Business

Health Care Stocks Show Signs of Recovery in 2025

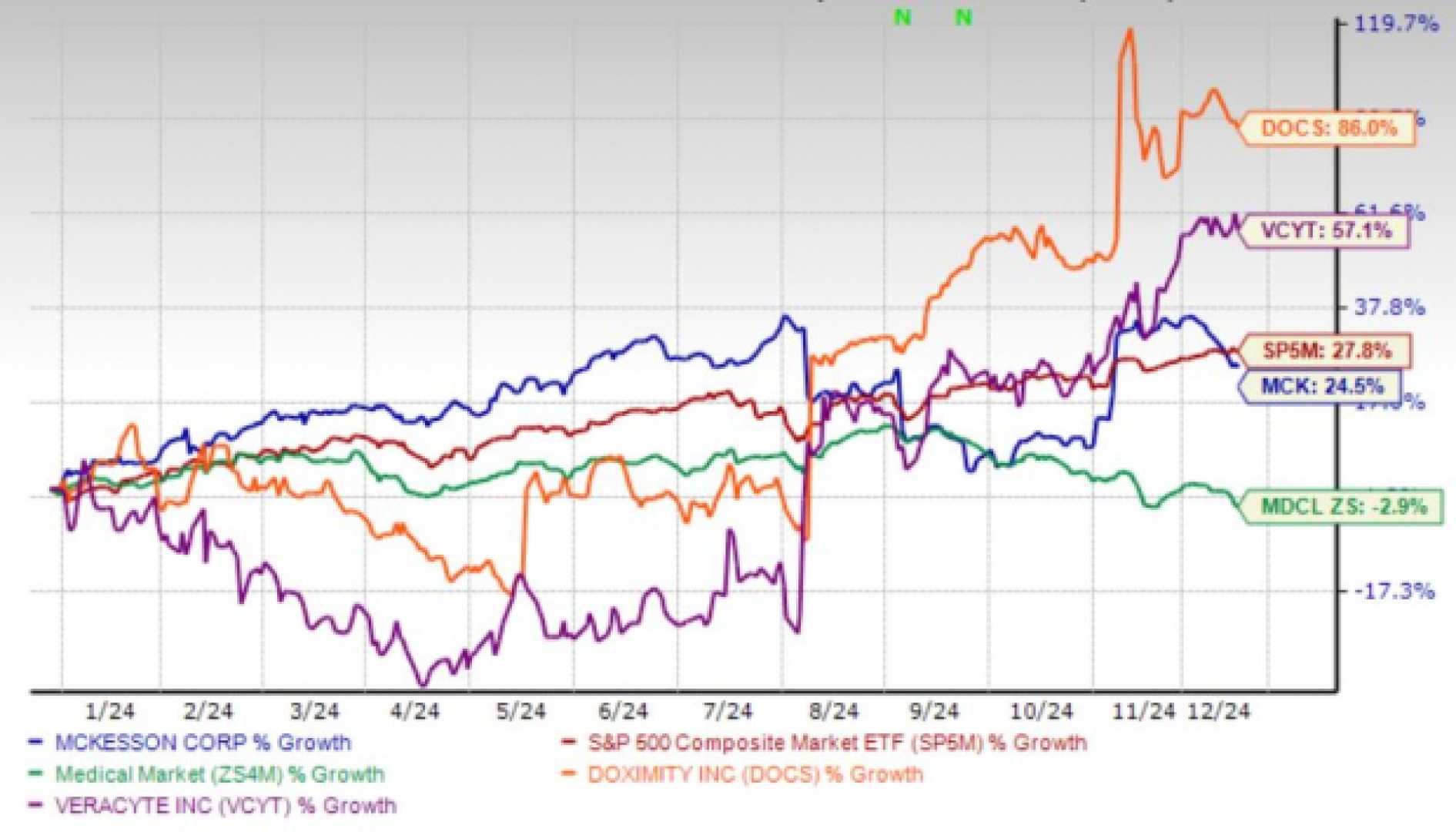

NEW YORK, NY — Health care stocks have begun to outperform the S&P 500 after lagging behind for three consecutive years. As of April 7, the S&P 500 has decreased by 14% year-to-date, while health care stocks only lost about 2%. This shift signals potential recovery for a sector that faced significant challenges recently.

The Fidelity Select Health Care Portfolio, a key player in health fund management, has underperformed relative to the health sector index this year. Despite reporting a 6.9% loss over the last 12 months, the fund surpassed 65% of its peers.

Investments in medical device companies have seen gains, with Boston Scientific leading advancements in the market. Similarly, biotech firm Alnylam Pharmaceuticals has shown positive momentum as well. However, managed care firms like UnitedHealth Group have struggled due to uncertainty surrounding government policies and rising costs, according to fund manager Yoon.

Yoon emphasizes investing in firms with increasing demand and strong free cash flow. He believes the recent positive turnaround in health care stocks is a recovery from poor performance after the 2024 election, where the sector experienced a downturn.

“The market is starting to shift, and if this trend continues, it could benefit the sector,” Yoon said, though he acknowledged that similar hopes had been dashed in the past.

Innovation is playing a crucial role in the recovery. Yoon pointed out that many companies that were previously unprofitable are now showing profitability, which could lead to an upward trajectory in stock prices. Since Yoon took the helm in 2008, he has achieved an annualized return of 12.5%, outpacing both typical health funds and the S&P 500.

This report was published first in Kiplinger Personal Finance Magazine, a reliable resource for financial advice.