Business

Are XRP and Bitcoin Positioned for a Major Comeback?

NEW YORK, United States — As of April 7, 2025, Bitcoin and XRP are facing significant turbulence in the cryptocurrency markets despite emerging from a pro-cryptocurrency political environment. Bitcoin, the largest digital asset, has seen its price drop to $1.76, while XRP has also faced declines, though it has outperformed Bitcoin over the last year.

Following the transition of power to the Trump administration in January, a notable shift in policy towards cryptocurrencies was observed. This included directives to create strategic reserves for digital assets, a sign indicating the U.S. government’s intent to officially embrace cryptocurrencies. However, the market has remained volatile, with Bitcoin dropping 8.59% recently while XRP’s value dipped 16.16% on the same day.

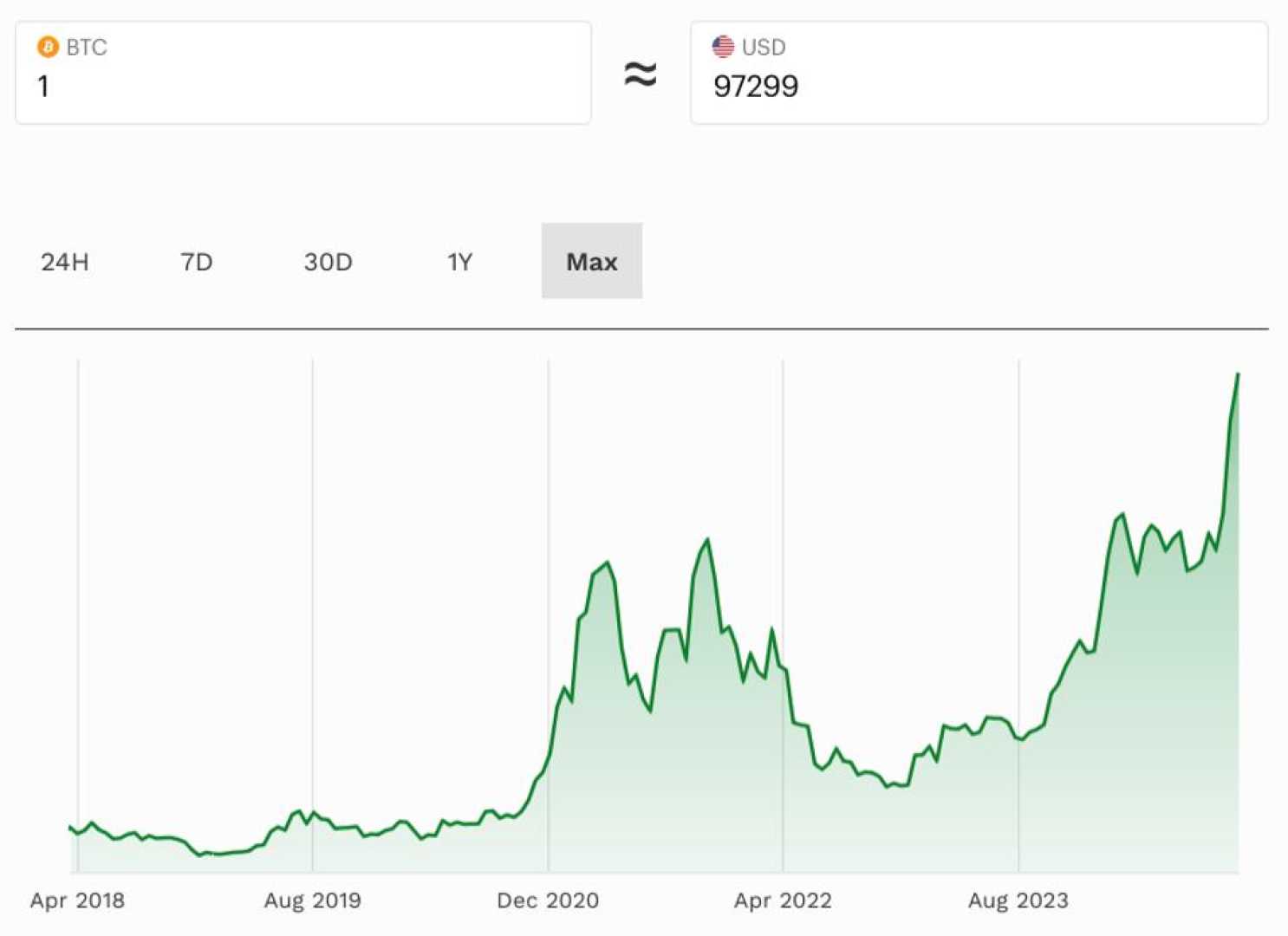

XRP, developed by Ripple Labs to enhance cross-border transaction efficiency, currently has a market cap of $125 billion. Bitcoin, often considered ‘digital gold,’ boasts a hefty market valuation of $1.7 trillion. Comparatively, XRP has surged approximately 300% in value over the past six months, primarily spurred by favorable political narratives and the recent halting of a lawsuit against Ripple by the SEC.

According to Ripple’s CEO, there may be a considerable increase in XRP adoption following the potential resolution of its legal battle with the SEC, which accused the company of selling XRP as an unregistered security. ‘The conclusion of this lawsuit opens up new avenues for financial institutions to adopt our technology,’ remarked the CEO, reflecting optimism about XRP’s future in the financial technology space.

Conversely, Bitcoin’s decline may appear counterintuitive given the government’s announcement to establish a dedicated reserve of seized Bitcoin. Experts suggest that while these developments could enhance Bitcoin’s long-term viability, they may have failed to resonate with investors in the short term, resulting in a sell-off post-inauguration.

An analyst noted, ‘Investors often buy on speculation leading up to major announcements but then sell once those events are realized,’ creating a phenomenon known as ‘buying the rumor, selling the news.’

Moreover, the recent regulatory shifts have instilled uncertainty among investors, discouraging risk-laden asset purchases amidst broader market fluctuations. Since the new administration’s policies, both XRP and Bitcoin have experienced withdrawals, impacted by a general sell-off in technology stocks and cryptocurrencies.

The potential impact of a government reserve dedicated to Bitcoin remains to be seen. Industry stakeholders remain wary, and while some analysts express confidence in an upcoming bull market, substantial risk remains.

In summary, XRP presents a unique investment opportunity post-SEC litigation resolution and could be a long-term winner if adoption increases among financial institutions. Bitcoin, however, remains the more stable option for conservative investors, offering a solid store of value amid ongoing market headwinds.