Business

Patient Capital’s Strategy Outperforms Benchmark, Highlights Coinbase Growth

New York, NY – Patient Capital Opportunity Equity Strategy reported a total return of 15.3% net of fees for the second quarter of 2025, significantly outperforming the S&P 500 Index, which returned 10.9%. The firm’s investor letter, which outlines its performance and top holdings, highlighted the success and growth potential of Coinbase Global, Inc.

According to their letter, the selection effect positively impacted their portfolio’s performance, although allocation and interaction effects partially offset these gains. Patient Capital expressed optimism about Coinbase, which operates a platform for crypto assets.

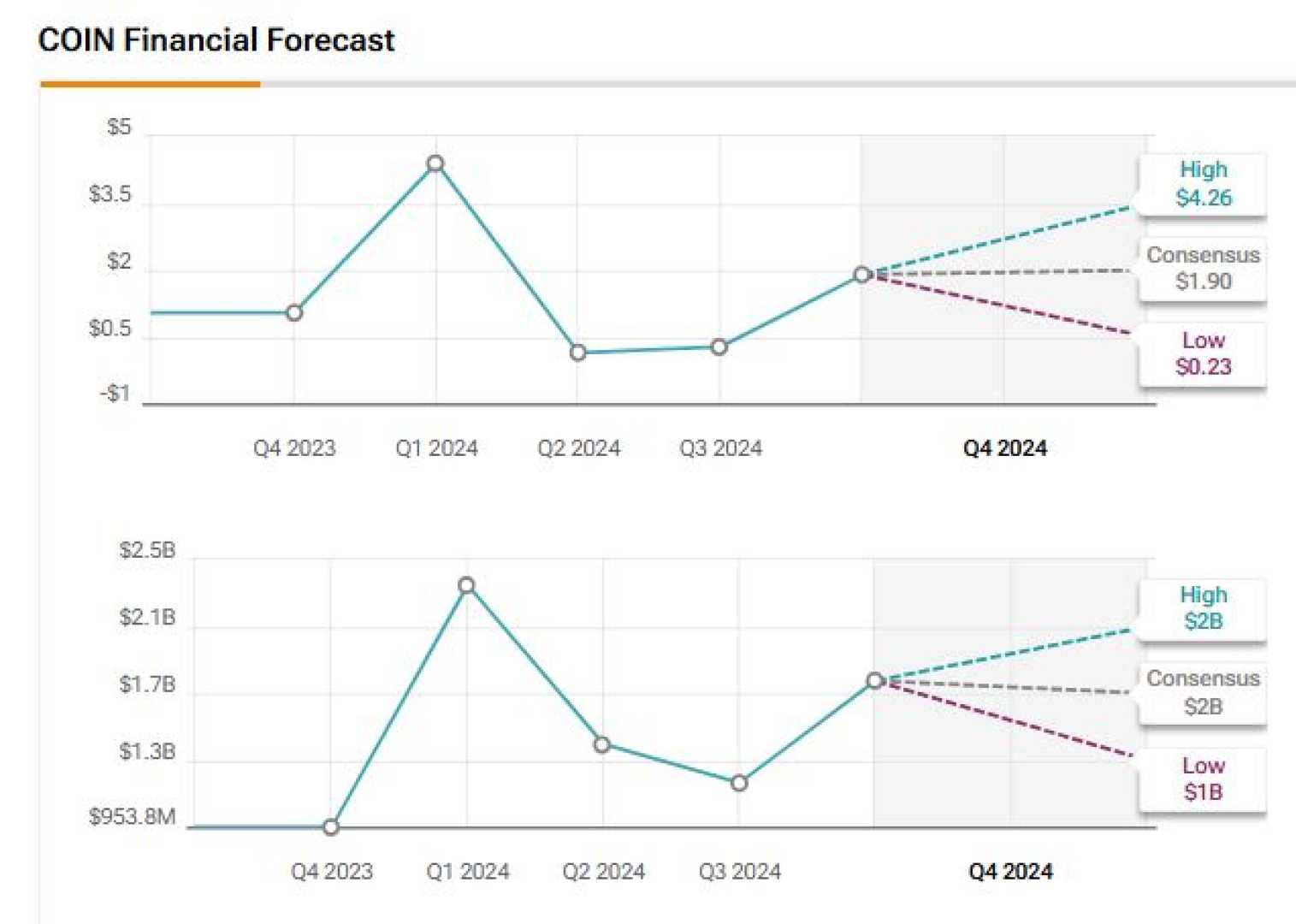

Coinbase saw a remarkable one-month return of 33.20%, with shares rising 59.34% over the past year. On July 17, 2025, Coinbase stock closed at $410.75, with a market cap of $104.62 billion. The investment strategy noted, “Coinbase Global, Inc. rebounded in the second quarter, tracking strength in both Bitcoin and the broader cryptocurrency market.”

The report highlighted advancements at Coinbase, including enhancements to its wallet and the Base platform. The firm believes these developments could attract greater institutional adoption of digital assets.

Furthermore, the letter referenced recent regulatory changes, such as the Trump administration’s GENIUS Act and an executive order aimed at establishing a Strategic Bitcoin Reserve. “We’re encouraged by Coinbase’s continued investment in innovation,” they stated, with expectations that these factors will bolster its competitive position.

While Coinbase is an essential part of Patient Capital’s strategy, the firm has acknowledged the existence of higher-potential AI stocks that may offer better short-term returns. They reported that 66 hedge fund portfolios included Coinbase at the end of the first quarter, down from 69 in the previous quarter.

This strategic insight reflects a cautious yet optimistic outlook on the rapidly evolving digital asset landscape, which requires investors to analyze both risk and reward closely.