Business

AMD Stock Surges Ahead of Q3 Earnings: Analysts Predict Market Share Gains Over Intel

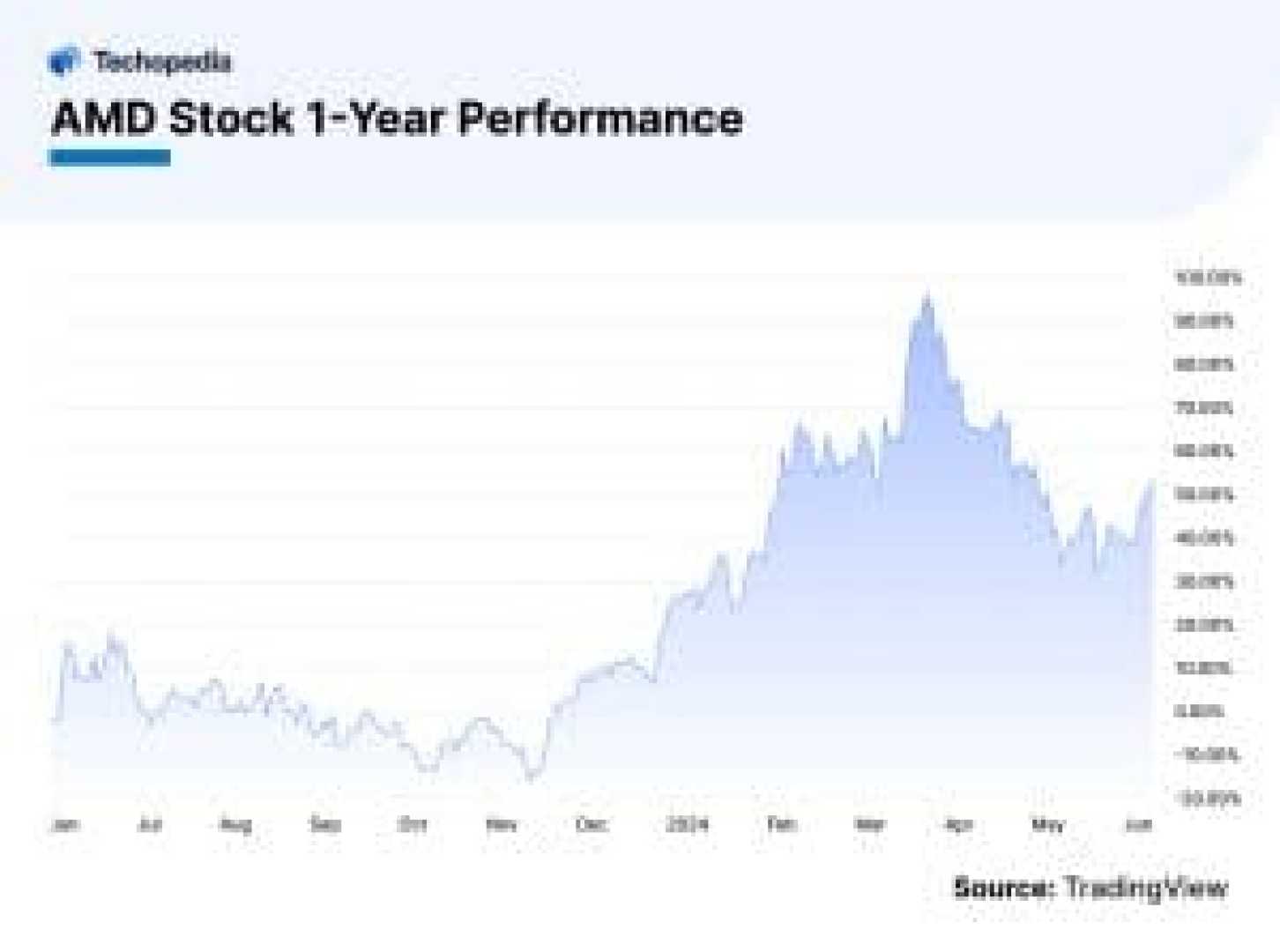

Advanced Micro Devices, Inc. (AMD) has seen a significant surge in its stock price in recent days, with the stock rising by 4.37% to $166.91 as of October 29, 2024. This uptick comes ahead of the company’s third-quarter earnings report, which is set to be released after the close of trading.

Analysts are optimistic about AMD’s performance, with Barclays predicting that the company is taking “material” market share from its competitor, Intel. This assessment is based on AMD’s strong positioning in the market and its ability to maintain pricing power. Dr. Lisa Su, AMD’s CEO, has been instrumental in driving this growth.

The anticipation around AMD’s Q3 earnings is high, with investors and analysts closely watching for any signs of continued growth and market share expansion. The company’s ability to compete effectively with Intel has been a key factor in its recent success, and the upcoming earnings report is expected to provide further insights into this trend.

In addition to the market share gains, AMD’s financial performance is also under scrutiny. The company’s ability to sustain its revenue growth and maintain profitability will be crucial in determining the stock’s future trajectory. As the tech sector continues to evolve, AMD’s strategic moves and product innovations will remain critical factors in its competitive landscape.