Business

AMD’s Stock Faces Volatility Amid AI Growth Challenges

Sunnyvale, California – Advanced Micro Devices (AMD) reported strong earnings despite a challenging year, as investors speculate on its stock recovery potential. On May 9, 2025, AMD’s stock price sat at $102.86, marking a 1.14% change after a significant decline over the past year.

The chip maker, led by CEO Lisa Su, has made a remarkable turnaround from a struggling competitor to a leader in the semiconductor industry, particularly in AI technologies. Over the last decade, AMD’s stock increased over 4,000%, but it has faced obstacles with nearly a 40% drop in the past year due to slower-than-expected growth in its AI business.

Despite recent challenges, AMD’s revenue has grown significantly. In its first-quarter report, the company achieved a 36% increase in revenue, bringing in $7.44 billion, exceeding the analyst expectations of $7.12 billion. Much of this growth came from the data center segment, which reported a 57% jump in revenue to $3.7 billion, thanks to the popularity of its EPYC CPU and Instinct GPU chips.

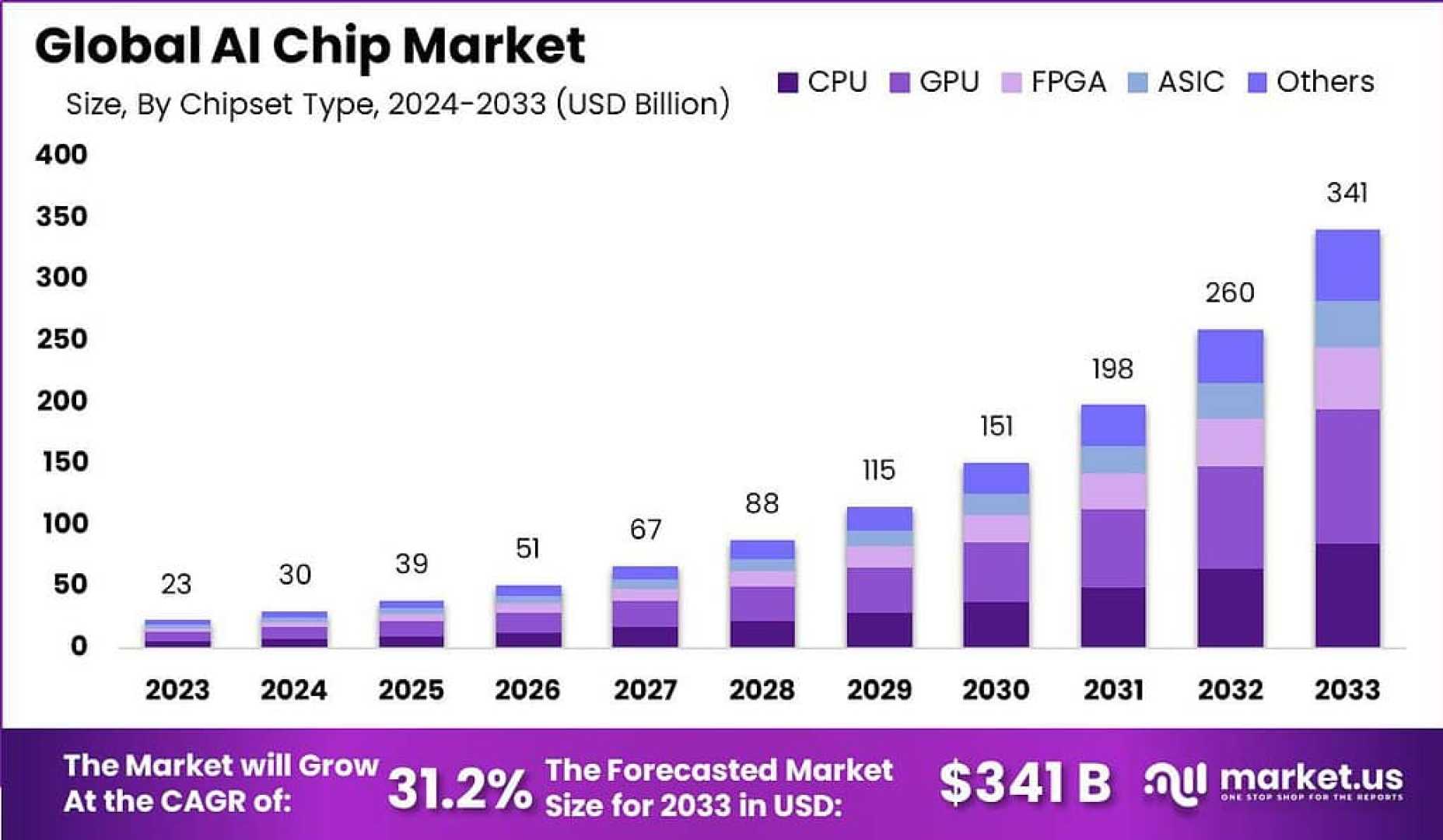

In contrast, Intel has seen a decline in its client segment, reporting an 8% drop to $7.6 billion. AMD has capitalized on this dip, recording a 68% revenue increase in its client segment driven by the high demand for its latest Zen 5 Ryzen processors. After acquiring ZT Systems, AMD is positioning itself to grow in the AI accelerator market, expected to be worth $500 billion by 2028.

Looking ahead, AMD’s second-quarter forecast predicts approximately $7.4 billion in revenue, which includes $1.5 billion in losses from new export restrictions on AI chips for China. This estimate reflects a 27% growth from the same period last year, despite the prevailing uncertainty in the market.

Amazon‘s investment in AMD, purchasing 822,234 shares, indicates a strengthening relationship between the two companies and could signal confidence in AMD’s technology as a competitive alternative to Nvidia in the AI chip market.

As AI continues to shape business strategies, AMD’s advancements in chip technology might position it for further gains. The next significant opportunity will be an upcoming launch of its new Instinct MI350 and MI400 accelerators.

Investors are anticipating an announcement on June 15 when AMD hosts its “Advancing AI” day, hoping to reveal more insights into its future plans and technologies.