Business

U.S. Explores Equity Stakes in Quantum Computing Firms Amid Funding Talks

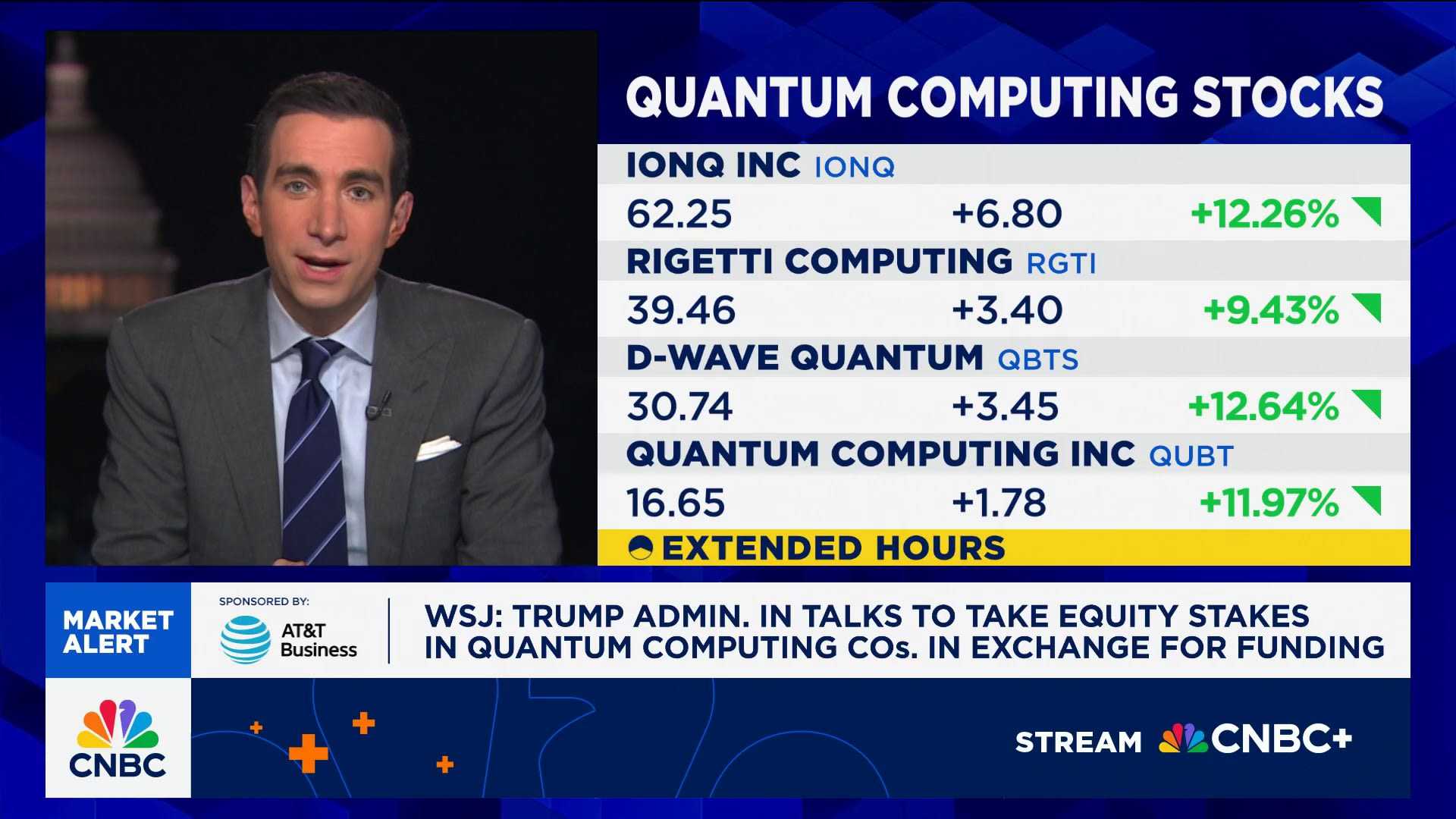

WASHINGTON, D.C. — The Trump administration is reportedly discussing equity stakes with several quantum-computing companies as part of a federal funding initiative. According to a Wall Street Journal report on Wednesday, firms such as IonQ, Rigetti Computing, and D-Wave Quantum are among those in talks to allow the U.S. government to become a shareholder for a minimum funding award of $10 million each.

Sources familiar with the situation indicate that the Commerce Department is leading the discussions, under the direction of Deputy Commerce Secretary Paul Dabbar, who is a former quantum-computing executive. However, a Commerce official has stated that the department is not currently negotiating with these companies.

Earlier this year, the administration made headlines by announcing a 10% stake in Intel, converting government grants into equity. Other notable interventions include the Pentagon’s investment in MP Materials, a mining company, aimed at increasing the production of rare earth magnets.

Furthermore, the U.S. government gained a “golden share” with veto rights in a deal allowing Japan’s Nippon Steel to acquire U.S. Steel. These actions reflect a growing trend where the government seeks financial stakes in industries deemed crucial to national security.

Experts say the government’s increasing interest in equity stakes in private companies is unprecedented in recent decades. Proponents argue that as federal funds are involved, government ownership may be beneficial, particularly for the development of quantum technology.

Quantum computing has surged in interest recently, with promises of groundbreaking advancements in technology and applications expected within the next five years. Companies in this sector are racing to create practical quantum computers, which have the potential to revolutionize fields such as medicine and cryptography.

Despite the hype, the industry currently operates at a loss, with reported revenues of under $750 million in 2024. Investors remain wary, recognizing the technical challenges that quantum computing faces, which include error correction and maintaining coherence among qubits.

If discussions lead to agreements, the U.S. will have taken a significant step towards becoming an investor in emerging technologies. However, questions remain about the implications of public investment in private firms and how this could reshape the future of quantum technology development in the U.S.

As negotiations evolve, the outcome could redefine public-private partnerships in key technology sectors and either accelerate or hinder innovation based on the relationship established.