Business

S&P 500 Index Dips Amid Disappointing GDP Growth Rate Report

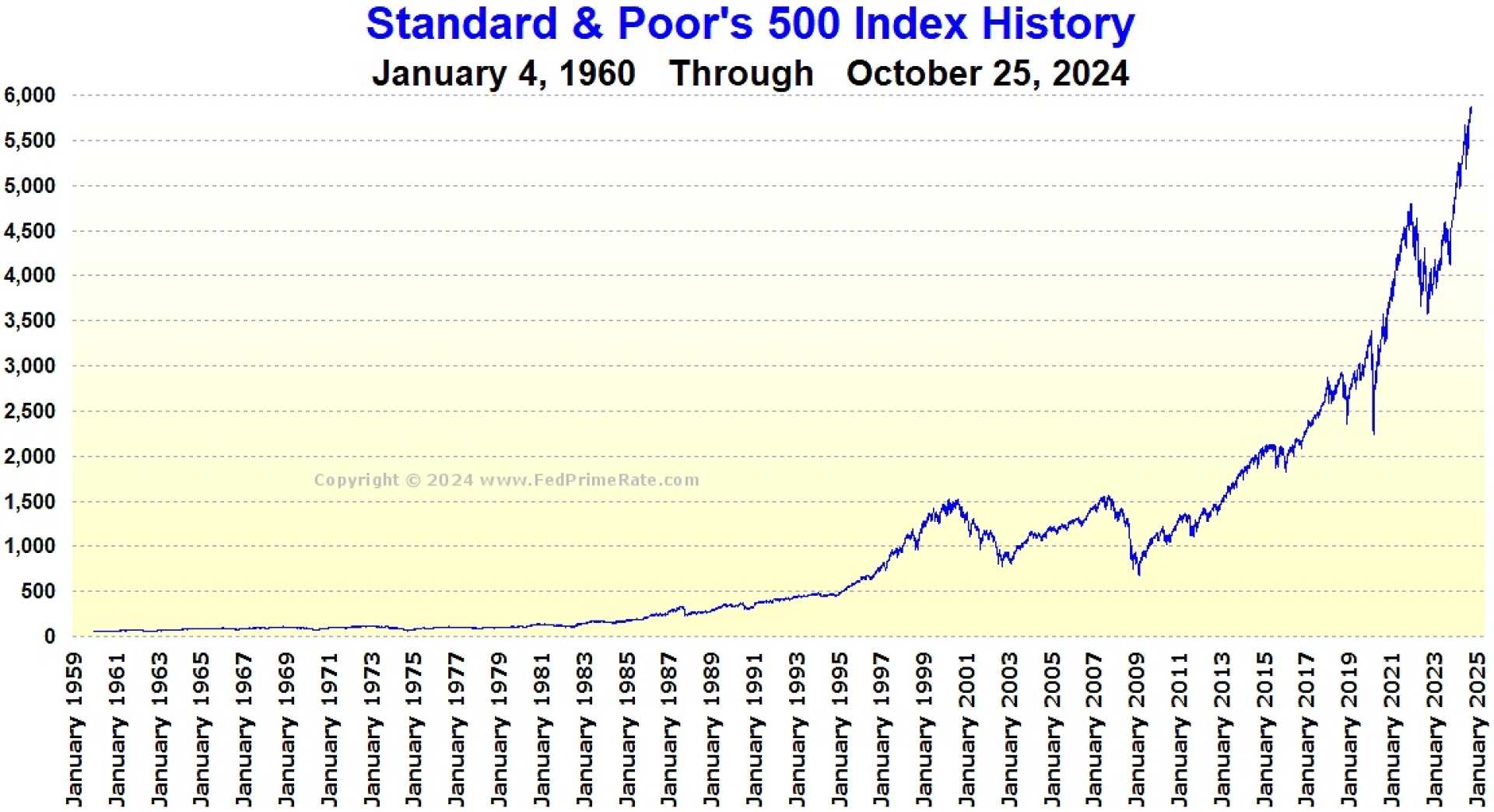

The S&P 500 index has experienced a decline in recent trading sessions, driven largely by the disappointing GDP growth rate report released this week. As of October 31, 2024, the S&P 500 closed at 5,732.06, down 81.61 points or 1.40% from the previous day.

The downturn is attributed to investor concerns over the economic outlook, as the GDP growth rate fell short of expectations. This has led to a broader market pullback, particularly affecting the tech sector, which is a significant component of the S&P 500 index. The NASDAQ, heavily weighted with tech stocks, has also been losing ground in response to these economic indicators.

The S&P 500 is a key gauge of the large cap U.S. equities market, comprising 500 leading companies across various industries. It covers approximately 75% of the U.S. equities market and is closely watched by investors and analysts as a barometer of the overall health of the U.S. economy.

Market analysts are closely monitoring the situation, as the combination of economic data and market sentiment continues to influence trading decisions. The current market volatility underscores the importance of staying informed about economic indicators and their impact on major stock indices like the S&P 500.