Business

Strategies to Enhance MSTR Investments Using Bitcoin Insights

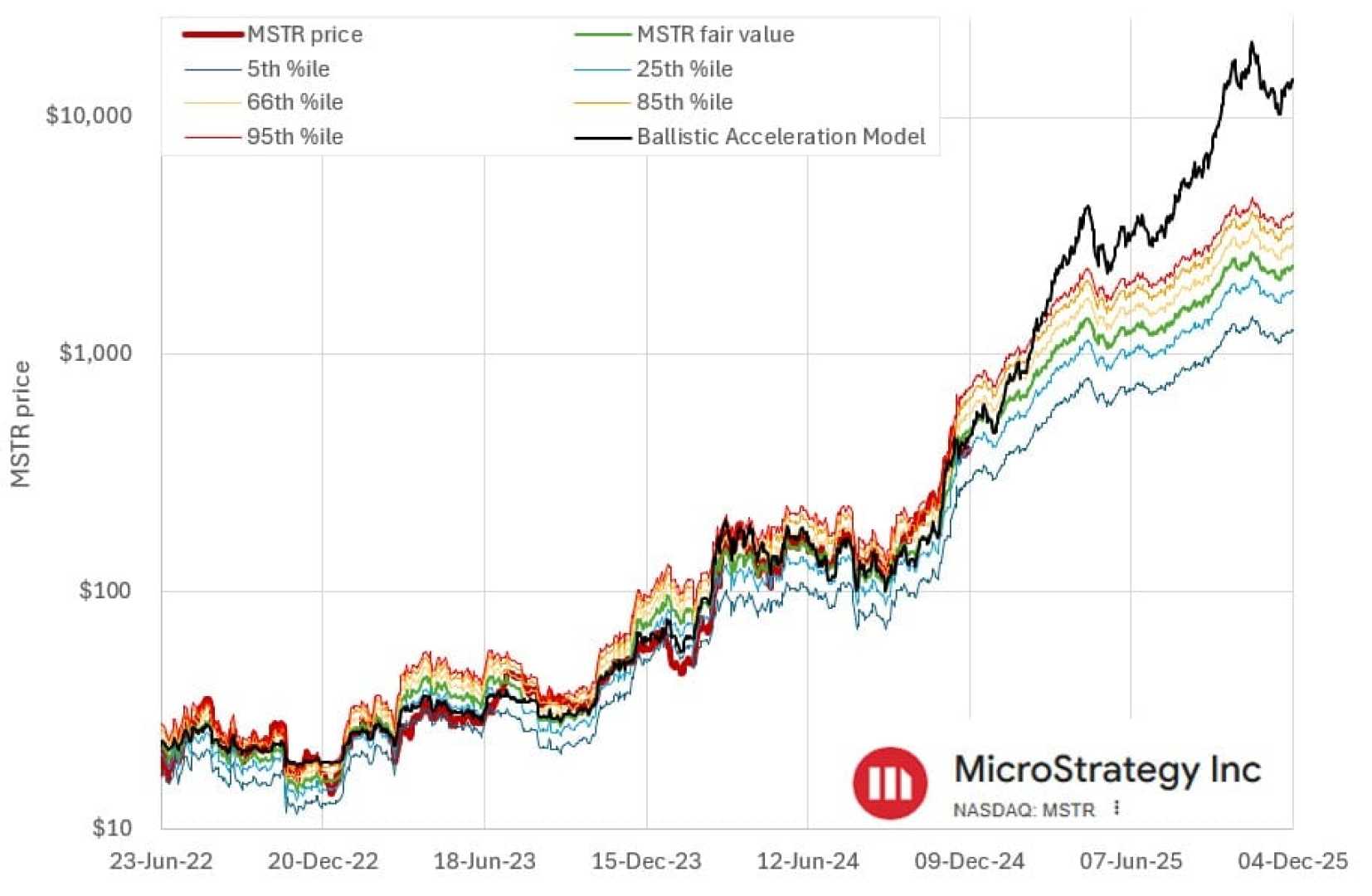

ARLINGTON, Va. — Since Michael Saylor and his team at Strategy (formerly MicroStrategy) began investing in Bitcoin, the company’s returns have far outpaced those of Bitcoin itself. Investors now have opportunities to enhance their MSTR investment strategies further by leveraging key Bitcoin market data.

After starting to accumulate Bitcoin, Strategy has achieved returns exceeding 3,000%, while Bitcoin has only seen a 700% increase. This impressive performance highlights the potential benefits of investing in firms with considerable Bitcoin holdings.

To improve MSTR investment strategies, it’s crucial to use relevant metrics. Key indicators include:

MVRV Z-Score: This metric helps determine whether Bitcoin is undervalued or overvalued. By comparing market cap with realized cap, investors can pinpoint optimal buying and selling points.

Active Address Sentiment Indicator: This tracks network activity and user engagement, offering insights into market sentiment. A significant price change can indicate the right time to take profits or accumulate additional assets.

Crosby Ratio: This technical indicator assists in identifying potential market peaks and troughs for better trade timing.

Global Liquidity: Monitoring global liquidity trends allows investors to gauge broader market movements impacting MSTR’s stock price.

The MVRV Z-Score can signal when to buy or sell Bitcoin and is applicable to MSTR given their strong correlation. Additionally, activity in the network enhances understanding of market conditions, offering insights into potential buying or selling opportunities.

Current trends in global liquidity have shown strong correlations affecting MSTR’s price fluctuations. Monitoring liquidity changes can help anticipate reversals, helping investors make informed decisions.

Michael Saylor continues to accumulate Bitcoin, indicating sustained potential for MSTR’s positive performance. Utilizing these indicators can help streamline investment choices and may boost returns. Investors are encouraged to explore more resources to stay updated on Bitcoin and MSTR.

This guidance is intended for informational purposes and should not be construed as financial advice. Always conduct personal research before making investment decisions.