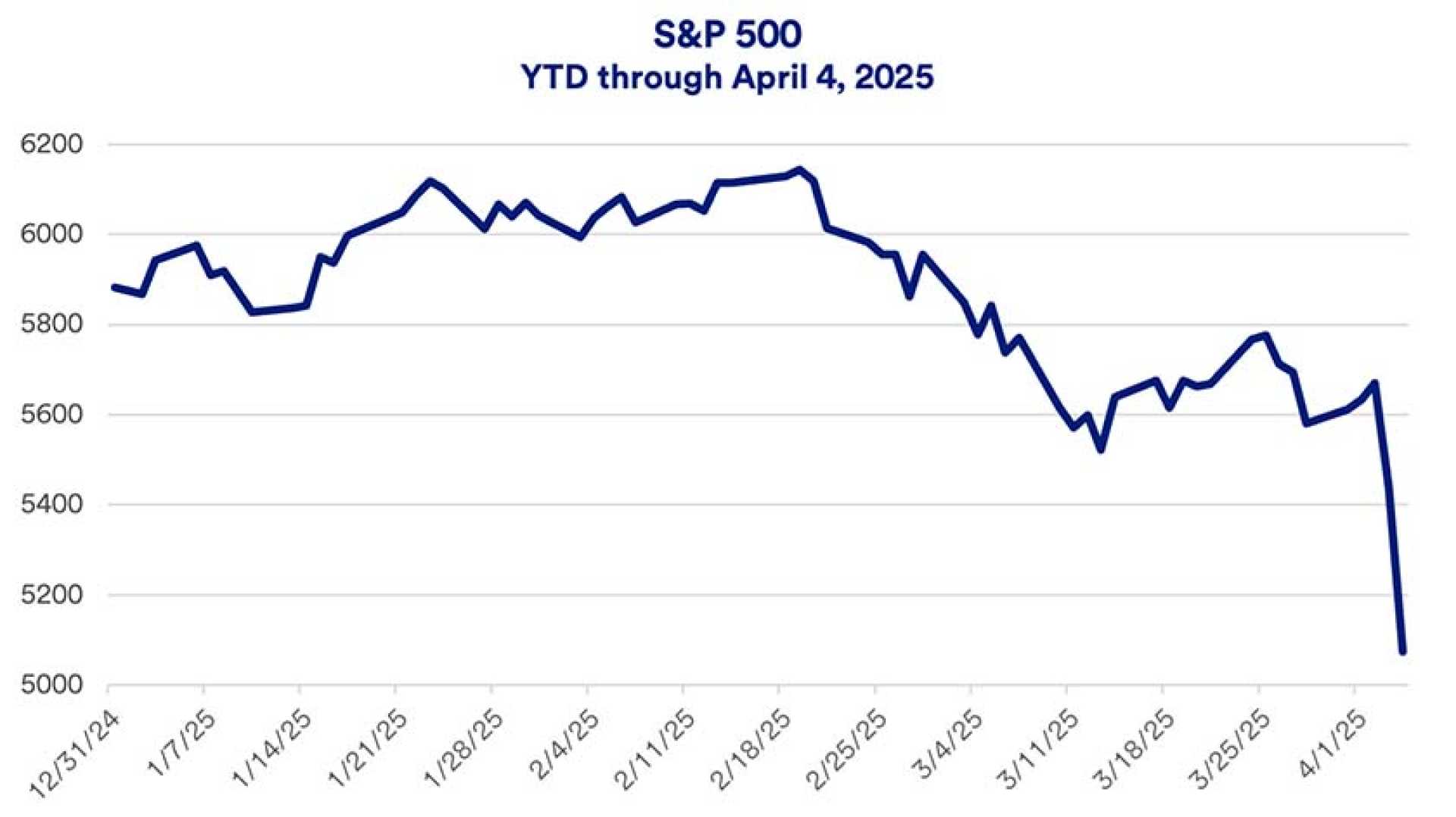

NEW YORK, N.Y. — Major U.S. stock indices experienced sharp declines on Friday, with the Dow Jones Industrial Average dropping over 2,200 points, reflecting escalating fears surrounding a global trade war that threatens corporate profits and economic growth. The losses mark the steepest two-day decline since the onset of the COVID-19 pandemic in March 2020.

The Dow closed down 5.5% on Friday, while the S&P 500 fell 6% and the tech-heavy Nasdaq Composite dropped 5.8%. For the week, the S&P 500 and Nasdaq recorded declines of 9.1% and 10% respectively, with all three indices marking their worst weekly performances in years.

The volatile trading was triggered by President Donald Trump‘s recent announcement of new tariffs against U.S. trading partners. The situation intensified as China announced reciprocal measures, targeting U.S. imports in retaliation for tariffs imposed on Chinese goods. “Tariffs will restore competitive balance,” a White House official argued, despite growing concerns that such policies might reignite inflation and lead to a recession.

The market initially showed promise following a report indicating that U.S. employers added 228,000 jobs in March, significantly exceeding economist predictions of 140,000. However, optimism quickly faded as Trump’s trade policy announcements weighed heavily on investor sentiment.

Federal Reserve Chair Jerome Powell acknowledged the situation’s seriousness, stating, “The risks for slower growth and higher inflation have increased.” Despite the market turbulence, Powell noted that the Fed remains poised to wait for further data before considering adjustments to interest rates.

The yield on the 10-year Treasury dipped to 4.00%, down from 4.06%, as concerns over economic stability grew, affecting borrowing costs across various loans. The decrease in yield reflected market tensions, with many investors seeking safer assets amidst the uncertainty.

Technology stocks, particularly those within the “Magnificent Seven,” faced significant losses. Shares of Nvidia plunged more than 7%, while Tesla fell by 10%, continuing a downward trend in the tech sector exacerbated by tariff announcements. Likewise, Apple, with substantial manufacturing in China, saw a 7% decrease after a previous decline of 9%.

Chip stocks also bore the brunt of the selling frenzy, with companies like Intel and Micron experiencing drops exceeding 10%. The iShares Semiconductor ETF was down 7.5%, illustrating the sector-wide impact of trade concerns.

In addition to tech, energy stocks suffered as oil prices fell, with West Texas Intermediate futures plummeting nearly 7% to $62.30 per barrel amid fears of a trade conflict influencing global oil demand.

Financial institutions also felt the heat as Bank of America, JPMorgan Chase, Citigroup, and Goldman Sachs all reported losses of over 7%. The convergence of tariff concerns and inflation fears led to significant selling pressure across sectors.

Despite the turbulence, some sectors showed resilience, such as homebuilders, who saw stock prices increase as mortgage rates fell. D.R. Horton, PulteGroup, and NVR performed well, indicating potential benefits from lower borrowing costs.

In the wake of the sell-off, prognosticators have increased their likelihood of a recession. Predictions for the U.S. gross domestic product have been adjusted downward, highlighting the growing sentiment that the trade war and high tariffs could potentially slow economic growth.

“It is becoming clear that tariffs will be significantly larger than expected,” Powell reiterated during an economic reporting conference, adding to fears that longer-lasting inflation may accompany a slowing job market.

As markets brace for further developments, investors remain focused on upcoming earnings reports and the broader economic implications of ongoing trade tensions.