Business

Nasdaq Faces Volatility Amid AI Bubble Concerns

New York, NY — U.S. stock markets are closed today, but the Nasdaq Composite is entering the weekend trying to recover from a rocky week. After a sudden AI-driven selloff on Thursday, big tech rallied on Friday as traders bought back into the market, encouraged by speculation of a potential Federal Reserve rate cut in December.

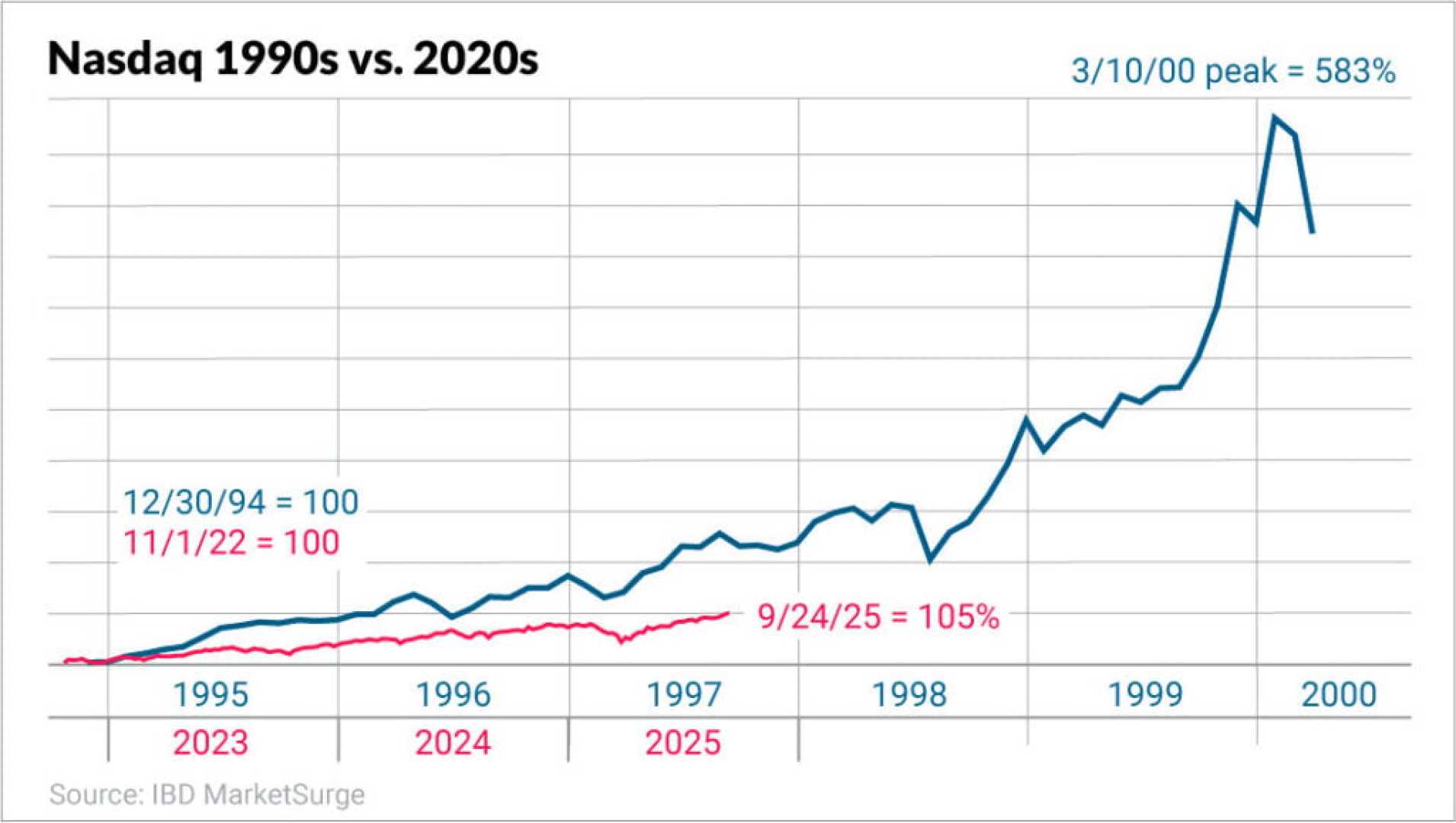

The Nasdaq concluded its week with its third consecutive decline, falling several percentage points from its October peak. The week’s turbulence was sparked by a severe drop on November 20, where investors expressed renewed fears about an “AI bubble,” questioning if the significant investment in AI infrastructure can yield quick returns.

Despite the downturn, Friday saw a significant rebound across all three major U.S. indexes — the Dow, S&P 500, and Nasdaq — with the Nasdaq leading the way. However, it struggled to mitigate the losses from earlier in the week. Key players included Nvidia, which rallied on reports that the Trump administration is reviewing a proposal to permit the company to sell AI chips to China, only to give up those gains as traders locked in profits.

The mixed signals in the Nasdaq highlight a deeper issue: exceptional earnings from companies clash with worries over inflated expectations for future growth. An increase in trading volume from TQQQ, a leveraged ETF connected to the Nasdaq-100, indicates active short-term trading, reflecting heightened volatility.

Thursday’s downturn affected not just tech stocks but also Nasdaq-listed cryptocurrencies, with Bitcoin reaching a seven-month low. This trend suggests that speculative investments across the index are prone to swift declines when questions arise about the durability of the AI and tech sectors.

Recent analyses from Reuters reveal a growing sentiment among investors. One article argues that while Nvidia continues to perform well, its current valuation requires extraordinary future growth, which some analysts view as increasingly unlikely. Another emphasizes that the latest volatility marks a critical moment for the AI trade, urging investors to be cautious.

As Nasdaq prepares for the upcoming week, volatility remains high, and investors must distinguish between sustainable earnings and businesses built on hype. The recent switch of Walmart to the Nasdaq symbolizes a possible shift in investor interest, with large companies still attracting attention while smaller firms face increased scrutiny.

Even though today’s stock markets are closed, futures market indicators hint at a possible relief rally heading into next week. Market watchers are leaning toward optimism as recent historical trends suggest that traders prefer to seize fast-moving opportunities.

Overall, the Nasdaq remains in a long-term bull market, but the days of easy gains in the AI sector may have passed. The focus now shifts to valuation and sustainability as investors look for solid indicators of financial health moving forward.