Business

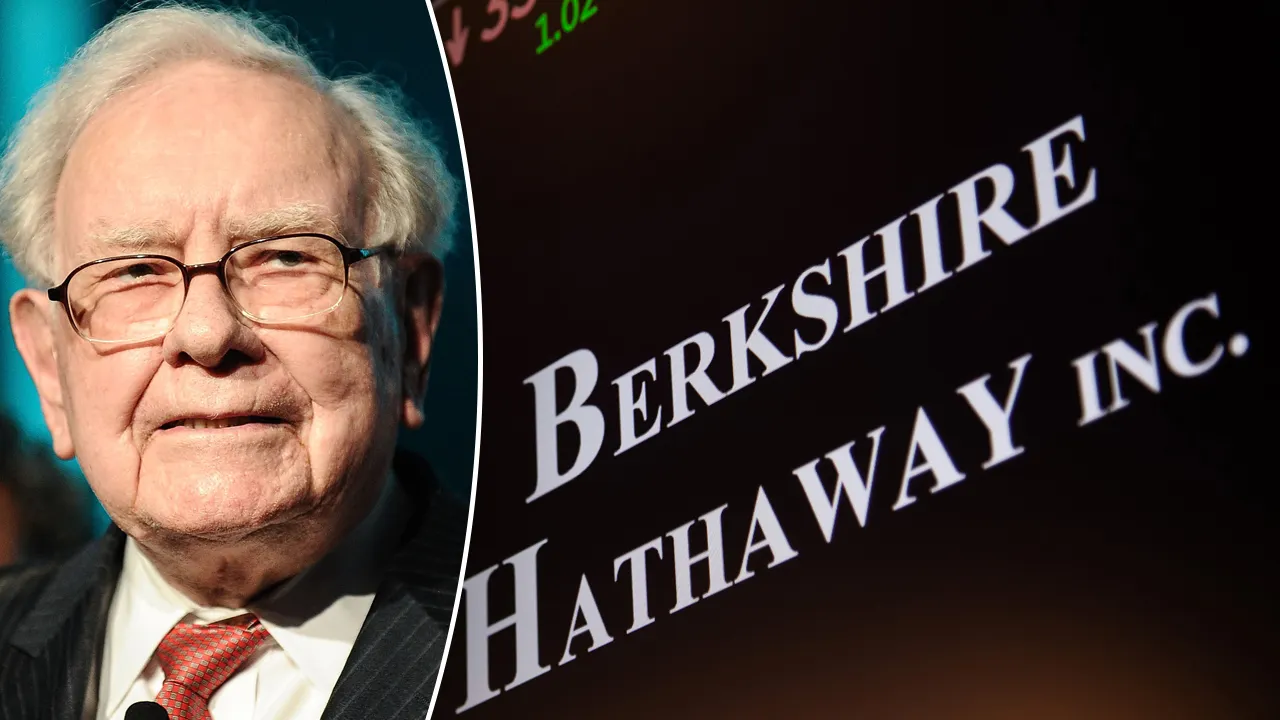

Berkshire Hathaway Emerged as World’s Most Valuable Company, Surpassing Tech Giants in Asset Strength

Berkshire Hathaway Inc. has solidified its position as the world’s most valuable company when measured by total book value – the net worth of its assets minus liabilities – reaching an estimated $670 billion as of the end of the second quarter of 2025. This metric, often overshadowed by market capitalization where Nvidia reigns supreme at over $4 trillion, underscores Berkshire’s unparalleled balance sheet fortress amid a year of economic turbulence and AI-driven market euphoria.

Book value, essentially shareholders’ equity, paints a picture of a company’s tangible financial muscle rather than speculative investor hype. For Warren Buffett’s sprawling conglomerate, it reflects decades of disciplined acquisitions, insurance operations, and investments in everything from railroads to energy pipelines. As of June 30, 2025, Berkshire’s shareholders’ equity stood at approximately $670 billion, up from $649 billion at the end of 2024, driven by robust operating earnings and a massive cash hoard now exceeding $340 billion. This figure dwarfs competitors: China’s Industrial and Commercial Bank of China (ICBC) trails at around $400 billion in equity, while fellow financial behemoth China Construction Bank lags at $350 billion.

The revelation comes as global markets grapple with interest rate cuts and geopolitical strains, including U.S. tariff hikes under the Trump administration. While tech darlings like Microsoft and Apple command trillion-dollar market caps fueled by artificial intelligence optimism, their price-to-book (P/B) ratios soar into the 10-50 range, signaling potential overvaluation relative to assets. Berkshire’s P/B ratio, by contrast, hovers at a modest 1.6 – calculated from its $1.05 trillion market cap divided by book value – suggesting the stock trades at a reasonable premium to its underlying net assets. With about 2.2 billion Class B equivalent shares outstanding, this translates to a book value per share of roughly $305, a benchmark Buffett himself has long championed as a true measure of intrinsic worth.

“Berkshire isn’t chasing the next big AI bubble; it’s built on real, cash-generating businesses that weather storms,” said David Kass, a finance professor at the University of Maryland and longtime Berkshire watcher. “In an era where market caps can evaporate overnight, book value highlights the company’s fortress-like stability – a $174 billion insurance float alone acts as low-cost leverage for investments.”

Berkshire’s ascent in this understated ranking isn’t new; the company has topped global book value lists for years, but 2025’s results amplify its lead. Second-quarter earnings, released August 2, showed operating profits of $11.6 billion, up 15% year-over-year, bolstered by insurance and railroad segments despite a $5 billion writedown on its Kraft Heinz stake. The firm’s cash pile, swollen by forgone share repurchases – none occurred in Q2 as shares traded above management’s value threshold – positions it for opportunistic buys. Analysts speculate that this war chest could fund mega-deals in energy or manufacturing, sectors where Berkshire already dominates through subsidiaries such as BNSF Railway and Berkshire Hathaway Energy.

Yet, the spotlight also falls on succession. Buffett, 95, announced at the May 2025 annual meeting that he would step down by year-end, handing the CEO reins to Greg Abel, 62, the current head of non-insurance operations. Abel, credited with steering Berkshire’s energy arm through renewable expansions, promises continuity in the value-oriented ethos. “Under Abel, expect more selective capital deployment – think buybacks at discounts or bolt-on acquisitions – but no radical shifts,” noted Macquarie Asset Management in its Q2 investor letter. Early signs are positive: Berkshire’s debt-to-equity ratio remains a pristine 0.19, with a current ratio of 6.35 signaling liquidity unmatched by peers.

Critics, however, caution that book value isn’t infallible. Intangible assets like brands or software – key to tech firms – often go undervalued on balance sheets, potentially understating companies like Apple ($200 billion in equity) or Amazon. Still, in a September 2025 environment of Fed rate cuts and softening growth forecasts, Berkshire’s asset-heavy model offers a hedge against volatility. As one hedge fund manager quipped, “When the AI party ends, the grown-ups with the biggest piggy bank win.”

For investors seeking value plays, Berkshire’s metrics signal an opportunity: a 10% year-over-year increase in book value per share, accompanied by a 78% historical hit rate for positive post-earnings momentum. As markets pivot from growth to stability, the Oracle of Omaha’s creation may just prove that slow and steady still builds the world’s richest foundation.