Business

Treasury Yields Rise Amid Economic Data and Tariff Threats

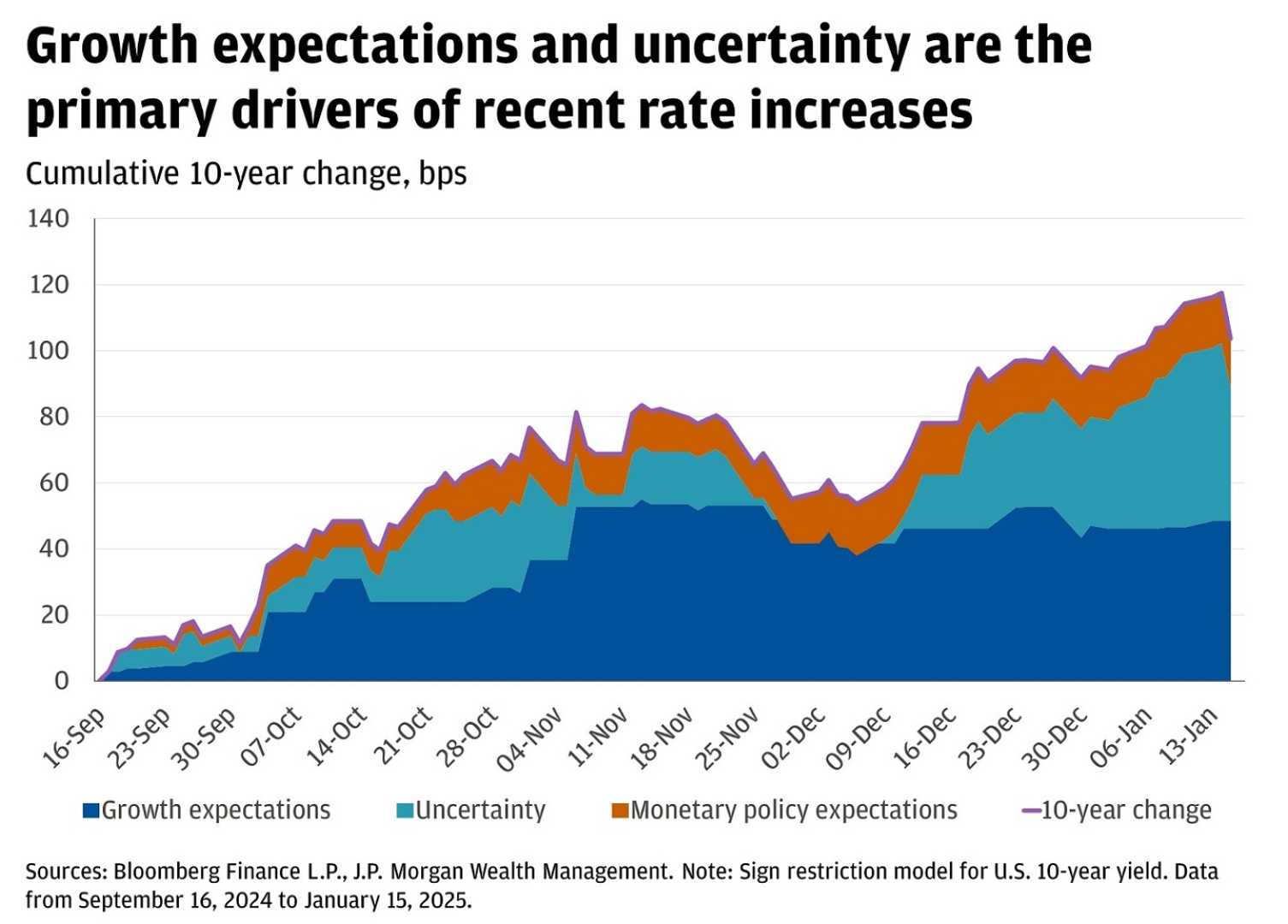

WASHINGTON, D.C. — U.S. Treasury yields climbed on Thursday as investors braced for forthcoming economic indicators and reacted to President Donald Trump‘s latest tariff threats. The benchmark yield rose approximately 5 basis points to 4.298%, while the 10-year yield increased by more than 3 basis points, reaching 4.107%.

This week has been bustling with significant data releases, including vital housing statistics and a consumer confidence survey. Investors are particularly focused on the key data point of the week — the personal consumption expenditures (PCE) index, set to be released Friday morning. The PCE index is the Federal Reserve‘s favored gauge for measuring inflation.

The next Federal Reserve meeting, which will shape monetary policy and interest rate strategies, is scheduled for March 18-19. Concerns have also arisen in light of President Trump’s comments during his first Cabinet meeting of his second term. He indicated plans to impose a 25% duty on imports from the European Union, with additional duties on goods from Canada and Mexico set to take effect on April 2.

“We’ll be announcing it very soon,” Trump told reporters. “It’ll be 25% generally speaking, and that will be on cars and all other things.”

On Friday, however, U.S. Treasury yields experienced a significant drop, following a sell-off in the stock market amid growing economic fears. The benchmark yield decreased about 7 basis points to 4.427%, while the 10-year yield fell by more than 6 basis points to 4.202%. A basis point is equal to 0.01%, and it’s important to note that yields and bond prices move inversely.

The S&P Global Purchasing Managers’ Index (PMI) for manufacturing recorded a score of 51.6 for February, falling short of the Dow Jones consensus estimate of 52.8. Furthermore, the services sector reported contraction in the same month, adding to the investors’ anxieties.

Data from the University of Michigan showed a more significant than expected decrease in the consumer sentiment index for February, as existing home sales also declined in January. This dismal economic outlook contributed to Friday’s yield drop amid a steep equity sell-off. The Dow Jones Industrial Average plummeted over 700 points, marking its worst trading day of the year.

“Another fresh round of data releases reflecting a slowing economy is weighing on stocks and generating bull-flattener movements across the yield curve. More specifically, investors are embracing the long end of the Treasury complex due to the possibility that the strongest economic reports of the current cycle are behind us, incentivizing traders to lock in those rates before they potentially drift south,” said Jose Torres, senior economist at Interactive Brokers, in an email.

Overall, a turbulent week in the markets underscores the uncertainty surrounding both economic indicators and ongoing trade policies.