Business

ANSYS Expected to Report Strong Earnings Amid Market Anticipation

Canonsburg, Pennsylvania — ANSYS, Inc., a leader in engineering simulation software, is set to reveal its quarterly financial results on Wednesday, April 30, after the market closes. Analysts predict the company will report an impressive growth of 31.8% in earnings compared to the same quarter last year.

With a keen focus on industries such as aerospace, automotive, and healthcare, ANSYS has consistently surpassed Wall Street‘s earnings estimates in three of the past four quarters. This trend has put the company in a strong position ahead of its upcoming report.

For fiscal year 2025, analysts forecast an adjusted earnings per share (EPS) of $8.71, up by 5.5% from the prior year. Furthermore, they anticipate a year-over-year growth of 20.6%, projecting the adjusted earnings to rise to $10.50 per share in fiscal 2026.

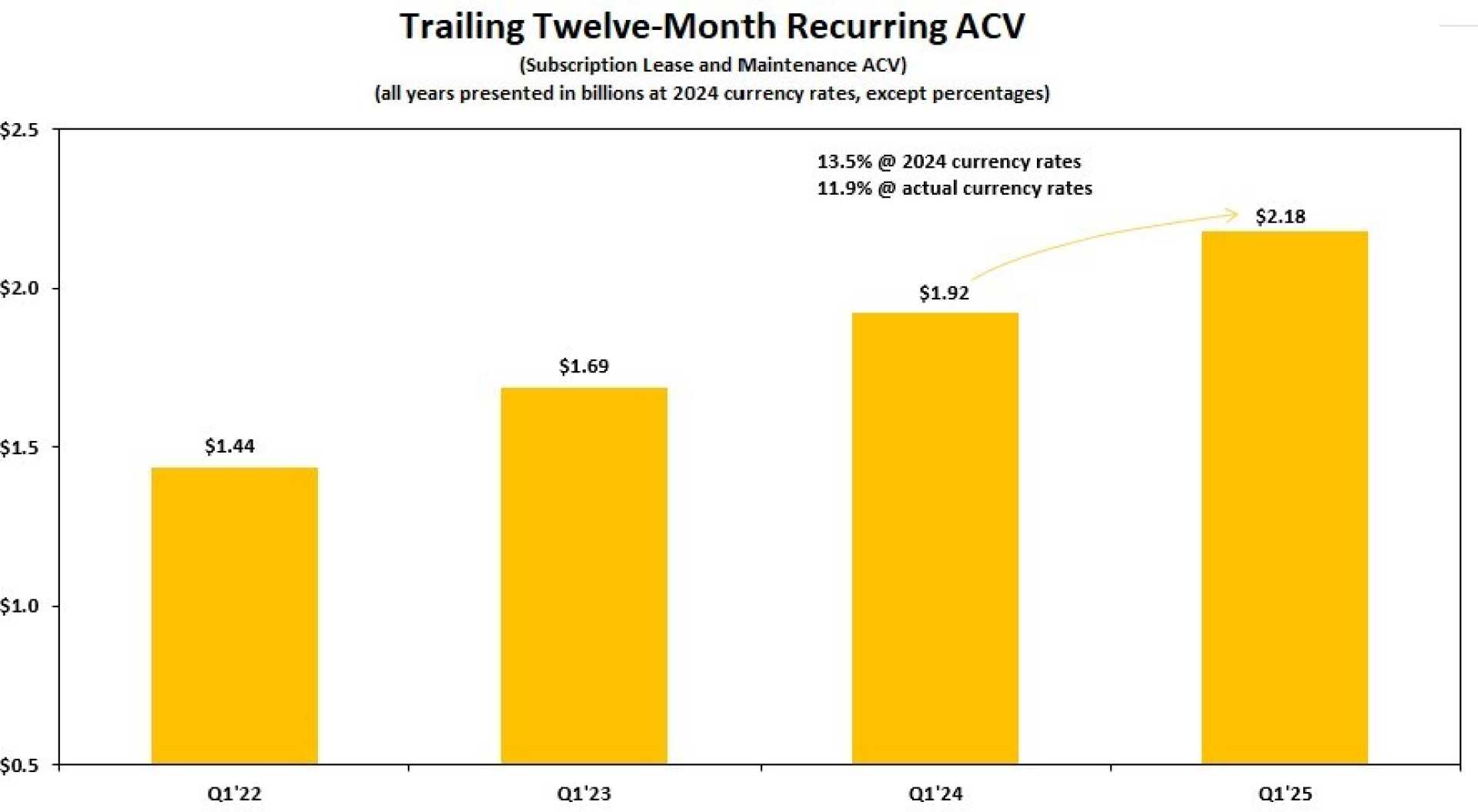

Despite the positive outlook, ANSYS stock has struggled over the past 52 weeks, underperforming compared to the S&P 500 Index and the Technology Select Sector SPDR Fund. In its most recent earnings report on February 19, the company posted revenues of $882.2 million, a 9.6% increase from the previous year, largely driven by a rise in annual contract value and robust demand from automotive and aerospace sectors.

Currently, analysts maintain a cautious stance on ANSYS stock, issuing an overall “Hold” rating. Out of 12 analysts covering the stock, two recommend a “Strong Buy,” nine suggest a “Moderate Buy,” while one advises a “Strong Sell.” The mean price target for ANSYS stands at $355.33, indicating a potential 12.3% increase from its current price levels.