Business

Oklo’s Stock Rises Amid AI and Nuclear Energy Buzz

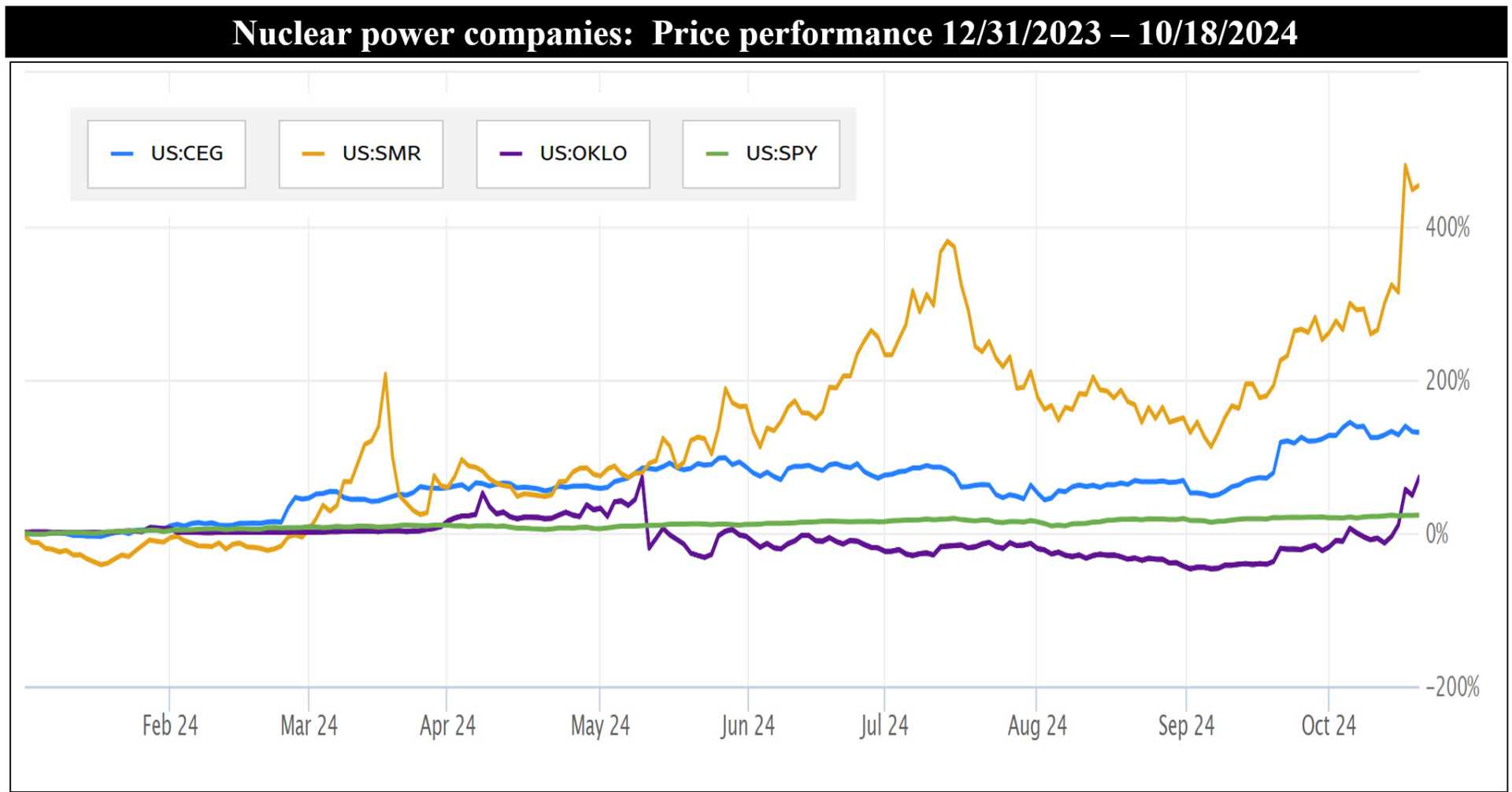

San Francisco, CA — Oklo, a nuclear energy startup, has seen its stock soar over the past year, with a staggering 1,130% increase recorded recently. On October 6, 2025, shares of the company reached $170.59, marking a significant rise alongside major advancements in artificial intelligence (AI).

The surge in Oklo’s stock reflects a growing intersection between AI and nuclear energy. Companies like Nvidia and Microsoft are ramping up demand for energy, intensifying the need for reliable power sources. Oklo’s mission is to develop small modular reactors (SMRs), designed to meet that demand.

Despite its impressive market capitalization of $20 billion, Oklo faces substantial challenges. The company has yet to generate any revenue or profits, which raises questions about its long-term viability. Analysts predict that partnerships, rather than profits, will define Oklo’s growth as it enters 2026. Collaborations with government and industry may generate headlines but won’t guarantee immediate cash flow.

Oklo’s valuation has drawn scrutiny, especially since it went public through a merger with a special purpose acquisition company (SPAC) in 2024. Critics argue that its current stock price doesn’t reflect its financial reality, given that the company is years away from true commercialization.

The Department of Energy has offered initial support, but Oklo will need to secure additional funding as it aims to develop and deploy its reactors. Building nuclear infrastructure remains tremendously costly and often subject to lengthy regulatory processes.

Recent media reports and community discussions have propelled Oklo into the spotlight as a potential leader in nuclear innovation. However, skeptics caution that current excitement is based on speculation and not on proven financial fundamentals.

The stock’s volatility is indicative of the speculative nature of Oklo’s investment profile. Investors considering Oklo must weigh the potential for future growth against the reality of its operational challenges, especially the long timeline before any profits can be realized.