Business

Dollar Falls as Investors Anticipate U.S. Rate Cuts Amid Economic Shift

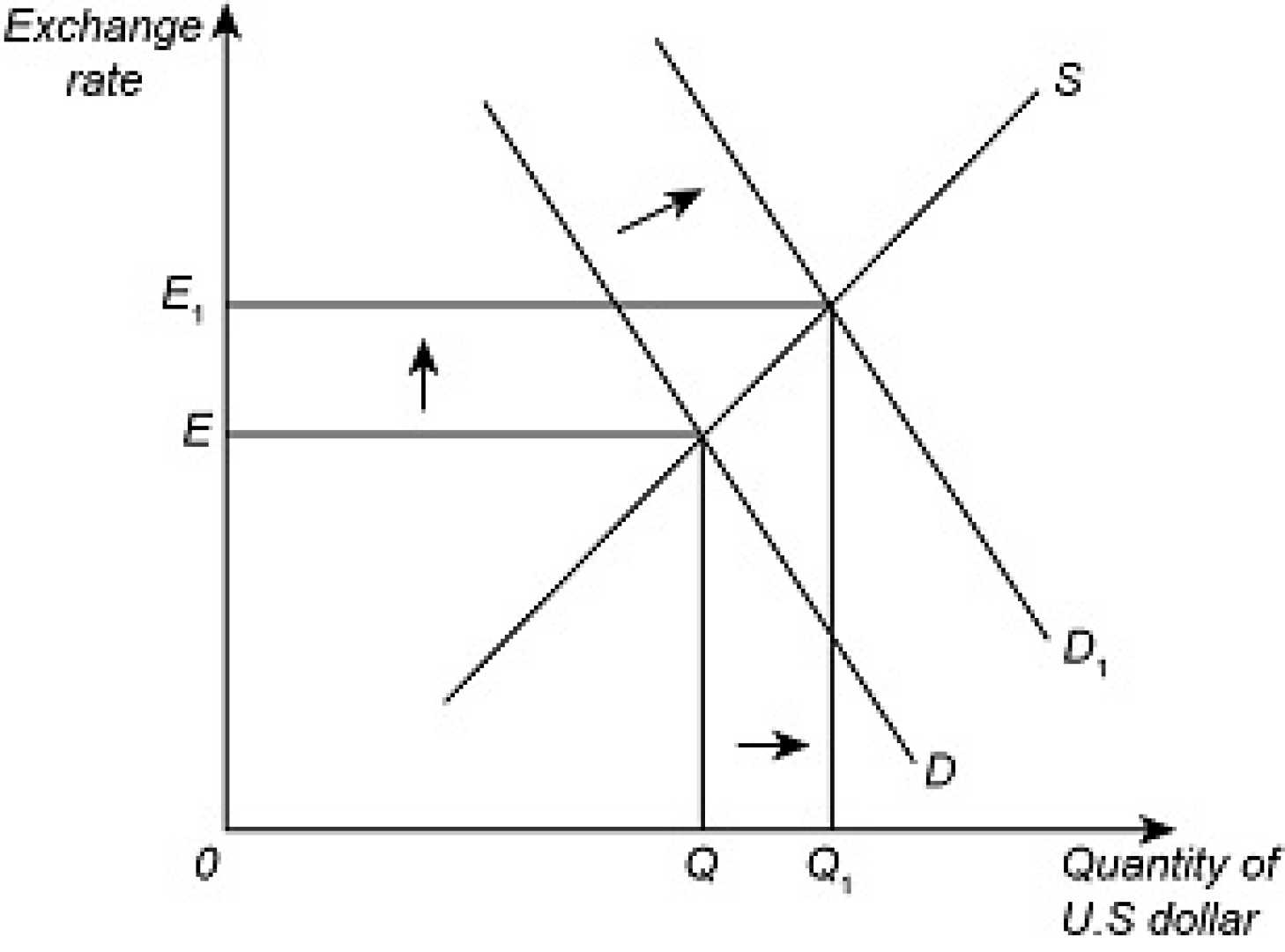

SINGAPORE, Singapore — The dollar slipped on Wednesday as traders focused on recent U.S. economic data, which reinforced expectations for a Federal Reserve rate cut in December. Investors are also speculating that the leading candidate for the next Fed chair may adopt a less aggressive policy approach.

The New Zealand dollar surged after the Reserve Bank of New Zealand lowered its rates. The RBNZ also presented a more optimistic outlook for future policy, which helped the kiwi rise 0.75% to $0.5663. The Australian dollar gained 0.14%, trading at $0.6478, as inflation data came in higher than expected.

Recent U.S. economic reports showed retail sales rose less than anticipated in September, while producer prices met expectations. Additionally, consumer confidence fell in November, as many households expressed concerns about job security and financial stability. This data contributed to traders pricing an 84% chance of a 25-basis-point Fed rate reduction next month.

Carol Kong, a currency strategist for the Commonwealth Bank of Australia, noted, “The overnight data definitely paints a picture of a slowing U.S. economy, adding to the case for a near-term rate cut by the FOMC.” The dollar’s decline was also supported by news that White House economic adviser Kevin Hassett is a leading candidate for the Fed chair position, advocating for lower interest rates.

In other currency news, the euro moved closer to the $1.16 mark, driven by slight progress in peace talks between Russia and Ukraine. Ukraine’s President Volodymyr Zelenskiy expressed readiness to move forward on a U.S.-backed framework for ending the conflict.

The British pound remained stable at $1.3166, ahead of significant budget announcements by U.K. finance minister Rachel Reeves, expected to include substantial tax increases. Traders have shown heightened interest in options related to the pound, preparing for potential volatility surrounding the U.K. budget outcome.

As the dollar dipped 0.03% to 99.82 against a basket of currencies, its decline continued to provide some relief to the yen, which fell slightly to 156.24 per dollar. This prompted speculation about potential Japanese government intervention to stabilize the yen, particularly with the U.S. Thanksgiving holiday approaching.

Overall, the market is watching closely for upcoming U.S. economic insights as traders adapt to shifting monetary policy expectations.