Business

IRS Delays Roth Catch-Up Contributions for High Earners Until 2026

Washington, D.C. — Starting in 2026, older workers earning more than $145,000 may need to make catch-up contributions to retirement plans, like 401(k)s, using after-tax dollars due to new regulations from the IRS.

This change stems from the SECURE 2.0 Act, a federal law enacted in 2022. Initially, the IRS planned to implement these rules for the 2024 tax year but has now postponed the start date by two years.

Elizabeth Thomas Dold, a principal at Groom Law Group, explained, “Hopefully, in the end, people will enjoy tax-free earnings. Change is not easy for anyone; it’s hard for record-keepers and plan participants.”

This requirement is specifically aimed at those over 50 who made catch-up contributions while earning over the threshold. This income limit, indexed for inflation, may rise for 2026, Dold noted.

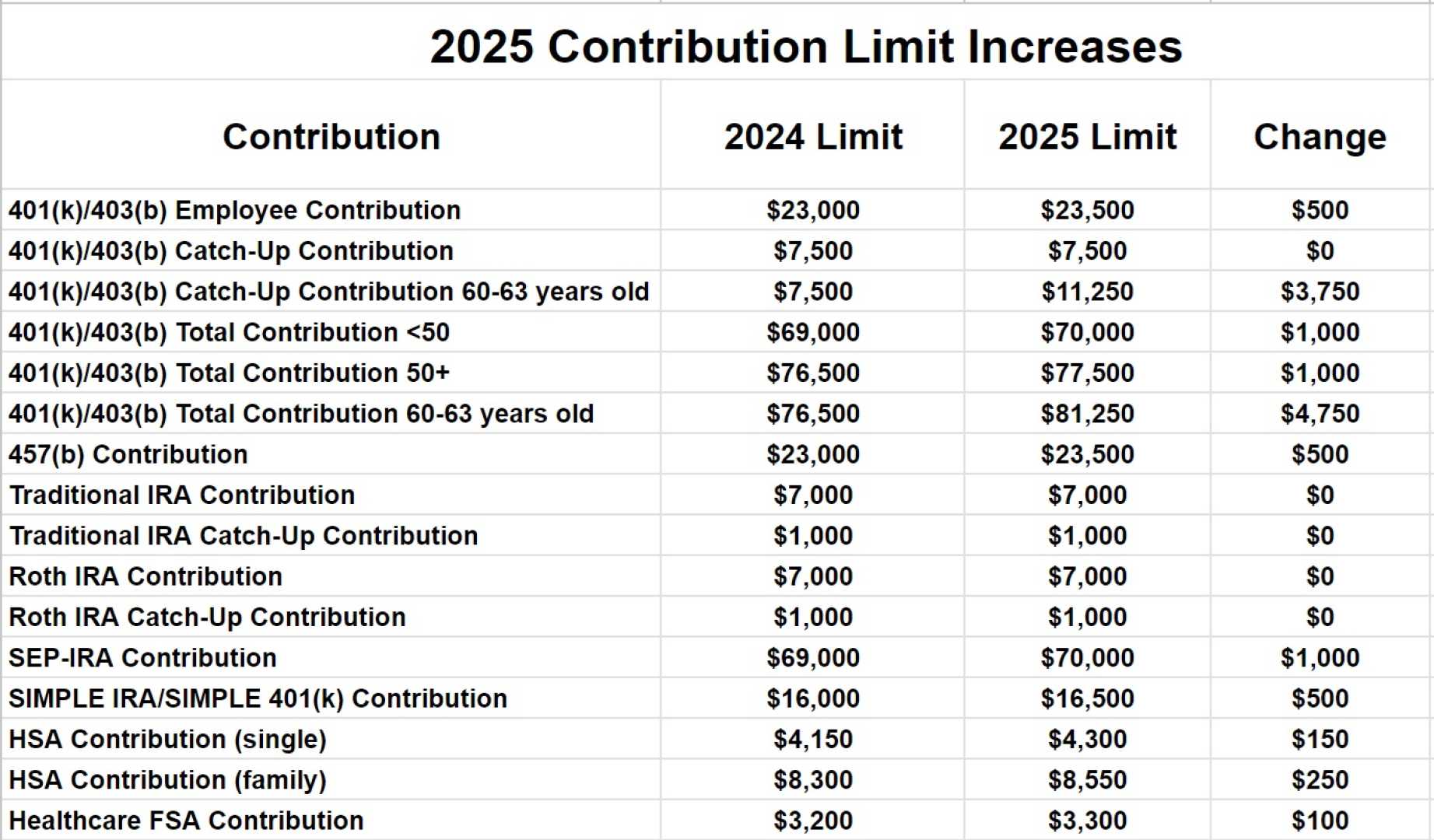

Age-eligible employees who contribute to a 401(k) can add up to $7,500 as catch-up contributions by 2025, totaling a maximum worker contribution of $31,000. For employees aged 60 to 63, the catch-up limit increases to $11,250 for a total contribution max of $34,750.

The change will mean higher tax payments now for those choosing Roth contributions, but could yield tax-free withdrawals in retirement—a potential benefit for those expecting to be in a higher tax bracket later.

The federal government stands to gain from this change as well, collecting taxes on contributions sooner rather than later. Dold commented, “This makes them [the government] a lot of money, allowing them to pay for other things.”

Yet, employees who earn over $145,000 might find it difficult to make these contributions if their plan sponsor does not offer a Roth option. Dold clarified, “The IRS has stated that plan sponsors do not need to eliminate catch-up contributions; only higher earners who surpass the threshold may be unable to make Roth catch-ups.”

For those planning on contributing next year, it’s essential to check whether your employer offers a Roth option and ensure your income aligns with the new limits.