Business

AMD Boosts Share Buyback Program by $6 Billion

SANTA CLARA, Calif., May 14, 2025 – Advanced Micro Devices (AMD) announced Wednesday that its board of directors approved a $6 billion share repurchase program, increasing its total buyback authority to approximately $10 billion. This is a significant move for the semiconductor company, which is known for its innovation in high-performance computing.

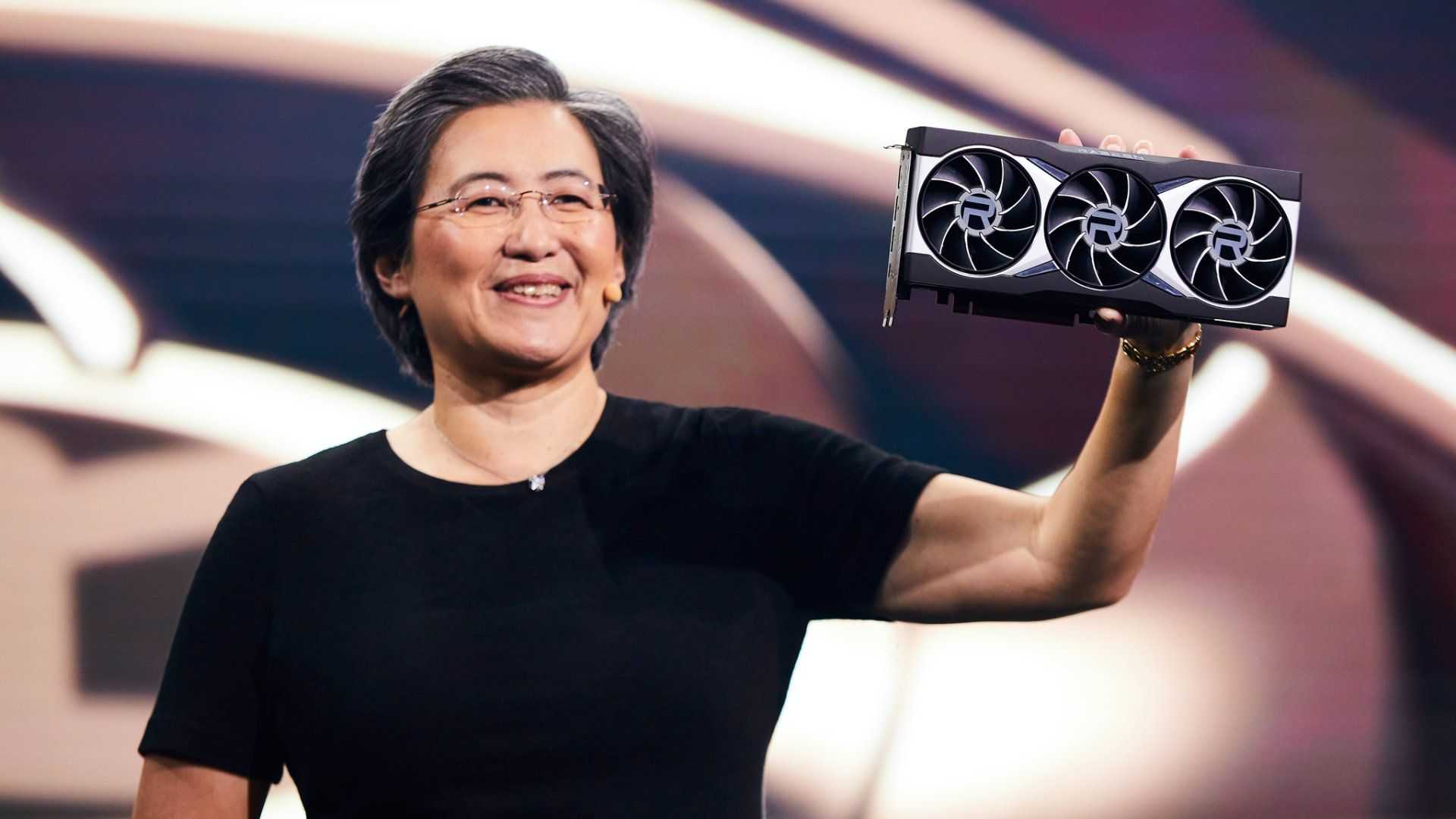

Shares of AMD rose by 6.4% in premarket trading following the announcement, reflecting positive investor sentiment. The new buyback program adds to the remaining $4 billion balance from its existing repurchase initiative. CEO Lisa Su stated, “Our expanded share repurchase program reflects the Board’s confidence in AMD’s strategic direction, growth prospects, and ability to consistently generate strong free cash flow.”

Importantly, the program does not have a set termination date, allowing AMD considerable flexibility. The company plans to execute the buybacks through open market purchases or private negotiations, depending on market conditions. AMD retains the option to suspend or discontinue the program at any time.

This bold strategy comes as AMD seeks to enhance shareholder returns while simultaneously investing in its product portfolio. The company’s commitment to disciplined capital allocation highlights its aim to foster long-term growth.

As of March 29, 2025, AMD had approximately $4 billion remaining from its previous share buyback program, demonstrating its proactive approach to managing capital effectively. AMD continues to solidify its position as a leader in the semiconductor industry, offering cutting-edge technology relied upon globally.