Business

Average U.S. Mortgage Rate Hovers Around 6.3% as Market Awaiting Fed Decisions

NEW YORK, Oct 9 (Reuters) – The average interest rate for a 30-year, fixed-rate conforming mortgage loan in the U.S. is currently 6.256%, according to Optimal Blue, a mortgage data company. This marks a decrease of 4 basis points from previous rates, and an increase of about 2 basis points from a week earlier.

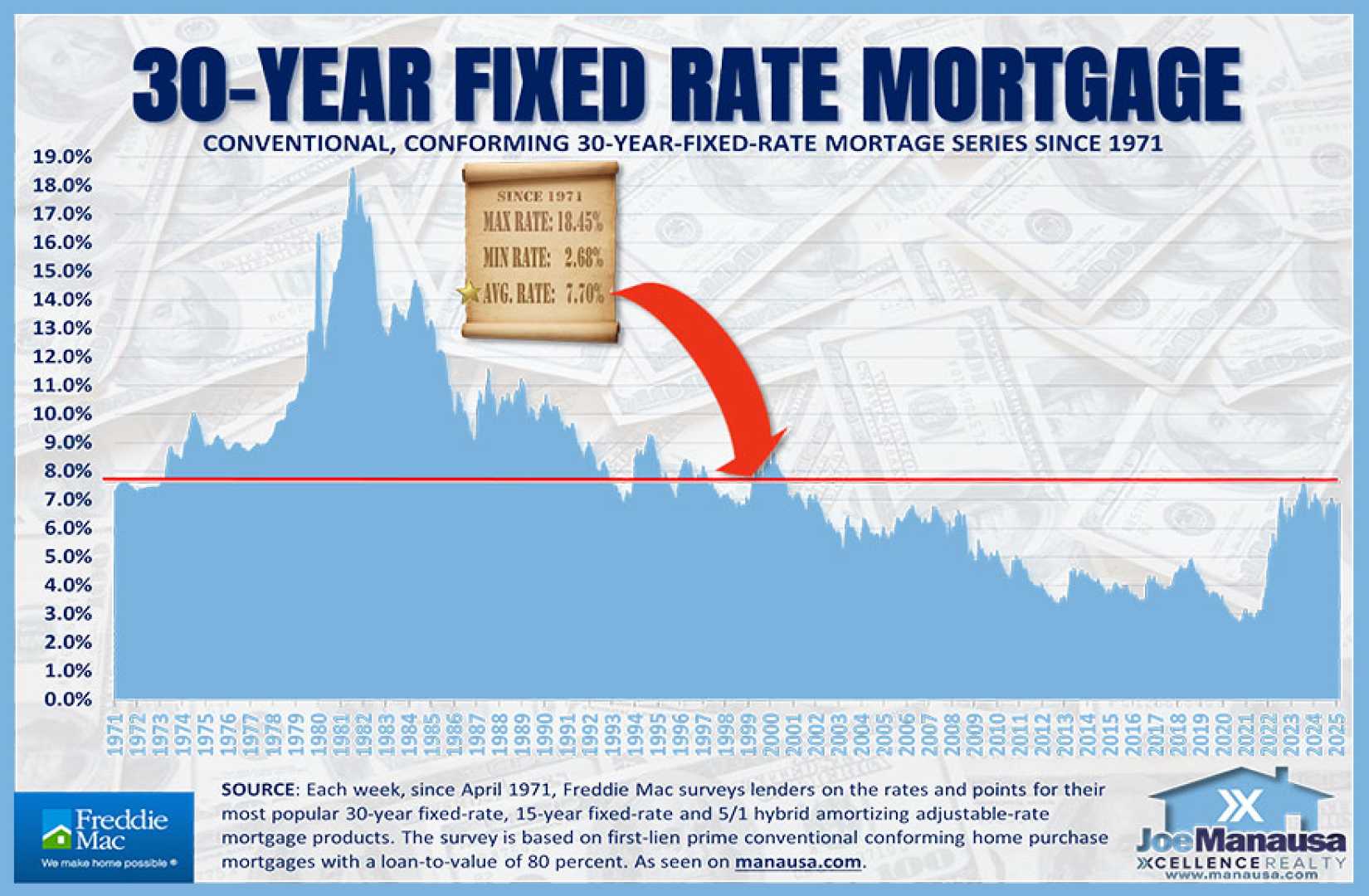

Despite expectations of lowered rates following the Federal Reserve‘s actions last year, many have noted a persistent hovering around 7%, as evidenced by statistics showing rates exceeded that threshold again in January 2025. This is a significant shift from the record low of 2.65% observed in January 2021.

Experts have cautioned that without another major economic crisis, low mortgage rates seen in the past may not return. The current high rates have left homebuyers seeking relief, with some negotiating rate buydowns with builders for newly constructed homes.

As of October 10, the rates seem to stabilize, with mortgage rates hitting lows not seen in nearly a year going into the Fed’s September meeting.

The factors influencing mortgage rates include the health of the U.S. economy, inflation rates, and the actions of the Federal Reserve. Historically, 30-year fixed mortgage rates around 7% are not unusual compared to the past decades.

Overall market conditions suggest rates may oscillate in the mid-6% range over the next 60 days, alongside fluctuations influenced by upcoming Federal Reserve meetings on October 28-29 and December 9-10.