Business

Chinese Stocks Surge as Alibaba Leads AI Market in 2025

NEW YORK, January 2, 2026 — Chinese stocks, led by Alibaba Group, are poised to outperform U.S. markets as 2025 comes to a close. The rally in Chinese stocks began in response to government stimulus measures and continued its momentum throughout the year.

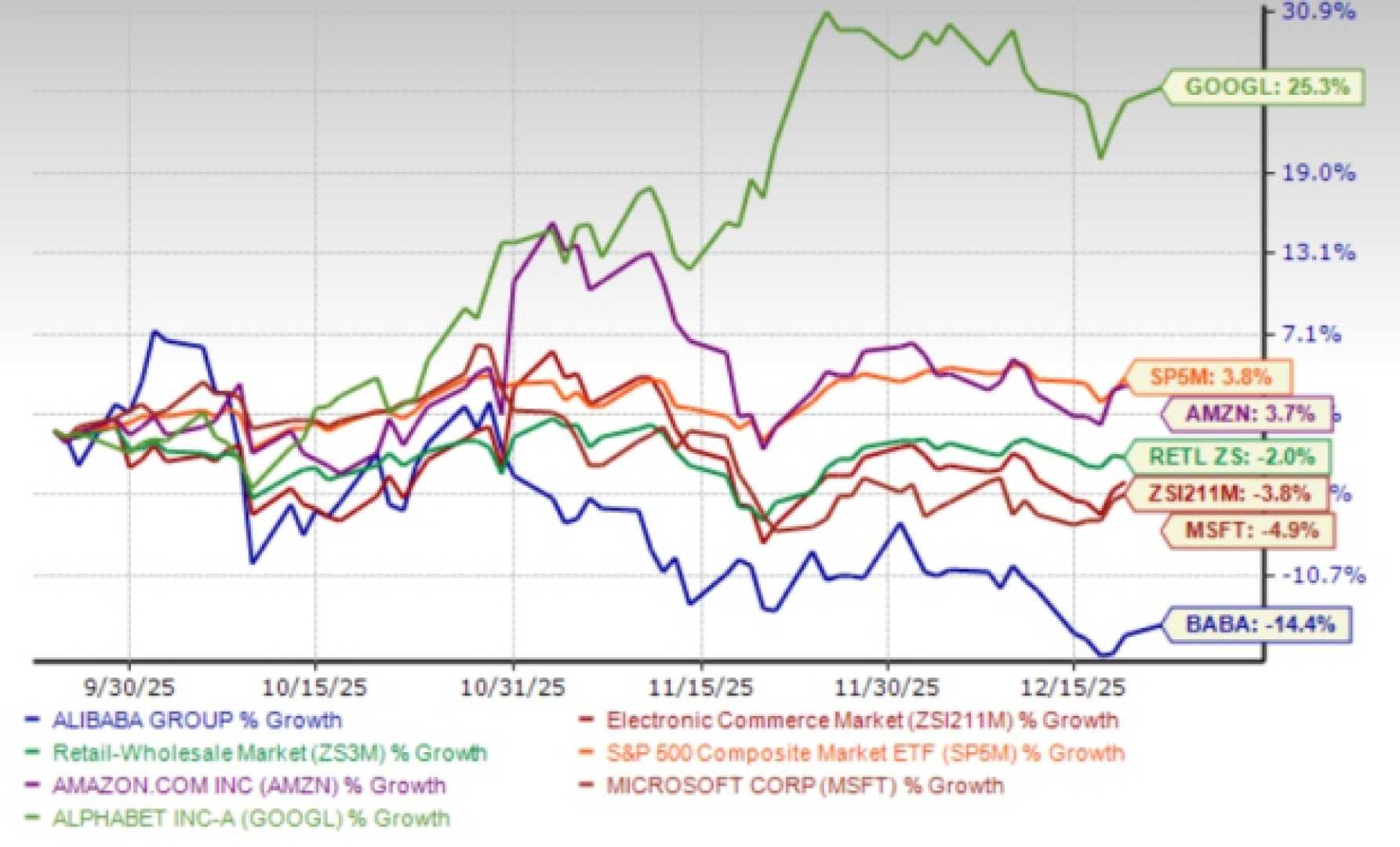

Alibaba, once seen as a risky investment due to regulatory crackdowns, emerged as a leader in artificial intelligence (AI). Despite a dip of over 20% from recent highs, its stock has risen about 75% this year. The company’s performance stands in contrast to the faltering “Magnificent 7” tech stocks in the U.S., highlighting a shift in investor confidence.

In early 2025, Alibaba’s stock surged 50% by mid-February, fueled by news from Chinese startup DeepSeek, which released a low-cost AI model. This innovation sparked a wave of investment into Chinese tech firms, marking a significant shift from the U.S. AI sector.

The meeting between President Xi Jinping and Alibaba’s co-founder, Jack Ma, was a critical moment. After previously facing a crackdown, Alibaba’s positive reception by the government signaled a renewed commitment to the tech sector, which is crucial in the ongoing AI competition with the U.S.

Alibaba’s partnerships with foreign companies, including AstraZeneca and Apple, further solidified its status as an AI powerhouse. However, the company faced challenges as profits fell due to rising capital expenditures in AI and struggles in its instant commerce sector.

On Wall Street, analysts remain optimistic about Alibaba. The stock holds a “Strong Buy” consensus rating among 23 analysts, with a mean target price of $198.58, suggesting a 30% upside from current levels. Despite concerns about the sustainability of the Chinese economic revival, analysts believe Alibaba is well-positioned for long-term success.

As 2026 begins, Alibaba’s market leadership in AI cloud technology and recent global data center announcements indicate ongoing growth potential. Estimates suggest a significant rise in earnings per share for Alibaba in fiscal year 2027, reinforcing its growth narrative.

The recent trading performance of Alibaba in Hong Kong reflects a broader recovery in Asia’s tech markets. The company is emerging as a serious competitor to both domestic and international firms in the tech landscape.

Thursday morning’s trading saw Alibaba’s shares rise 3.2%, reflecting positive sentiment amid signs of improving factory activity in the region. Investors will continue monitoring both the tech sector in China and economic reports in the U.S. for future indications of market movement as 2026 progresses.