Business

Arista Networks (ANET) Stock Surges Following Strong Q3 2024 Financial Results

Arista Networks, Inc. (NYSE: ANET) has seen a significant surge in its stock price following the release of its strong third-quarter 2024 financial results. On November 7, 2024, the company reported earnings per share (EPS) of $2.40, exceeding analyst estimates by $0.32. The revenue for the quarter came in at $1.81 billion, surpassing the consensus estimate of $1.75 billion.

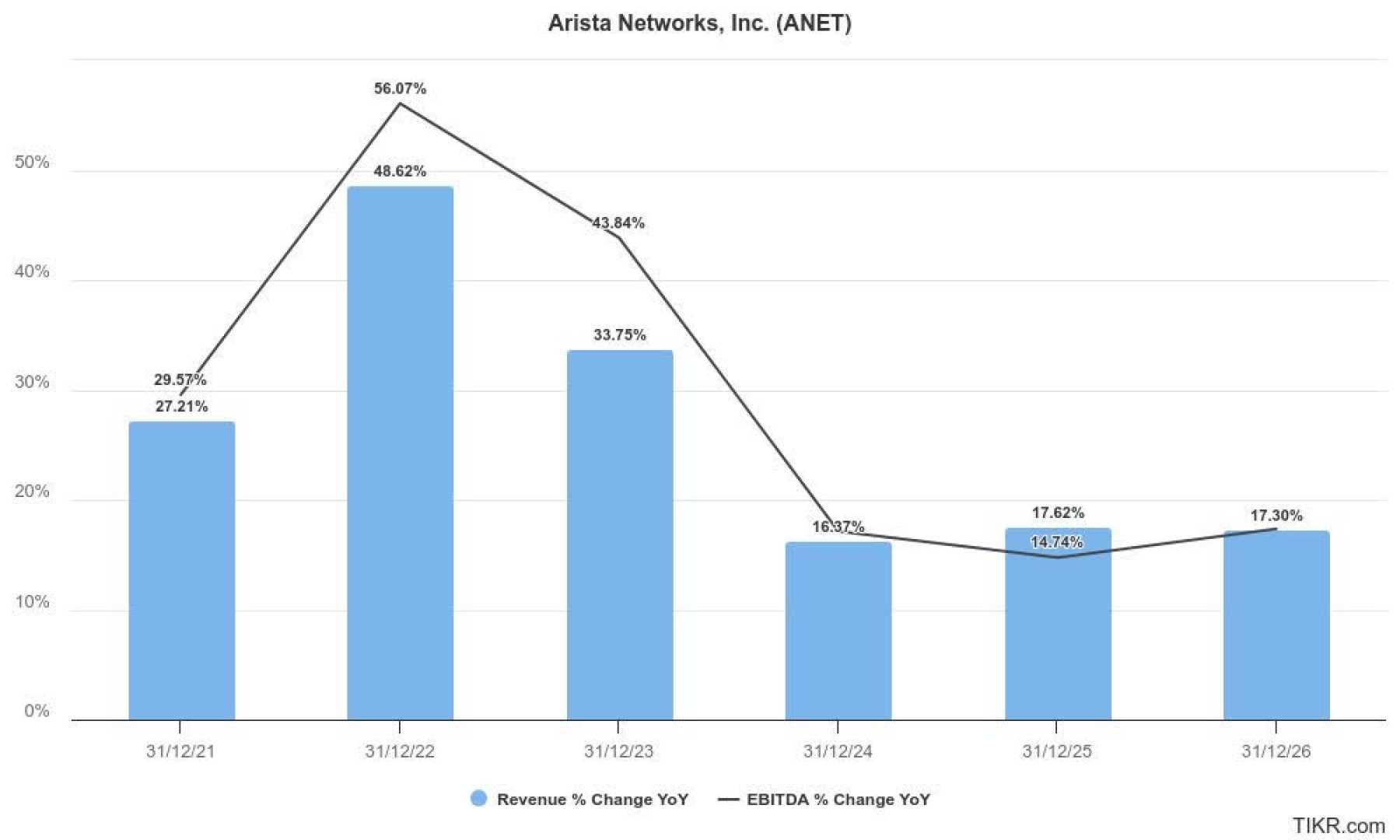

The company’s financial performance was marked by a 7.1% increase in revenue from Q2 2024 and a 20% rise from Q3 2023. The GAAP gross margin was 64.2%, and the non-GAAP gross margin was 64.6%. GAAP net income was $747.9 million ($2.33 per diluted share), up from $545.3 million ($1.72 per share) in Q3 2023. Non-GAAP net income was $769.1 million ($2.40 per share), compared to $581.4 million ($1.83 per share) in Q3 2023.

Arista Networks also provided guidance for Q4 2024, forecasting revenue in the range of $1.85 billion to $1.90 billion, which is above the analyst consensus of $1.82 billion. This positive outlook has contributed to the bullish sentiment around the stock, with several analysts maintaining or upgrading their ratings. For instance, Citigroup and Wells Fargo & Company have raised their price objectives to $460.00, with both firms giving the stock a “buy” or “overweight” rating.

In addition to the strong financial results, institutional investors have shown increased interest in Arista Networks. Walkner Condon Financial Advisors LLC recently acquired a new stake in the company valued at approximately $2.32 million during the third quarter. Other significant investments include GQG Partners LLC and Swedbank AB, which also added to their stakes in the first quarter.

The stock’s technical indicators also suggest a continued bullish trend. The stock price is above its 5, 20, and 50-day exponential moving averages, indicating strong buying pressure. The Relative Strength Index (RSI) is at 57.96, and the Bollinger Bands suggest that the stock is not overvalued at current levels.

CEO Jayshree Ullal’s recent stock transactions, which included the sale of shares worth approximately $330,625 as part of a pre-arranged trading plan, did not dampen the overall positive sentiment. Ullal also exercised options to acquire additional shares, reflecting her ongoing commitment to the company.