Business

Student Loan Repayment Plans Paused Amid Legal Battle

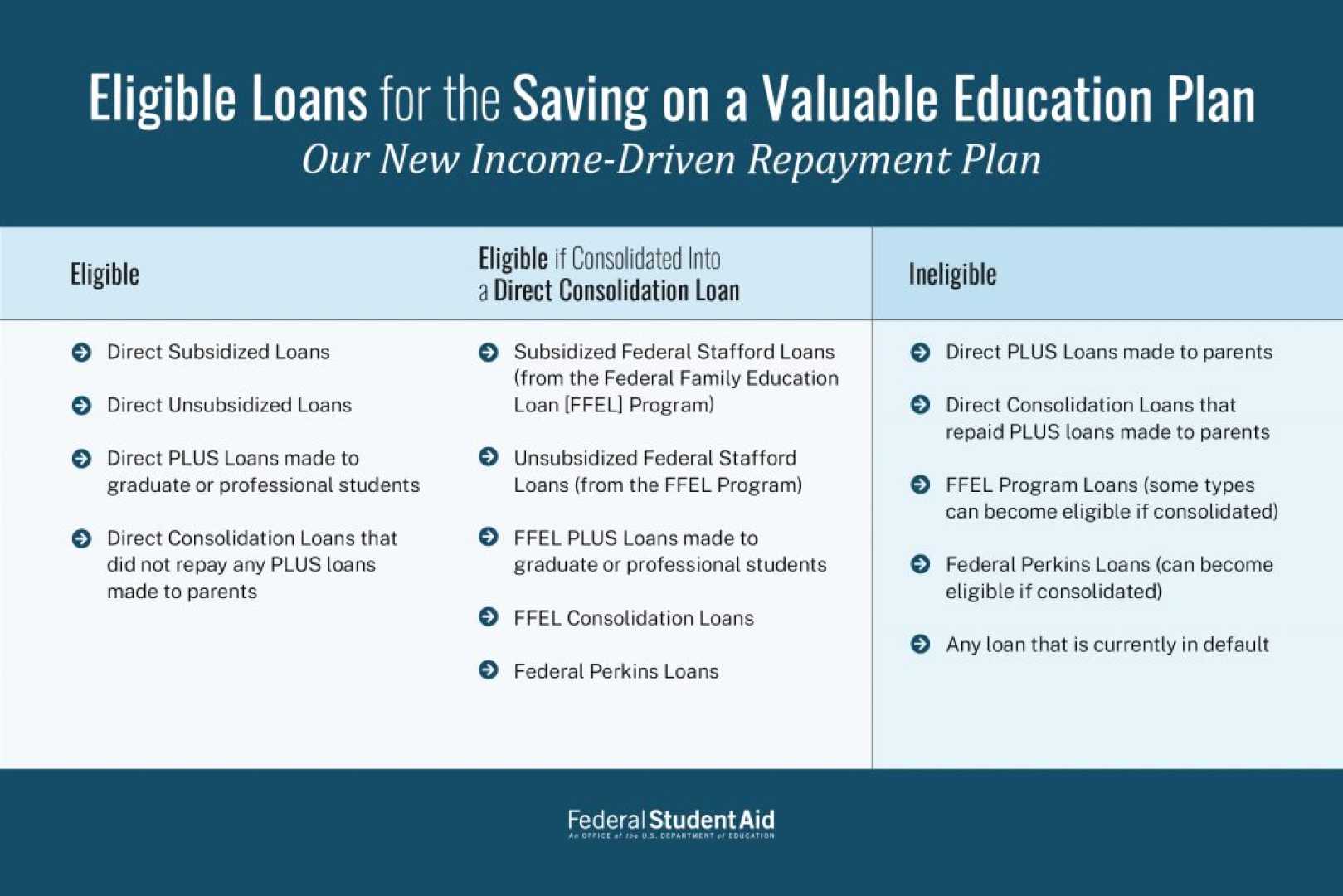

WASHINGTON, D.C. — Millions of student loan borrowers have lost access to vital online repayment applications due to a recent federal court ruling. The Department of Education halted access following an injunction that prevents the implementation of the Saving on a Valuable Education (SAVE) plan and several income-driven repayment (IDR) programs.

The Department of Education announced the changes on February 27, 2025, in response to the decision made by the 8th Circuit Court of Appeals, which upheld the injunction against the SAVE plan. The notice issued by Federal Student Aid stated, “A federal court issued an injunction preventing the U.S. Department of Education from implementing the SAVE Plan and parts of other IDR plans.” Consequently, the online applications for these programs are temporarily unavailable, though borrowers can still utilize standard repayment options.

Income-driven repayment plans, established by Congress in 1993, allow borrowers to make monthly payments based on their income. After 20 or 25 years of consistent payments, these plans enable borrowers to forgive their remaining balances. The Public Service Loan Forgiveness program, intended to erase student debt for government and nonprofit employees after ten years of qualifying payments, heavily relies on these income-driven plans.

The suspension of applications has raised concerns among borrowers who depend on these repayment options. Their situation has become increasingly urgent as many have been enrolled in an interest-free forbearance, which has extended indefinitely due to the legal challenges against these repayment plans.

Persis Yu, deputy executive director and managing counsel at the Student Borrower Protection Center, criticized the actions of the Department of Education. “Shutting down access to all income-based repayment plans is not what the 8th Circuit ordered,” Yu said. “This was a choice by the Trump Administration and a cruel one that will inflict massive pain on millions of working families.”

The removal of income-driven repayment options has profound implications, particularly for those who have recently graduated and cannot afford higher payments under standard repayment plans. The Department’s decision to eliminate both online and paper versions of the IDR application has effectively cut off borrowers’ ability to manage their loan repayment options.

The SAVE plan aimed to streamline federal student loan repayment, offering lower monthly payments based on income and providing a shorter timeline for loan forgiveness. However, after the lawsuit filed by a coalition of Republican-led states last summer, access to these reduced payments has been halted, putting over 8 million borrowers at risk. Many borrowers have been anxiously awaiting developments as they entered a six-month forbearance period following the legal challenges.

While the Department of Education continues to work on its legal response, there is no definitive timeline for the resolution of these issues, leaving millions of borrowers in a state of uncertainty regarding their loan repayments and potential forgiveness. The Education Department has yet to provide specific guidance on how borrowers should navigate this sudden lack of options.

As borrower advocates and policymakers assess the potential fallout from this situation, many worry that the halt in applications will further complicate the financial lives of millions of Americans bearing the weight of student debt. With the loss of accessible repayment plans, the future for these borrowers looks increasingly grim.