Business

Adobe Earnings Report Expected to Ignite Stock Volatility

LOS ANGELES, California — Adobe Inc. (ADBE) is scheduled to announce its fiscal 2025 first-quarter earnings on Thursday, March 13, 2025, after the market closes. Investors are poised for a tight watch on the software company’s advancements in artificial intelligence, with sentiments regarding their effectiveness dampening expectations.

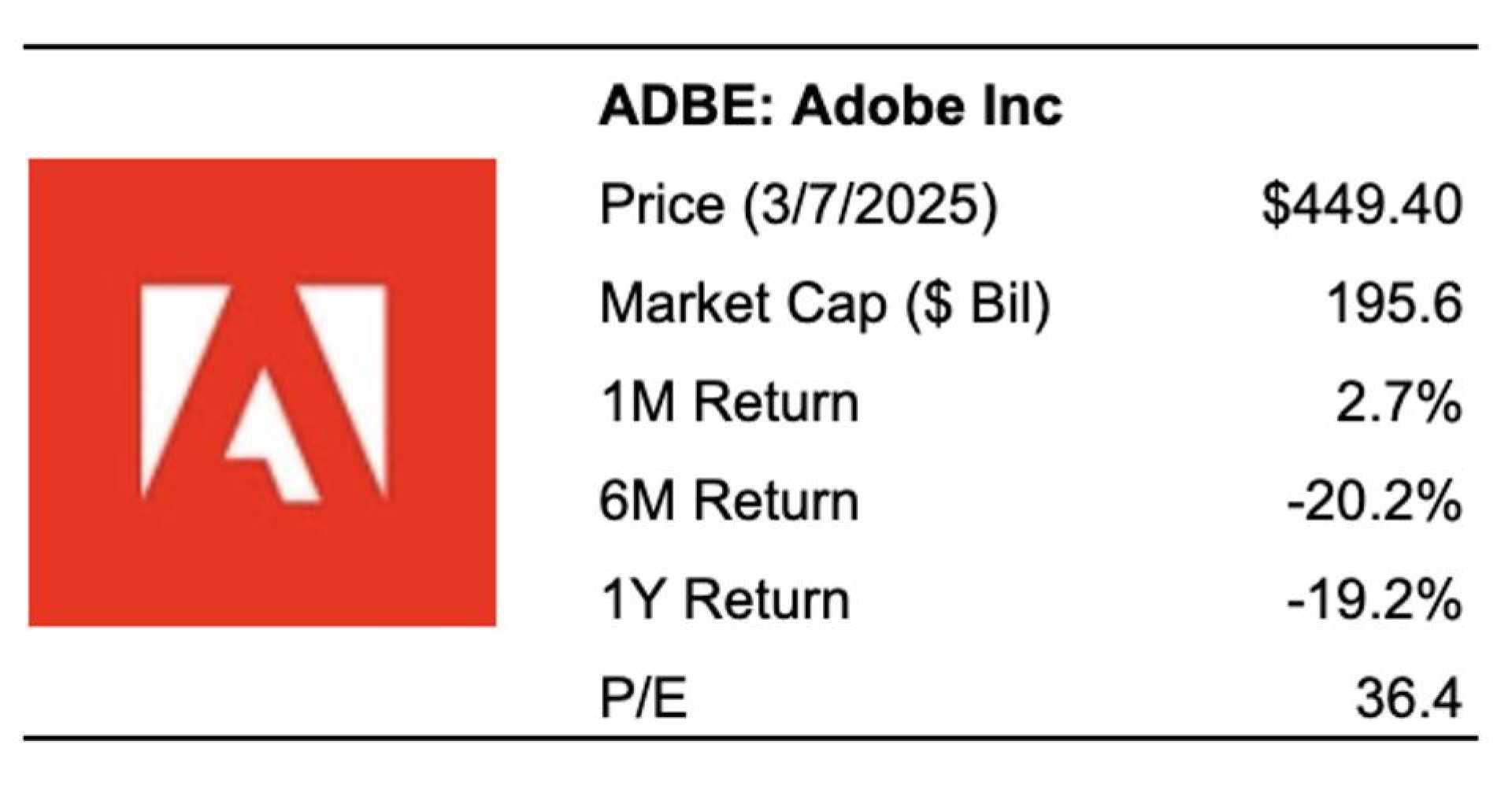

Analysts estimate that Adobe will report earnings of $4.97 per share and revenue of $5.66 billion, indicating year-over-year growth rates of 11% and 9%, respectively. With a market capitalization of approximately $198 billion, the company’s total revenue over the last twelve months was recorded at $22 billion, showcasing operational profitability with $7.7 billion in operating profits and a net income of $5.6 billion.

Market expectations vary, and historical patterns suggest that knowing how to navigate the earnings announcement can be beneficial for event-driven traders. Analysts encourage investors to examine previous performances closely, particularly focusing on the correlation between immediate and medium-term returns following earnings releases.

Among the 17 analysts who cover Adobe, ten have given “buy” ratings, while six marked it as a “hold” and one issued a “sell.” Their consensus price target stands around $551, implying a potential 25% upside from Monday’s trading level of about $438. Analysts at RBC Capital Markets noted the forthcoming Adobe Summit as a critical event for updates on generative metrics, although they recently adjusted their price target down to $550.

The company’s recent developments involving Creative Cloud and its generative AI platform, Firefly, are receiving attention. Stifel analysts praised the launch of a new video model from Firefly as a positive move towards monetization, maintaining a “buy” rating with a $600 price target.

In the days leading up to the earnings announcement, Adobe shares experienced a decline of 2.5%, reflecting a broader downturn across the technology sector. The stock has reduced by about 20% over the past year, contributing to heightened investor anxiety.

Commenting on the situation, Adobe CEO Shantanu Narayen previously emphasized a robust fiscal outlook, stating that “Adobe delivered record FY24 revenue, demonstrating strong demand and the mission-critical role Creative Cloud plays in fueling the AI economy.”

Market strategies indicate higher-than-usual volatility ahead of the earnings call, with current options pricing reflecting an expected stock price range of +/- $36.27, accounting for an 8% change from its current $435 stock price. Historically, fluctuations nearing earnings calls have typically registered at 5%-10% among major tech stocks.

For those with a bullish stance on ADBE stock, evidence of solid performance is essential, as market conditions may dictate that surpassing earnings expectations is crucial amid ongoing tech stock declines. Conversely, a bearish outlook may gain traction given the prevailing sentiment of cautious investing across sectors.

The company’s forthcoming performance will soon be crucial in determining investor confidence as the earnings report unfolds tomorrow at 11 a.m. CDT.