Business

Applied Materials Set to Announce Earnings Amid Strong Dividend Prospects

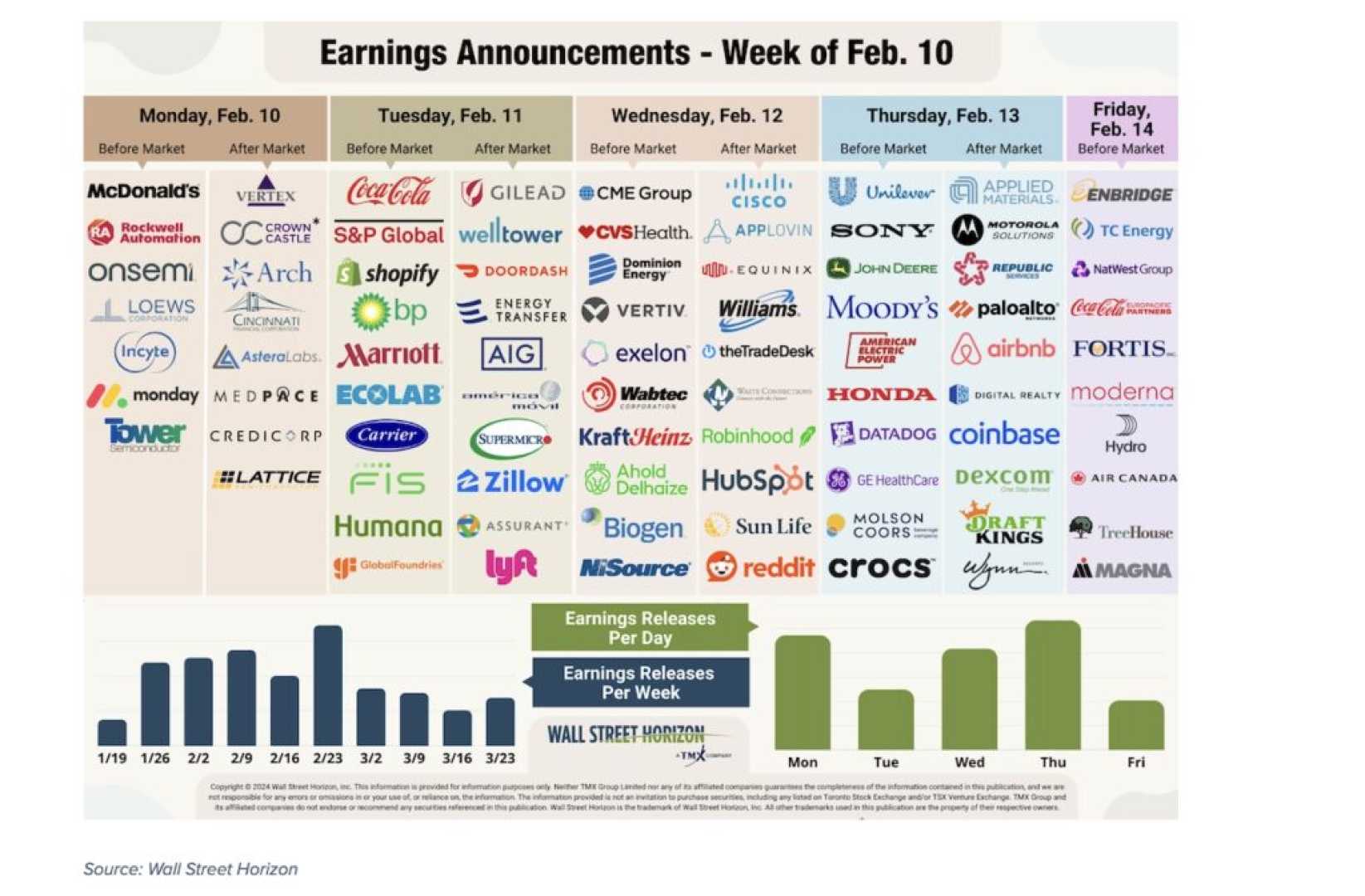

Santa Clara, California — Applied Materials, Inc. (AMAT) is scheduled to release its fourth-quarter financial results on February 15, 2025. Analysts expect the semiconductor equipment company to report earnings of $2.30 per share, up from $2.13 per share in the same period last year, indicating strong financial growth.

In addition to its expected earnings, Applied Materials projects quarterly revenue of $7.16 billion, an increase from the previous year’s revenue of $6.71 billion. The company has consistently exceeded consensus estimates on both revenue and earnings for the last ten quarters, showcasing its robust performance in the semiconductor market.

Investors are closely watching Applied Materials not only for its earnings but also for its dividend potential. The company currently offers a dividend yield of 0.88%, translating to a quarterly payment of 40 cents per share, or $1.60 annually. To achieve a goal of $500 monthly from dividends, an investor would need to own approximately 3,750 shares, equating to an investment of around $678,338 based on the current share price.

“With the ongoing momentum in the semiconductor industry, we anticipate strong results from Applied Materials. Their history of surpassing estimates creates a favorable outlook for both earnings and dividends,” said Michael Carter, a financial analyst at TechInvest.

According to Carter, the volatility in dividend yields emphasizes the need for consistent monitoring of stock prices and dividend payments. As prices fluctuate, the yield, calculated by dividing the annual dividend by the stock price, will also change accordingly. For example, if Applied Materials were to increase its dividend payment, the yield would rise even if the stock price remains constant.

On Wednesday, shares of Applied Materials closed at $180.89, down 1.3% amid trade fluctuations. The market will closely analyze the upcoming earnings report for indications of growth in a competitive environment.

Investors should also be cautious of various market factors that could affect performance, including global demand, technological advancements, and supply chain dynamics. With major market players focusing on scaling production and improving efficiency, the upcoming quarterly report can be pivotal for Applied Materials’ future trajectory.

Upcoming earnings reports will also be closely watched as they trail Applied Materials’ announcement next week. Industry experts predict that the overall earnings growth for S&P 500 companies in the fourth quarter will average 7.5% when accounting for various sectors.