Business

CoreWeave Inc. Stock Soars Amid AI Demand Yet Concerns Loom

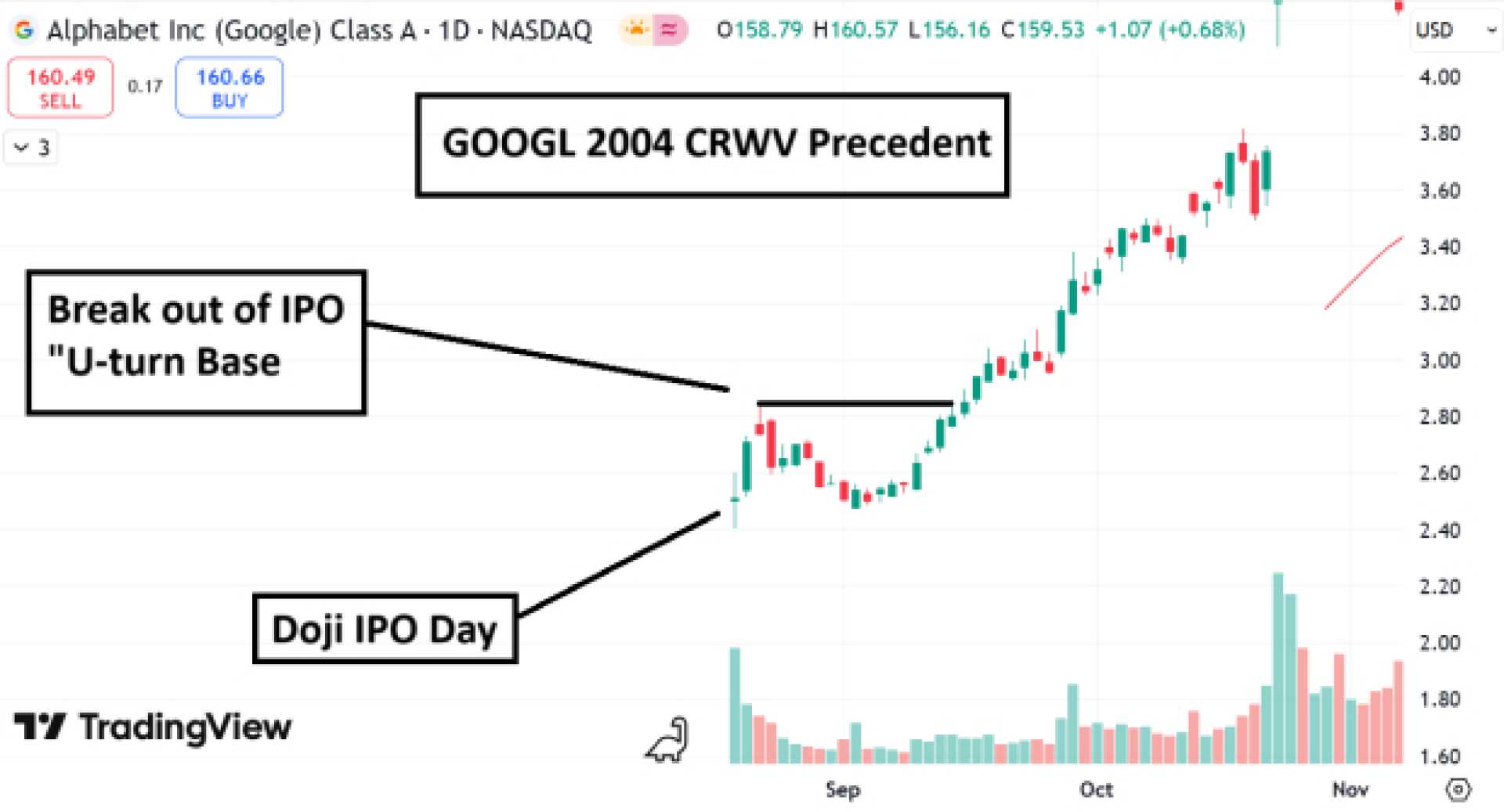

NEW YORK, NY — CoreWeave Inc. (NASDAQ:CRWV) has made waves in the stock market this year, showcasing a remarkable one-month gain of 145% in May. This surge has catapulted its year-to-date performance to around 160%, making it a standout in the over $10 billion market capitalization category.

The stock’s impressive rally can largely be attributed to significant news events. Notably, Nvidia revealed a 7% stake in CoreWeave at the end of March, and the company secured high-profile contracts, including a massive $4 billion expansion deal with OpenAI, which already has a $12 billion agreement in place.

Despite this soaring trajectory, some investors are questioning the sustainability of CoreWeave’s rapid rise. Pat Burton, a senior managing director at Winslow Capital Management, pointed out that the risk-reward ratio for CoreWeave appears unfavourable compared to more established firms such as Microsoft.

The cautious sentiment among investors gained traction as short interest in CoreWeave shares jumped from 18% to 45% in late April, according to S3 Partners LLC. While a short squeeze could theoretically occur, S3’s analysis suggests that sellers are remaining unfazed, as the market still seems eager to accept new short positions.

Investors have voiced concerns regarding CoreWeave’s debt levels and overall financial health. According to Bloomberg, the company reported a debt-to-total assets ratio of 54% as of March 31, significantly higher than the 30% average within the Nasdaq 100 index. This increase raises questions about the viability of its aggressive expansion strategy.

Moreover, industry analysts are growing wary of the overall demand for AI infrastructure, particularly as major tech firms have begun curbing their investment in AI, hinting that CoreWeave’s growth might face challenges. Gil Luria, an analyst at D.A. Davidson, downgraded CoreWeave to Underperform earlier this month, setting a price target of $36, far below its recent trading price of about $66.

As of May 23, a CNN report shows that 44% of analysts rate CoreWeave as a Buy, while 50% suggest a Hold, and 6% advise selling the shares. The consensus 12-month median price target reflects potential downside, estimating the stock could fall approximately 35%.

Another crucial date for investors is September 24, 2025, when the company’s lockup period expires and insiders will be allowed to sell their shares, potentially increasing trading volume and market volatility.

CoreWeave specializes in providing cloud-based GPU infrastructure for AI developers, primarily utilizing Nvidia technology. While the stock holds promise, caution remains as uncertain factors could impact its future performance.