Business

Abercrombie & Fitch Stock Surges After JPMorgan Adds to ‘Positive Catalyst Watch’

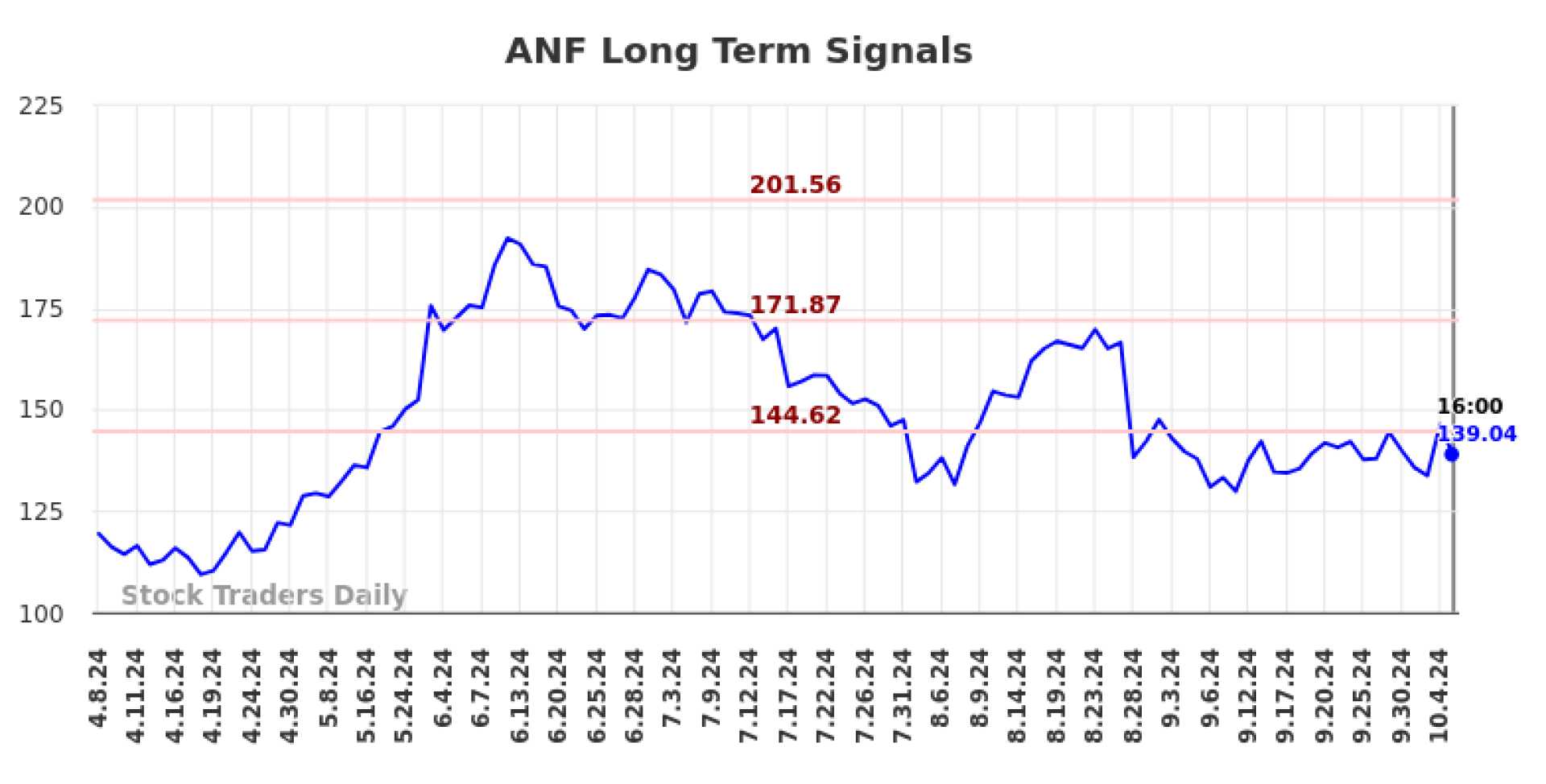

Abercrombie & Fitch Co. (ANF) shares experienced a significant surge on Friday, October 18, 2024, following a positive analyst note from JPMorgan. The stock was added to JPMorgan’s ‘Positive Catalyst Watch’ list, a move that aligns with the growing optimism around the company’s performance, particularly the growth of its Hollister brand..

The addition to the watch list and the subsequent price target increase by JPMorgan analyst Matthew Boss contributed to an 8.02% rise in Abercrombie & Fitch’s stock price. This upward movement reflects the market’s confidence in the company’s future prospects, despite recent volatility in the retail sector..

Despite a strong second-quarter earnings report that showed a 21% year-over-year revenue increase, Abercrombie & Fitch’s stock had previously faced challenges. The company’s CEO, Fran Horowitz, had warned about an increasingly uncertain economic environment, which led to a temporary drop in the stock price. However, the latest analyst upgrade suggests that investors are now focusing more on the company’s positive fundamentals and growth potential..

The current market capitalization of Abercrombie & Fitch stands at approximately $8.17 billion, with shares outstanding at around 51.11 million. The company’s financials, including its revenue and earnings per share, continue to attract positive attention from analysts, with many maintaining a ‘Buy’ rating and a 12-month stock price forecast of $168.63..