Business

Affirm Holdings Sees Significant Stock Surge and Bullish Sentiment Amidst Strong Earnings and Market Trends

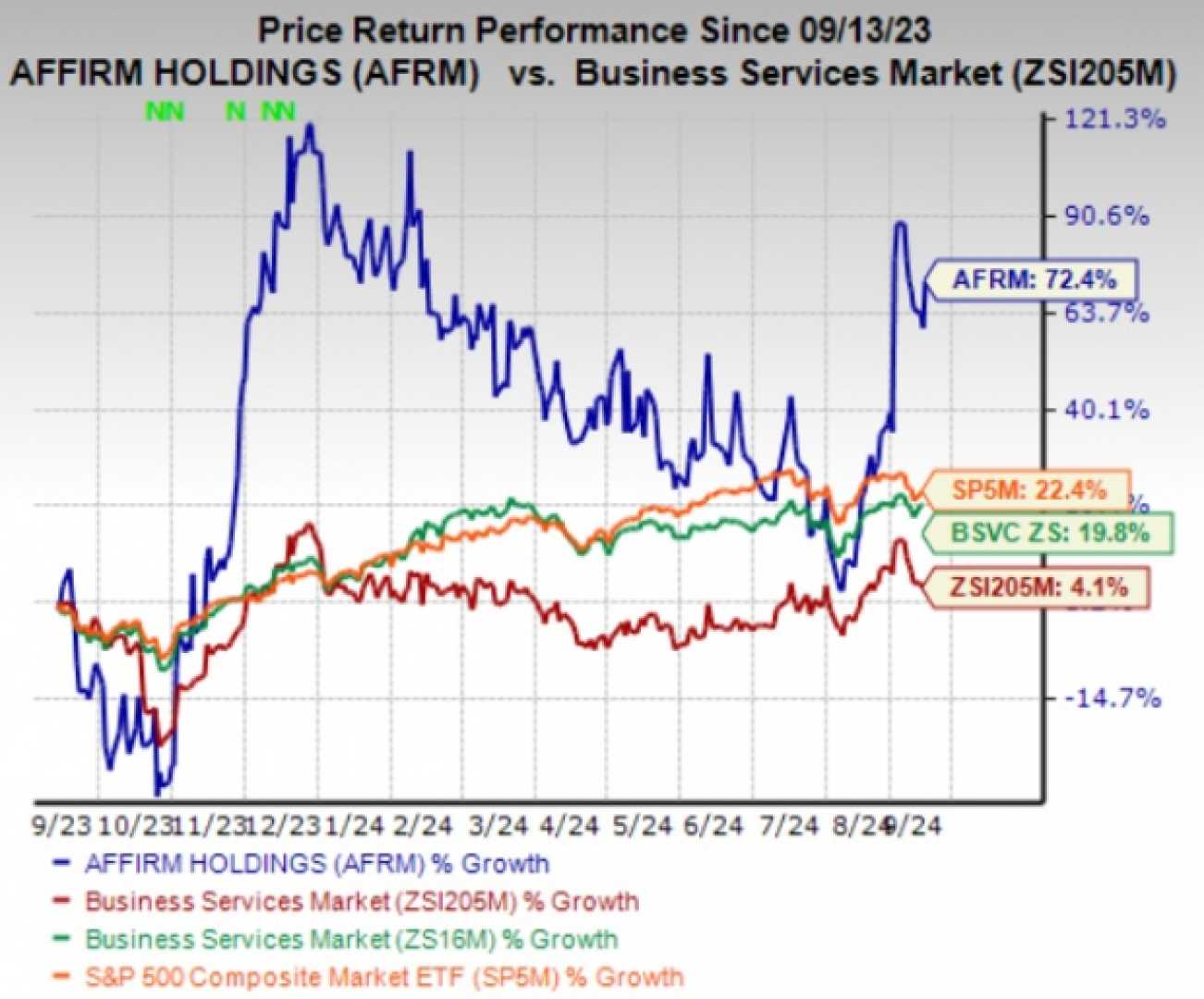

Affirm Holdings (NASDAQ: AFRM), a leading player in the buy-now-pay-later (BNPL) industry, has experienced a notable surge in its stock price recently. As of October 28, 2024, Affirm’s stock has risen by 10.24% to $46.31, reflecting positive market sentiment and strong earnings performance.

The company’s recent earnings report, released in late August 2024, exceeded expectations, leading to a significant increase in stock value. Affirm shares surged 34% in a single day, marking one of the best days for the stock in three years. This upward trend is attributed to better-than-expected results and strong guidance for the future.

Financial bloggers and analysts have also shown a bullish sentiment towards Affirm. According to TipRanks, the blogger sentiment for AFRM is more bullish than other stocks in the Technology sector, with 78% of bloggers expressing a positive outlook. Recent articles highlight the company’s game-changing deal with Apple and its potential for long-term growth.

Affirm’s market capitalization has also seen an increase, standing at approximately $14.89 billion USD as of October 2024, making it the world’s 1255th most valuable company by market cap.

The BNPL sector, led by companies like Affirm, continues to gain traction despite economic challenges. Consumers are increasingly using BNPL services, which has contributed to Affirm’s growth and positive market perception.