Business

Tech Stocks Hit Hard: Three Bargains to Consider Now

NEW YORK, USA — Shares in key technology companies plunged following President Donald Trump‘s recent “Liberation Day” announcement, raising fears of an impending global trade war. As investors reacted to potential economic impacts, stocks fell sharply, with tech giants among those hardest hit.

Before the announcement, Nvidia, Amazon, and Meta were considered top growth stocks. However, their valuations have since shifted, creating unique opportunities for cautious investors. For instance, Nvidia’s stock decreased by 7.03% to a current price of $94.64, trading at just 23 times this year’s analyst estimates and boasting a PEG ratio near 0.4, indicating it is undervalued.

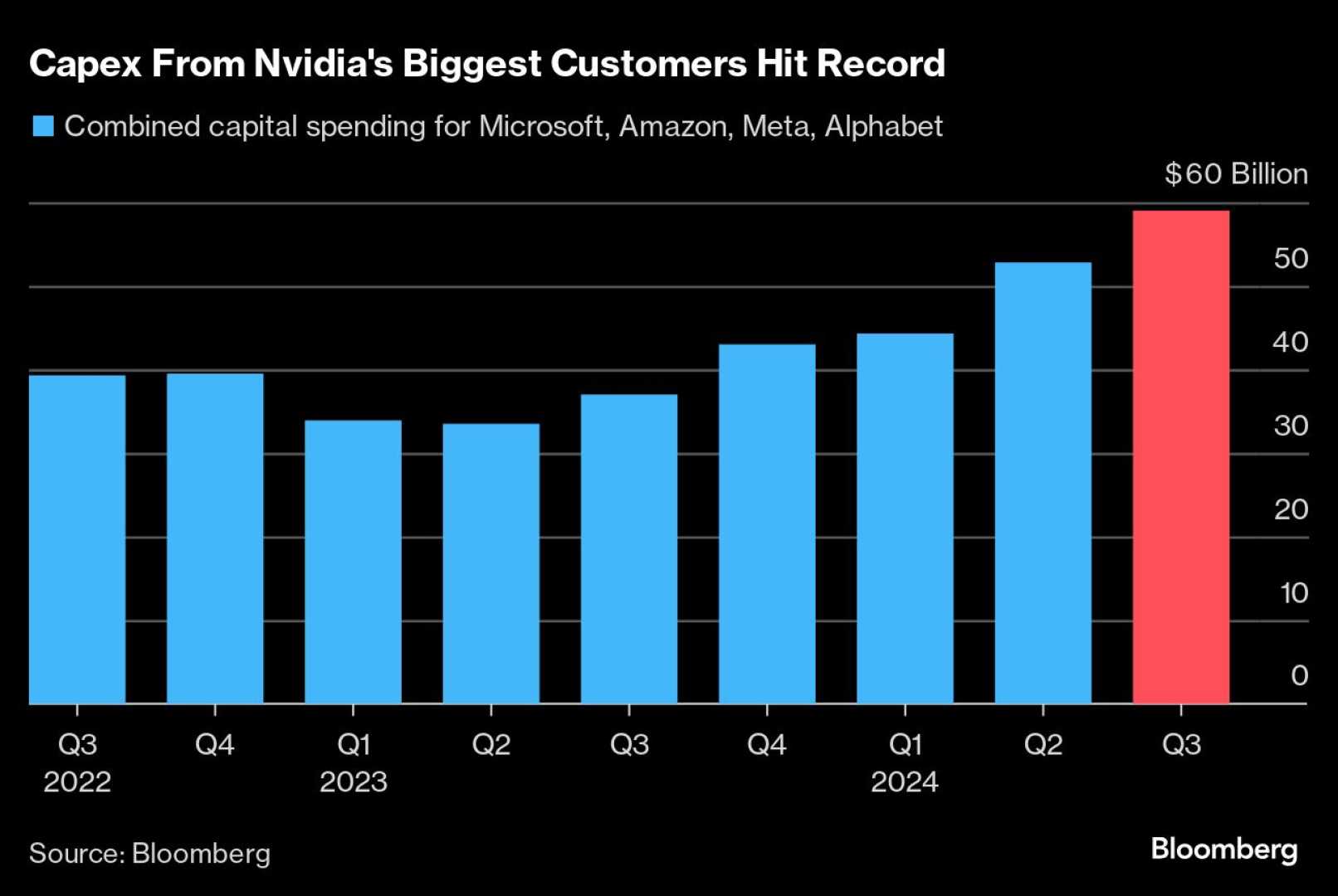

Nvidia continues to show potential despite market pressures. The company is at the forefront of artificial intelligence (AI) technology, which is expected to drive substantial growth. Analysts project revenue will continue to rise, with data center spending anticipated to hit $1 trillion by 2028.

“The demand for AI infrastructure will remain robust, supported by major firms investing heavily in this space,” said Chris Johnson, an investment analyst.

Similarly, Amazon’s stock fell by 3.92% as tariffs on imported goods threaten net profits. The company, which serves as the largest e-commerce retailer globally, must navigate increased costs of goods manufactured overseas. However, Amazon has diversified its business model, especially with its Amazon Web Services (AWS) cloud segment, which generates significant revenue and offers high-profit margins.

“Even with the headwinds from tariffs, Amazon is strategically positioned for long-term growth through its AWS unit and enhanced logistics efficiency,” remarked Sarah Lee, a tech market expert.

Meta Platforms, whose stock dipped 5.00%, remains a leader in digital advertising, witnessing a 21% growth in revenue last quarter, bolstered by AI innovations in advertising. However, rising operational costs could pinch its profits moving forward.

“Despite the immediate challenges, Meta’s investment in AI allows for better ad targeting, which could mitigate some negative impacts of a potential recession,” noted analyst Mark Phillips.

As the market recalibrates against the backdrop of escalating trade tensions, cautious investors may find Nvidia, Amazon, and Meta compelling buying opportunities. Their technologies remain essential, positioning them for recovery as market conditions stabilize.