Business

Apple Set to Reveal Q2 Earnings Amid Tariff Concerns Next Week

Cupertino, California — Apple Inc. will announce its fiscal second-quarter results next Thursday, amid heightened scrutiny over the effects of recent Trump tariffs on its business operations.

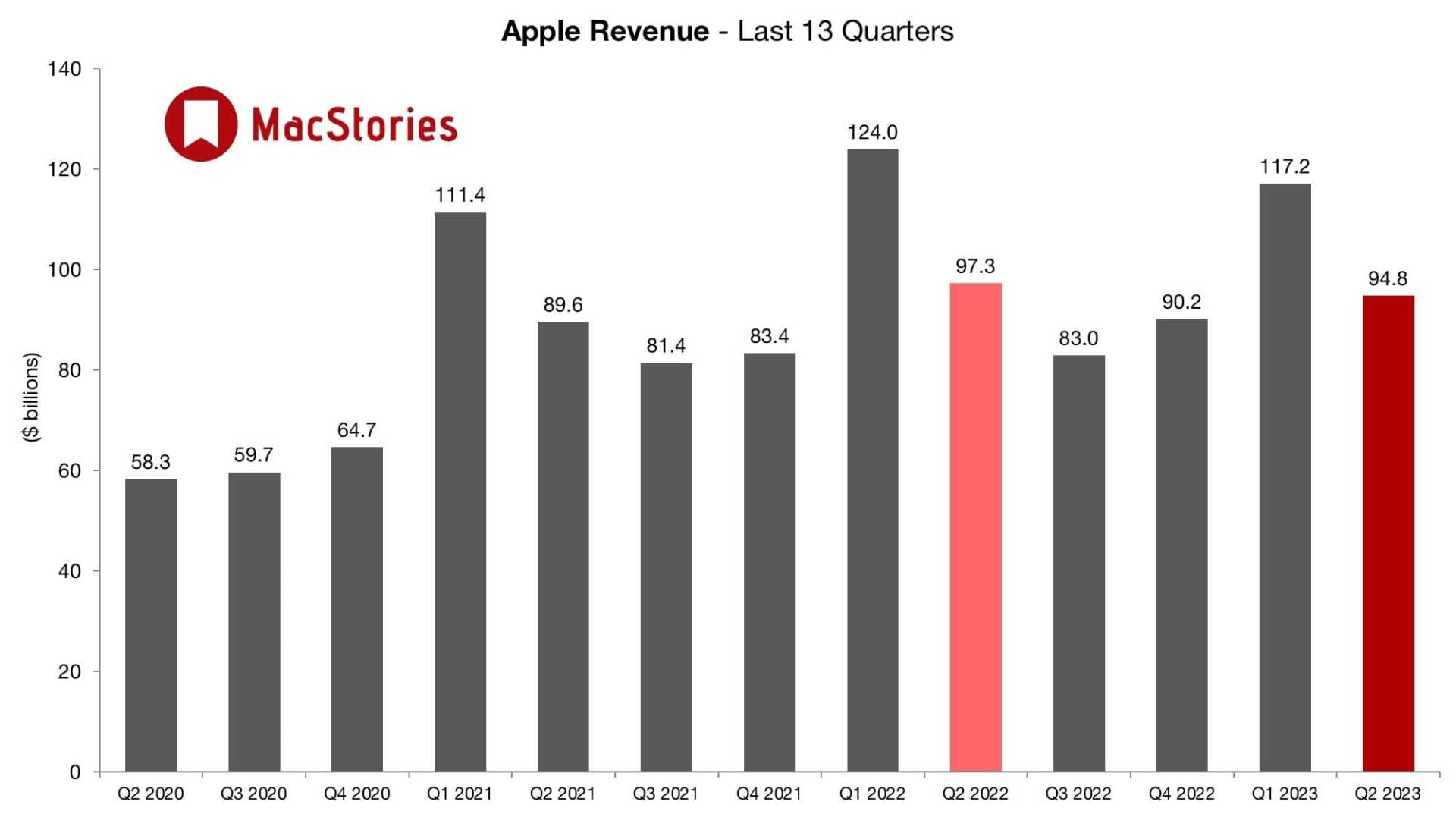

Wall Street analysts predict that Apple will earn $1.61 per share, marking a 5% increase year-over-year, and report revenue of $94.08 billion, up 4%. Notably, Apple’s imports from China now face a 20% tariff. The company managed to avoid a more severe 125% tariff on Chinese goods, which was announced on April 11.

To mitigate the risks associated with tariffs and geopolitical tensions, Apple plans to shift more of its iPhone production from China to India. According to reports from Bloomberg and Financial Times, Apple aims to produce all iPhones sold in the U.S. in India by the end of 2026. Currently, Apple sells over 60 million iPhones annually in the U.S. and hopes to double its production in India to exceed 80 million units each year.

Contract manufacturers, including Foxconn and Tata Electronics, are involved in assembling iPhones in India. Wedbush Securities analyst Matt Bryson expressed reservations about this production shift, noting that newer factories in India are less efficient than those in China. However, he still believes that doubling the production is feasible, according to a note to clients on Friday.

Analysts will closely monitor Apple’s guidance for the June quarter and any forecasts for the full year, looking for indications of “demand destruction” among consumers due to tariffs and potential price hikes. Currently, for Apple’s fiscal third quarter, analysts estimate earnings of $1.47 per share, also reflecting a 5% year-over-year increase, with sales projected at $88.96 billion, a 4% rise.

On Friday, Apple shares rose 0.4% to close at $209.28, though year-to-date, the stock is down 16.4%. Indications of further struggles include the stock trading below its 50-day and 200-day moving average lines, forming a “death cross,” a technical indicator that can forecast weakness.

This week, three Wall Street firms reduced their price targets for Apple stock. UBS lowered its target from $250 to $240 while maintaining a buy rating. Goldman Sachs adjusted its target to $256, down from $259, and also reaffirmed its buy rating. Monness Crespi Hardt analyst Brian White highlighted concerns about the trade war with China, noting that even in the best-case scenario, Apple’s U.S. prices are likely to rise, and manufacturing is expected to continue moving out of China. White maintains a buy rating with a price target of $260.

Follow Patrick Seitz on X, formerly Twitter, for more insights on consumer technology and market trends.