Business

Is Australia Really Undermining US Aluminum Markets? A Closer Look

Canberra, Australia — Peter Navarro, former trade adviser to Donald Trump, has voiced strong criticism of Australia’s aluminum manufacturing sector, claiming it poses a threat to the United States. His comments raise questions about the veracity of such claims, particularly as Australia seeks to secure an exemption from new U.S. tariffs on steel and aluminum.

Navarro characterized Australia and Canada as conducting “frontal assaults” on the U.S. aluminum market, accusing Australian producers of having an “unfair dumping advantage” supported by heavily subsidized smelters. The claims have sparked debate among industry experts and government officials in Australia, particularly given the country’s modest market share in the global aluminum sector.

“Consider Australia. Its heavily subsidized smelters operate below cost, giving them an unfair dumping advantage,” Navarro stated in a White House press release. However, the claim that these smelters are significantly impacting the U.S. market is contentious.

Tracking subsidies in the aluminum industry can be complex. Many states provide discreet financial support to smelters, making it challenging to quantify the exact benefits. Australia has historically offered subsidies to sustain smelting facilities under financial pressure, such as the $150 million agreement made in early 2021 to support the Alcoa smelter in Portland, Victoria. This deal was put in place after consideration was given to halting 1.5 million tonnes of smelting capacity.

However, industry analysts believe Navarro’s criticisms may be more closely related to a January 2023 announcement by the Australian government regarding a $2 billion initiative. This program aims to incentivize aluminum smelters to transition to renewable energy, addressing the significant costs associated with energy, a factor pivotal to the global aluminum production landscape.

The Albanese government asserts that this policy is essential for the future viability of smelters and is designed to support their transition to renewable energy by 2036. Despite this, as the incentives will not take effect until 2028-29, the argument that they allow smelters to operate below cost appears unfounded.

Moreover, an investigation by Guardian Australia found no evidence of U.S. authorities accusing Australian aluminum producers of dumping, which typically refers to a strategy employed to offload excess production onto foreign markets. Navarro has also voiced concerns about Australia’s trade relations with China, alleging they distort global aluminum trade. Although Australia maintains strong ties with China, especially in raw materials like iron ore and alumina, there is no substantiated evidence indicating these connections are affecting global aluminum trade.

Navarro’s statements reference a voluntary restraint agreement between Australia and the U.S., established during the Trump administration to manage aluminum exports. Following an agreement in 2019 between Prime Minister Scott Morrison and Trump, Australian exports to the U.S. fell sharply after peaking in 2018. The Biden administration’s recent 35% tariffs on Russian aluminum post-invasion of Ukraine opened opportunities for Australian exports, boosting shipments back to over 200,000 metric tonnes in 2022 and 2023.

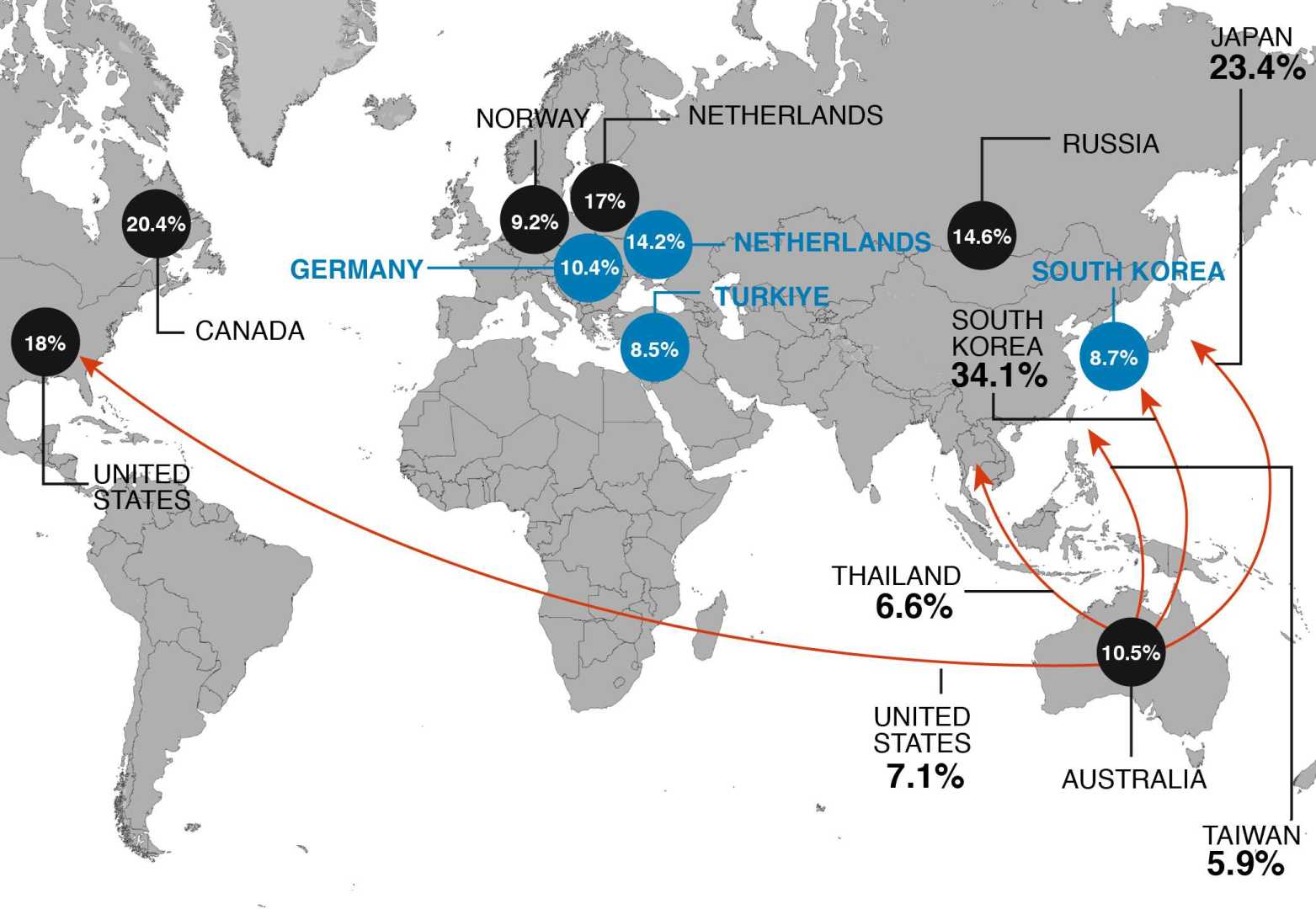

Despite Australia’s subsequent recovery as the fourth-largest aluminum exporter to the U.S., projections indicate that exports may decline in 2024, potentially dropping back to eighth position among suppliers. Overall, these shifts indicate that if Australia has engaged in any increase in aluminum exports, it is largely a response to U.S. demand for alternatives to Russian sources.