Business

Ackman Bolsters Nike Stake Amid Market Challenges

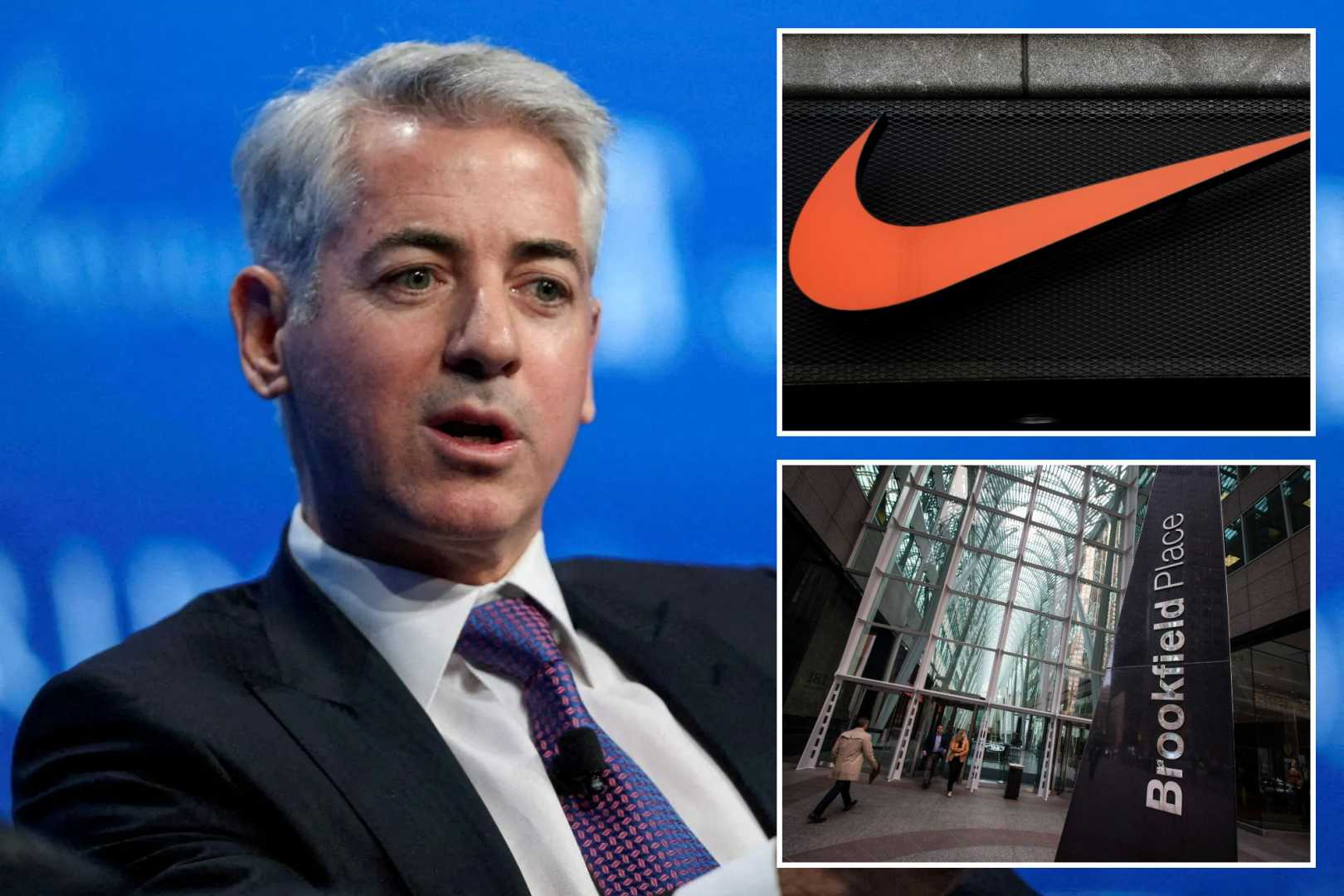

NEW YORK, NY — Billionaire investor Bill Ackman’s Pershing Square Capital Management increased its stake in Nike Inc. (NKE) by 15% during the fourth quarter of 2023. This move signals Ackman’s confidence in Nike’s long-term growth potential despite recent challenges, including a 28% decline in stock value over the past year.

Nike has faced significant hurdles, particularly inChina, where sales have dipped due to stronger competition from local brands and evolving consumer preferences. The company also navigated backlash from its recent marketing campaigns featuring female athletes such as Caitlin Clark, Jordan Chiles, and Sha’Carri Richardson, which some critics deemed too politically charged.

“Bill Ackman’s belief in Nike underscores his confidence that the company can manage its current challenges,” said John Smith, an investment analyst at Capital Insights. “Nike’s strong branding and focus on global expansion are critical factors in their recovery strategy moving forward.”

Despite these challenges, Ackman’s investment reflects a broader strategy of identifying resilient companies in turbulent financial climates. Alongside his increased position in Nike, Ackman also expanded his holdings in Brookfield Corp. (BBU), a leading global infrastructure and alternative asset manager, acquiring over 2.15 million shares in the fourth quarter.

In a shift in strategy, Ackman reduced his positions in Chipotle Mexican Grill (CMG) and Hilton Worldwide (HLT) by 14% and 26%, respectively. These adjustments suggest a possible reevaluation of the dining and hospitality sectors amid rising economic uncertainties.

On Wall Street, Nike holds a Moderate Buy consensus rating, with 15 Buys and 14 Holds recorded in the last three months. Currently trading at $85.88, analysts predict a 17.58% upside potential from its present levels.