Business

Investors Eye Crypto and Cyclicals Amid Fed Rate Cut Hopes

New York, NY — Investors are increasingly looking for opportunities in the cryptocurrency market and cyclical sectors as optimism grows for a quarter-point rate cut from the Federal Reserve in September. This trend was highlighted during CNBC’s “Worldwide Exchange” broadcast, which airs at 5 a.m. ET.

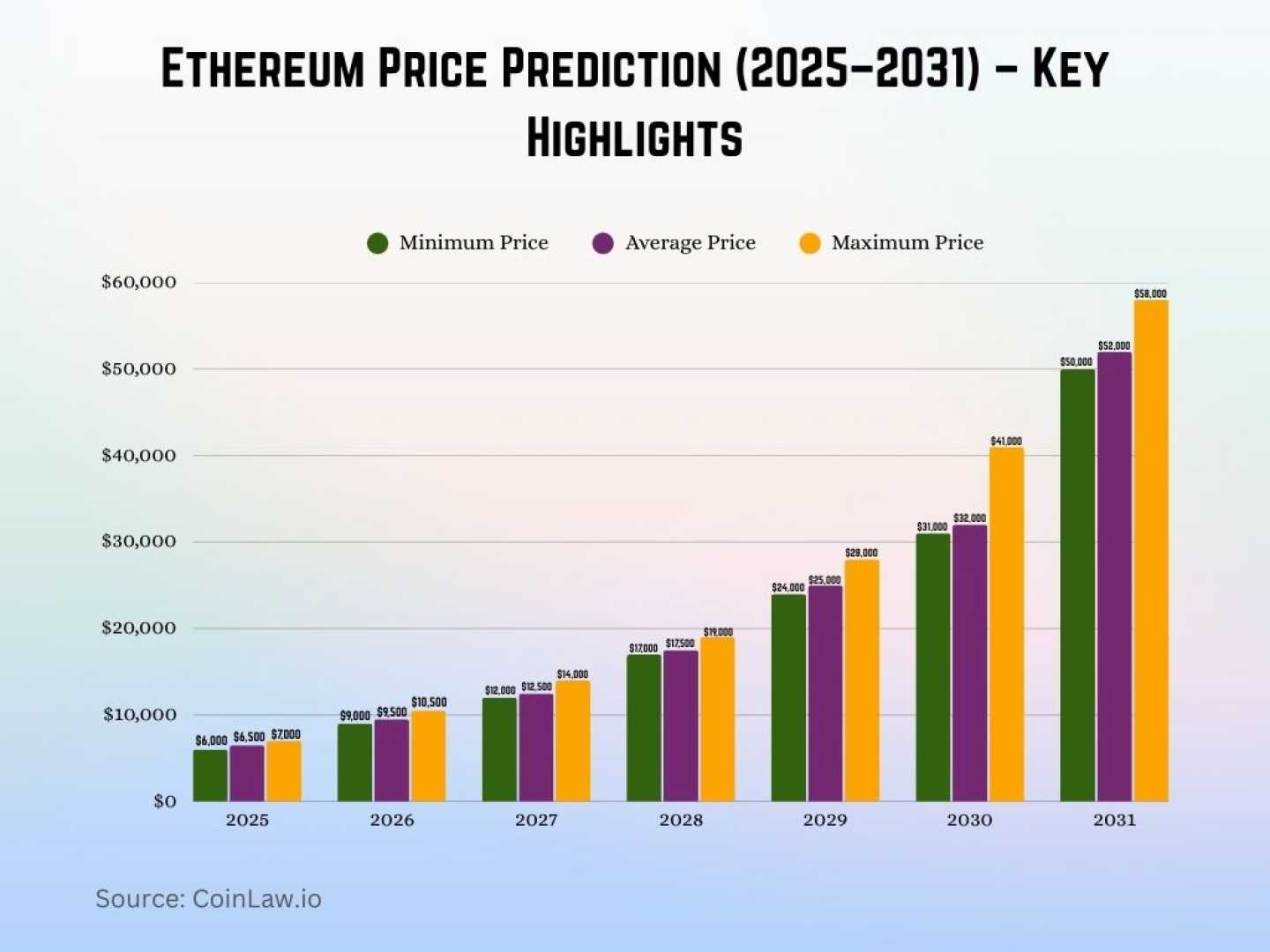

Tom Lee, co-founder of Fundstrat, expressed a bullish outlook on Ethereum, linking the potential Federal Reserve rate cut to positive momentum for the cryptocurrency. He forecasts Ethereum could reach $7,500 by the end of the year, a prediction that may be conservative. “$7,500 might even be on the low end of what’s possible. I’ve seen many targets of $10,000 to $15,000,” Lee said during the discussion.

Lee emphasized the importance of Ethereum in the evolving financial landscape, stating, “Wall Street needs to find a stable and legally compliant blockchain to work on. The majority of stablecoin creation is taking place on Ethereum. … It is the place where Wall Street is essentially financializing the system.” Lee also serves as the chair for BitMine Immersion Technologies, a company that holds over $5 billion in Ethereum.

Meanwhile, Ed Clissold, Chief U.S. Strategist at Ned Davis Research, pointed to a 99% chance of a Federal Reserve rate cut this September, according to the CME FedWatch tool. “The overall landscape favors cyclical growth sectors like technology,” Clissold noted, advising investors to be selective about which cyclicals to invest in.

“That’s where the earnings growth is, where the top-line sales growth is, and a lot of those bigger cap companies are probably better able to navigate this tariff environment. That’s where we would lean towards cyclical growth,” he said.

Additionally, Brian Reynolds of Reynolds Strategy highlighted a significant trend in U.S. company stock buybacks, which are on track for a record year, having already surpassed $900 billion in 2025. He believes this trend will continue, driven largely by underfunded U.S. public pensions. “The last three months have seen a record amount of pensions intending to allocate to credit. That’s going to hit the market over the next three-to-12 months, and we see them doing even more going forward in the fourth quarter,” Reynolds explained.

Reynolds also noted, “So I think the risk of a slowdown in buybacks is very, very small.”