Business

Federal Reserve Rate Cuts Impact Mortgages and Housing Affordability

Washington, D.C. — The Federal Reserve‘s recent decision to cut interest rates has stirred discussions on its impact on mortgages and housing affordability. Financial analysts like Katrina Campins from FOX Business have weighed in on the potential effects during appearances on ‘America Reports.’

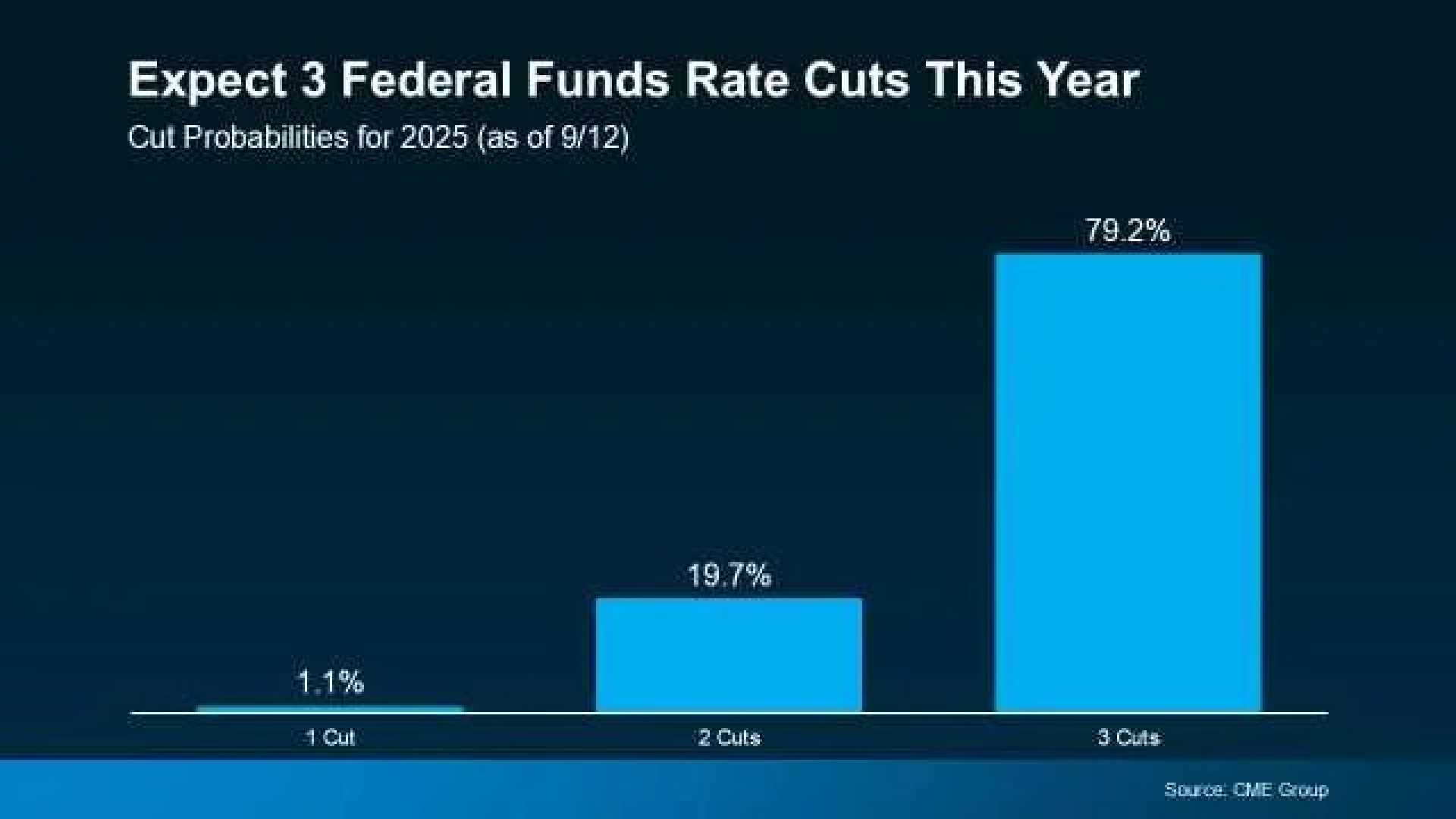

The Fed announced the rate cuts on September 18, 2025, aiming to stimulate the economy amid ongoing inflation concerns. By lowering rates, the central bank hopes to make borrowing cheaper, which could increase demand for homes in a challenging market.

Campins emphasized that lower interest rates typically lead to reduced mortgage rates. “This could lead to lower monthly payments for homeowners and increase the number of buyers who can afford to enter the market,” she explained. However, she also cautioned that the overall cost of homes may still remain high due to ongoing supply chain issues and other economic factors.

Additionally, experts predict that while the cuts may provide short-term relief, long-term housing affordability will depend heavily on how quickly the supply of homes can meet demand. “We need to see more inventory in the market, or else prices could continue to rise irrespective of lower mortgage rates,” Campins noted.

The housing market remains a critical indicator of overall economic health. As the Fed’s actions unfold, both buyers and investors will be monitoring the ongoing developments closely.