Business

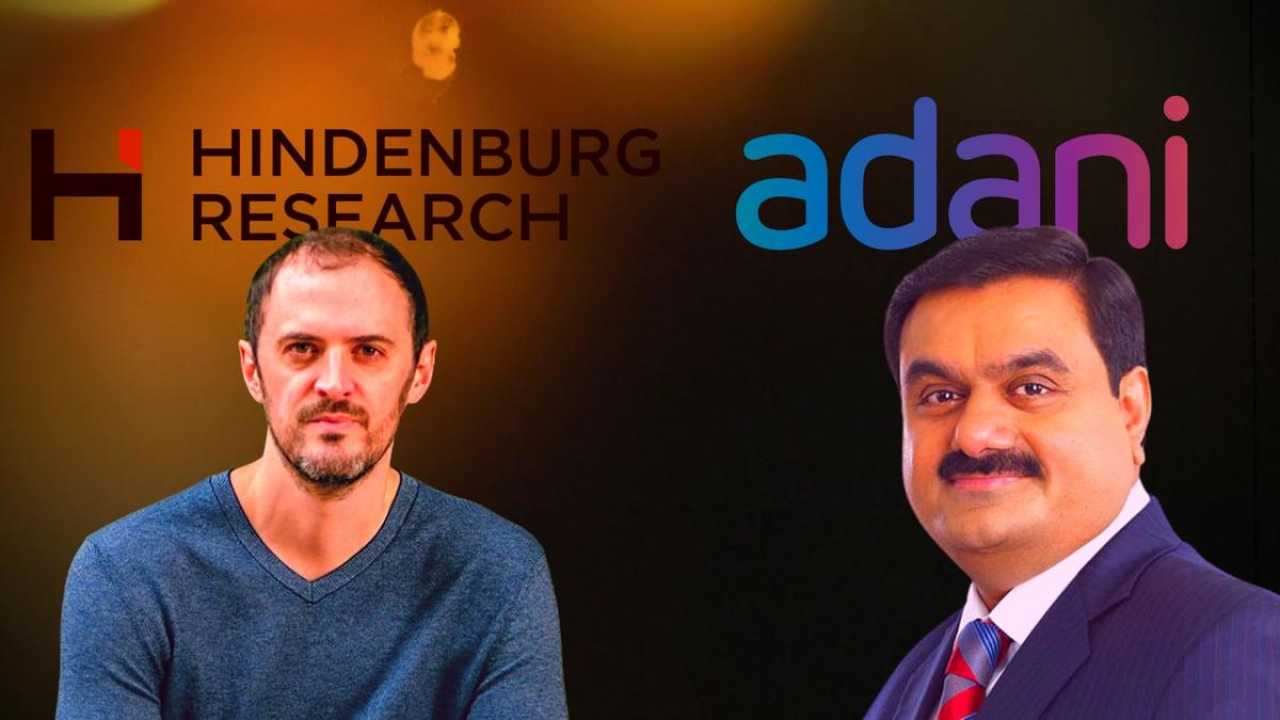

Adani Stocks Hit by New Allegations

A recent report from Hindenburg Research has created a stir in the markets, focusing on the investments that mutual funds have made in 10 companies of the Adani Group, which total a staggering Rs 41,814 crore. This comes after serious allegations involving SEBI chairperson, Madhabi Puri Buch, and her husband, Dhaval Buch, allegedly having stakes in offshore funds connected to Adani.

The report came out on August 10, detailing whistleblower documents that suggest potential conflicts of interest in SEBI’s oversight of the Adani Group. In response, Madhabi Buch and her husband have denied these allegations in a joint statement.

The trading day on August 12 saw many Adani stocks drop significantly, with Adani Ports down around 2.44 percent and Adani Enterprises seeing a decline of 4.1 percent by mid-morning. Other companies, such as Ambuja Cements and ACC, also experienced slight losses.

According to data from Value Research, mutual funds currently have significant investments in the Adani Group. Adani Ports and SEZ holds the largest mutual fund exposure at about Rs 13,024 crore, followed by Ambuja Cements and ACC, which have Rs 8,999 crore and Rs 7,668 crore invested, respectively.

Interestingly, Adani Wilmar has reached 100 percent passive mutual fund investment, while ACC shows the lowest at only 0.8 percent. The active investments in Adani stocks have grown steadily over the past two years, with mutual funds increasing their engagement in this controversial group.

Among the mutual funds, the SBI Nifty 50 ETF has the largest single investment in Adani Ports, coming in at Rs 1,520 crore. Meanwhile, HDFC Mid-Cap Opportunities Fund has the highest exposure to ACC stock, with investments reaching Rs 1,149 crore.

This news comes on the backdrop of the ongoing concerns about the Adani Group following the previous Hindenburg report from January 2023 that accused them of stock manipulation and other serious issues. As the market reacts, investors are advised to stay vigilant and exercise due diligence.